-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

sniper's Account Talk

- Thread starter wavecoder

- Start date

FAB1

Market Veteran

- Reaction score

- 34

Congratulations - the more you make the more you pay to feed the poor with food stamps and pay for their free phones.

They dont use that food stamp stuff anymore old man -- EBT card is where its at, baby.

Yes, Congrats to Sniper -- I didnt get a promotion, and no beer but I'll drink a cup of hot herbal tea

wavecoder

TSP Pro

- Reaction score

- 24

Sorry I haven't updated in a while, job's been busy and new gf been taking all my time :nuts:

watching the weekly chart for the russell 2000 (IWM), the recent down move is nothing to panic about atm, the chart is still channel surfing in an uptrend. Two things I'm looking at is:

1. bottom of the channel is near the 20-week moving average

2. a close below the 20-week moving average hasn't been good for the market in the past 3 years.

Red arrows show the times there was a close below the 20-week line, and the next destination after that was the bottom bollinger band. The blue arrows were times that it closed below, but didn't hit the bottom bollinger next. Still, one out of those 2 occurences saw a big move down in the following week. In either case, I'm keeping my eyes peeled for a good buying opportunity soon

watching the weekly chart for the russell 2000 (IWM), the recent down move is nothing to panic about atm, the chart is still channel surfing in an uptrend. Two things I'm looking at is:

1. bottom of the channel is near the 20-week moving average

2. a close below the 20-week moving average hasn't been good for the market in the past 3 years.

Red arrows show the times there was a close below the 20-week line, and the next destination after that was the bottom bollinger band. The blue arrows were times that it closed below, but didn't hit the bottom bollinger next. Still, one out of those 2 occurences saw a big move down in the following week. In either case, I'm keeping my eyes peeled for a good buying opportunity soon

MrJohnRoss

Market Veteran

- Reaction score

- 58

Nice perspective, bro. Nice to see you back. And glad to hear your new gf is keeping you busy.

Mcqlives

Market Veteran

- Reaction score

- 24

Sorry I haven't updated in a while, job's been busy and new gf been taking all my time :nuts:

View attachment 24955

watching the weekly chart for the russell 2000 (IWM), the recent down move is nothing to panic about atm, the chart is still channel surfing in an uptrend. Two things I'm looking at is:

1. bottom of the channel is near the 20-week moving average

2. a close below the 20-week moving average hasn't been good for the market in the past 3 years.

Red arrows show the times there was a close below the 20-week line, and the next destination after that was the bottom bollinger band. The blue arrows were times that it closed below, but didn't hit the bottom bollinger next. Still, one out of those 2 occurences saw a big move down in the following week. In either case, I'm keeping my eyes peeled for a good buying opportunity soon

I like that chart! Plus it lines up very nicely with my SnP charting. Hopefully we can time it either within the trading range or at the charting low.

wavecoder

TSP Pro

- Reaction score

- 24

Nice perspective, bro. Nice to see you back. And glad to hear your new gf is keeping you busy.

Thanks JR, good to be back

wavecoder

TSP Pro

- Reaction score

- 24

Appears as if the price action hitting the 20-day weekly average may be very likely (Russell 2000 - IWM). If it hits, I'll be paying attention closely to how it behaves after that. Like the picture I posted a couple weeks ago, if it closes for the week below the 20-day, I'll wait more. If it crosses / hits and bounces upwards, I'll be looking to buy. Patience is the name of the game atm for me though.

wavecoder

TSP Pro

- Reaction score

- 24

Charts are looking interesting right now...

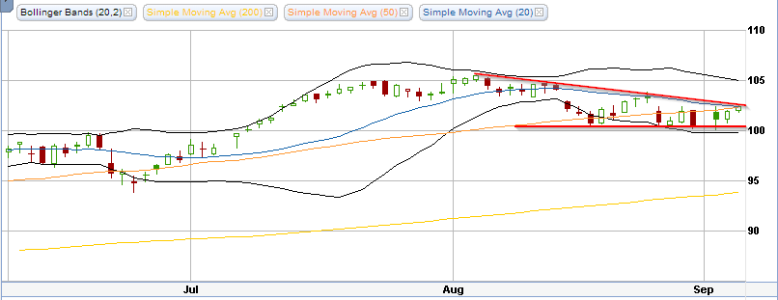

IWM / Russell 2000 (daily)

Levels are at the bottom of the long-term upward channel (green). The shorter term trend has been down (red), which trend will prevail? It is also near the original breakout level from early july (blue), this area may be tested. For me, this would require a little more wait and see, before getting an idea which way the market will head.

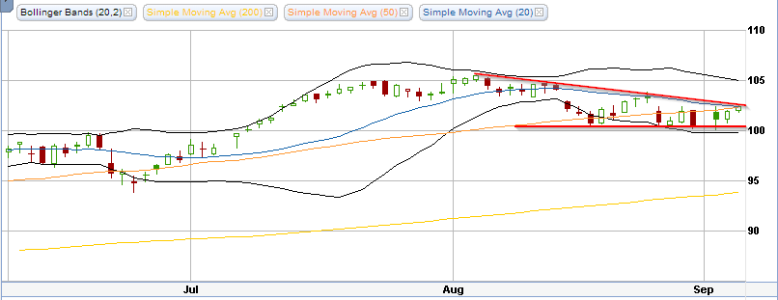

S&P Weekly Chart

I tend to put more weight on weekly charts for determining which way the market wants to go. Daily fluctuations can be confusing but it's much harder for the market to fool the weekly chart. The S&P chart bothers me a bit, and is one of the reasons why I won't be a buyer right at this moment. The 20-day SMA has been breached, and in the last 3 years, I noticed a trend of this happening, a good chance of lower price action followed (scroll down some). I'll wait more next week, but itching to be a buyer soon. Have a good weekend all

IWM / Russell 2000 (daily)

Levels are at the bottom of the long-term upward channel (green). The shorter term trend has been down (red), which trend will prevail? It is also near the original breakout level from early july (blue), this area may be tested. For me, this would require a little more wait and see, before getting an idea which way the market will head.

S&P Weekly Chart

I tend to put more weight on weekly charts for determining which way the market wants to go. Daily fluctuations can be confusing but it's much harder for the market to fool the weekly chart. The S&P chart bothers me a bit, and is one of the reasons why I won't be a buyer right at this moment. The 20-day SMA has been breached, and in the last 3 years, I noticed a trend of this happening, a good chance of lower price action followed (scroll down some). I'll wait more next week, but itching to be a buyer soon. Have a good weekend all

wavecoder

TSP Pro

- Reaction score

- 24

Daily Chart Russell 2000 (IWM)

Not much of an eventful day, but the daily chart is showing a descending triangle pattern. generally bearish, but that can be thrown out the window if it can manage to close above the top line mark and hold. it seems to be trying to break above it, but is meeting resistance. tomorrow (or next week) should be more telling of where it goes from here. as for now, it's mostly sideways movement. breaking and holding above the 102.50 level would be a short-term buy signal in my book, we'll see what happens! A lot of IF's come into play here (25 mins to close, looks like it's failing to break upper resistance again, greater possibility for downside movement imo if it can't breach that level).

Not much of an eventful day, but the daily chart is showing a descending triangle pattern. generally bearish, but that can be thrown out the window if it can manage to close above the top line mark and hold. it seems to be trying to break above it, but is meeting resistance. tomorrow (or next week) should be more telling of where it goes from here. as for now, it's mostly sideways movement. breaking and holding above the 102.50 level would be a short-term buy signal in my book, we'll see what happens! A lot of IF's come into play here (25 mins to close, looks like it's failing to break upper resistance again, greater possibility for downside movement imo if it can't breach that level).

Last edited:

MrJohnRoss

Market Veteran

- Reaction score

- 58

price action broke through the 102.50 barrier with authority, let's see if it can hold and close above it

Not coincidentally, the 50 DMA is currently sitting at 102.40. A close above the 50 day would be another positive sign.

wavecoder

TSP Pro

- Reaction score

- 24

Not coincidentally, the 50 DMA is currently sitting at 102.40. A close above the 50 day would be another positive sign.

seems to be running out of steam in the final hour, not the sign I was hoping for. It's now back at the upper resistance . Looks like we'll have to wait longer for a clear breakout signal (or down, who knows with this market

I think the short-term trend seems to be prevailing for now and we might see a down week next week.

MrJohnRoss

Market Veteran

- Reaction score

- 58

seems to be running out of steam in the final hour, not the sign I was hoping for. It's now back at the upper resistance . Looks like we'll have to wait longer for a clear breakout signal (or down, who knows with this market)

I think the short-term trend seems to be prevailing for now and we might see a down week next week.

Yeah, I think people get scared of what might happen over the weekend, so they bail. Chicken livers. :laugh:

wavecoder

TSP Pro

- Reaction score

- 24

Short term downtrend broken, from yesterday's movement looks like we have more upside. back to S fund i go (snort) :nuts:

with that said, i was hoping today wouldn't be such a strong continuation upwards because of the damn IFT delay. though at least my position in IWM is benefitting.

with that said, i was hoping today wouldn't be such a strong continuation upwards because of the damn IFT delay. though at least my position in IWM is benefitting.

wavecoder

TSP Pro

- Reaction score

- 24

Fear & Greed Index - Investor Sentiment - CNNMoney

I'm surprised after the recent price action, the fear/greed index is still in neutral. Time to climb this wall of worry, I think this market has another 4-6% increase in it before the next substantial pullback

I'm surprised after the recent price action, the fear/greed index is still in neutral. Time to climb this wall of worry, I think this market has another 4-6% increase in it before the next substantial pullback

rcknfrewld

TSP Pro

- Reaction score

- 8

I think this has another 4-6% increase

(that's what he said) (I said this with my elbow digging into sniper's side)

Similar threads

- Replies

- 2

- Views

- 530

- Replies

- 0

- Views

- 565

- Replies

- 0

- Views

- 81

- Replies

- 1

- Views

- 751