-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

sniper's Account Talk

- Thread starter wavecoder

- Start date

wavecoder

TSP Pro

- Reaction score

- 24

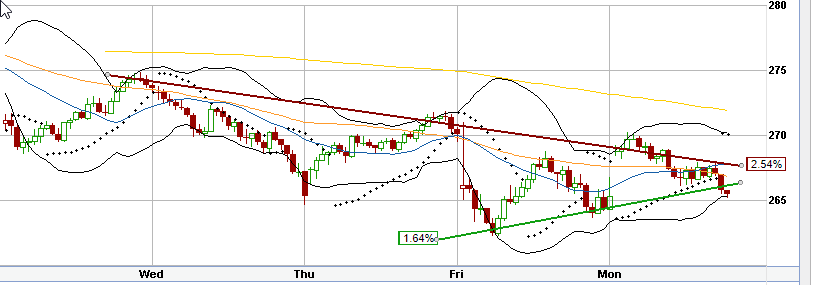

Not a strong showing by the bulls today, here's what I see on the 5-day chart (short term). Upper resistance has yet to be broken and held, which needs to happen if we're going to make any reversal. It looks like soon it'll try again, but I'm expecting more down side. Failed to break out on Friday and also this morning, so I think this little rally is running out of steam.

SPY 5-day

But heck with this market who knows? Things could easily change with strong earnings reports :nuts: However, I'm not liking the market as a whole, everything is being held up by large cap stocks. I've read that in the last days of a bull market, large caps outperform small caps, and that's been going on for a while. Trend change to the downside is looking more legit.

SPY 5-day

But heck with this market who knows? Things could easily change with strong earnings reports :nuts: However, I'm not liking the market as a whole, everything is being held up by large cap stocks. I've read that in the last days of a bull market, large caps outperform small caps, and that's been going on for a while. Trend change to the downside is looking more legit.

wavecoder

TSP Pro

- Reaction score

- 24

SPX ended today at -.45%, on a very low volume day. Have the bulls given up the fight already? In the last hour, it broke over the upper resistance line, only to be taken back down in the last 30 minutes. Sellers look like they control this market at the moment.

wavecoder

TSP Pro

- Reaction score

- 24

Bear flag or Ascending Triangle / W pattern? Depending on price action I may exit my short position in SPXS (edit: Sold it for a 5.5% gain). Wouldn't be surprised to see a relief rally going into tomorrow, but not planning on getting long. My system doesn't do trades against the trend, and I think it's safe to say the markets are in a downtrend right now.

edit: Looks like the latter, markets are moving back up. I think it wants to fill the gap & we'll see what happens from there

SPY 5-day

edit: Looks like the latter, markets are moving back up. I think it wants to fill the gap & we'll see what happens from there

SPY 5-day

Last edited:

wavecoder

TSP Pro

- Reaction score

- 24

The market feels different than it did in February, I feel this is just a dead cat bounce with a lot of sellers just taking profits. Volume is still pretty stagnant, so I don't think we really got the pain yet.

SPY 5-day, 15m

If this little breakout holds, the price target is right around where the gap would get filled at.

At that point it hits resistance, and a good chance the red button gets pushed again. But who knows..

SPY 5-day, 15m

If this little breakout holds, the price target is right around where the gap would get filled at.

At that point it hits resistance, and a good chance the red button gets pushed again. But who knows..

wavecoder

TSP Pro

- Reaction score

- 24

5-day chart looks bullish, but I can't say I'm intermediate-long term bullish when I look at the daily charts. I'm gonna sit on cash for a bit and see how things play out before jumping back in.

On the dailies though it does appear like a W pattern is trying to form, but I've been burned in the past trying to guess how the charts were trying to form, instead of waiting for confirmation.

On the dailies though it does appear like a W pattern is trying to form, but I've been burned in the past trying to guess how the charts were trying to form, instead of waiting for confirmation.

wavecoder

TSP Pro

- Reaction score

- 24

Woke up this morning to an etrade alert saying a TZA buy stop got hit, wasn't really expecting it, I thought the market would have opened green. Sold it for a 4% gain. It might have gone up more, but the IWM chart is looking like a falling wedge which is a bullish sign. That paired with Amazon and Google earnings tomorrow, the risk of a spike up erasing my gains is pretty good. I took the play and I'll sleep better tonight :smile:

IWM 3-month

IWM 3-month

wavecoder

TSP Pro

- Reaction score

- 24

Watching XBI (Biotech) and IWM. Filled the gap and crossed into the green today, how they respond after that will likely influence my next move. Push up was nearly straight up and low volume so I think that move is unsustainable. But we'll see. These 2 sectors have been the canary in the coal mine for the market recently.

wavecoder

TSP Pro

- Reaction score

- 24

for some reason i can't upload my charts right now.

But what I'm seeing (S&P Chart), 5-day is showing a symmetrical triangle, which is a continuation pattern. Zoom out to the 3-month chart, it's an obvious downtrend, and failed to break the upper resistance trend line today. My guess is this tumbles back down, bad time in the market to buy dips. Don't wait for Jim Cramer or CNBC to tell you we're in a bear market, they won't do that until the S&P is already down 20+% and by that time most of the damage is already done.

But what I'm seeing (S&P Chart), 5-day is showing a symmetrical triangle, which is a continuation pattern. Zoom out to the 3-month chart, it's an obvious downtrend, and failed to break the upper resistance trend line today. My guess is this tumbles back down, bad time in the market to buy dips. Don't wait for Jim Cramer or CNBC to tell you we're in a bear market, they won't do that until the S&P is already down 20+% and by that time most of the damage is already done.

Attachments

wavecoder

TSP Pro

- Reaction score

- 24

Nice rally but the gap up has me a little skeptical of buying in, not to mention it's also a low volume move (those are usually prone to reversals). Going to see how the market responds to it. Yesterday I bought a position in FAZ, but quickly exited when I saw the trend changing upward, took a 1.5% loss. Financials today looks like the only sector that isn't 'giving back' at the moment. Could be one to look at, the past 3 trading days were in the green, even when the entire market was red. I figured it would be the first to roll over because of that, but it seems to just be a strong performer right now.

Last edited:

wavecoder

TSP Pro

- Reaction score

- 24

Huge volume spike in the last 30 mins on SPY, bears are showing up again. No real change in volume in AAPL, which is a surprise to me. Nobody holding Apple seems to be taking profits, they're holding and hoping for a rally. If they don't have a strong beat there's gonna be a lot of pain. But the potential for a monster move up is always there with Apple as well. This is gonna be fun to watch

edit: Something seems fishy about this move up. All the big moves up were gap moves overnight, so unless you're a bag holder you missed all the moves upward. However, in this current market, holding overnight is a huge downside risk. Feels like it was a pump and dump but we'll see.

edit: Something seems fishy about this move up. All the big moves up were gap moves overnight, so unless you're a bag holder you missed all the moves upward. However, in this current market, holding overnight is a huge downside risk. Feels like it was a pump and dump but we'll see.

Last edited:

clester

Market Veteran

- Reaction score

- 37

Yeah, I wanted to buy some appl but it gapped up. Been a lot of sell on the earnings. I may wait for appl to report before I buy.Huge volume spike in the last 30 mins on SPY, bears are showing up again. No real change in volume in AAPL, which is a surprise to me. Nobody holding Apple seems to be taking profits, they're holding and hoping for a rally. If they don't have a strong beat there's gonna be a lot of pain. But the potential for a monster move up is always there with Apple as well. This is gonna be fun to watch

edit: Something seems fishy about this move up. All the big moves up were gap moves overnight, so unless you're a bag holder you missed all the moves upward. However, in this current market, holding overnight is a huge downside risk. Feels like it was a pump and dump but we'll see.

wavecoder

TSP Pro

- Reaction score

- 24

Yeah, I wanted to buy some appl but it gapped up. Been a lot of sell on the earnings. I may wait for appl to report before I buy.

Nice, yeah similar i was looking to get into FAS or SPXL for the short term, but the big gap up made me hold my hand and wait. Volume was also really low on today's jump which made me even more skeptical. In any case all eyes are on apple's earnings, The strength in the S&P and Nasdaq were probably due to optimism on Apple having a strong report.

Similar threads

- Replies

- 2

- Views

- 576

- Replies

- 0

- Views

- 582

- Replies

- 0

- Views

- 128