Now that the new year has begun and the tracker has been reset, I've found that I need to make some adjustments to my Top 50. I cannot merge one year to the next due to the resetting of the tracker, so I'm just going to track our Top 50 by year.

I'm also going to track something new. I pulled down the final tracker results from 2008 and 2009, filtered the names to include only those who were tracked the entire year in both years, and combined the totals for each year to give me a composite return for each person on the tracker. From that information I selected whom I consider the top 15 traders from those two years.

I did not use buy and hold type traders, but looked for folks who were shorter term traders. All but three of the 15 folks I chose had over 10 IFTs per year and were active members on the tracker. None of the top 15 placed over 31 out of a total of 92 traders. Of the 92 total the top 8 are in this group of 15. The remaining 7 I selected using the criteria I've already mentioned.

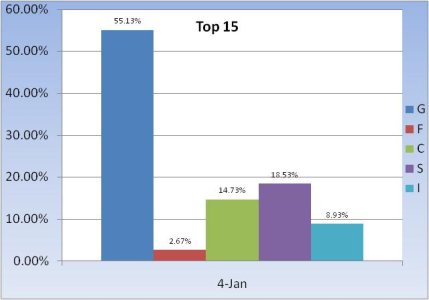

If you will recall, our Top 50 remained solidly bullish since mid-August and rarely held less than 80% stocks in aggregate since that time. With this in mind, you may be surprised with how our Top 15 performers are positioned to begin the first week of January. Here's the chart:

As you can see the Top 15 are holding a lot of cash and the I fund is not a favored fund. I expect this chart to be more volatile than the top 50 and will update it as changes are made.

I'm also going to track something new. I pulled down the final tracker results from 2008 and 2009, filtered the names to include only those who were tracked the entire year in both years, and combined the totals for each year to give me a composite return for each person on the tracker. From that information I selected whom I consider the top 15 traders from those two years.

I did not use buy and hold type traders, but looked for folks who were shorter term traders. All but three of the 15 folks I chose had over 10 IFTs per year and were active members on the tracker. None of the top 15 placed over 31 out of a total of 92 traders. Of the 92 total the top 8 are in this group of 15. The remaining 7 I selected using the criteria I've already mentioned.

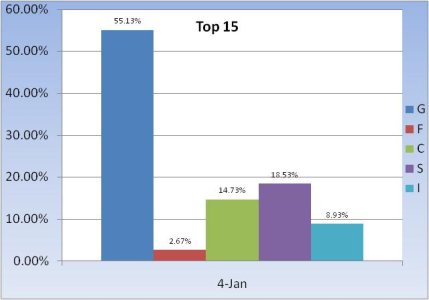

If you will recall, our Top 50 remained solidly bullish since mid-August and rarely held less than 80% stocks in aggregate since that time. With this in mind, you may be surprised with how our Top 15 performers are positioned to begin the first week of January. Here's the chart:

As you can see the Top 15 are holding a lot of cash and the I fund is not a favored fund. I expect this chart to be more volatile than the top 50 and will update it as changes are made.