-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

sniper's Account Talk

- Thread starter wavecoder

- Start date

wavecoder

TSP Pro

- Reaction score

- 24

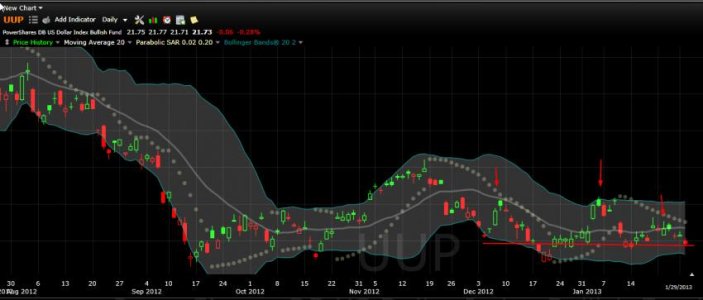

dollar's tanking, looks like I fund is the place to be right now

took profits in my real account, don't like what I see on the daily charts and didn't want to use my first IFT in february to run to safety early in the month.

tracker account will stay in S fund, sticking with the system I'm testing (after all, i'm here to test it so i have to follow the guidelines 100%)

took profits in my real account, don't like what I see on the daily charts and didn't want to use my first IFT in february to run to safety early in the month.

tracker account will stay in S fund, sticking with the system I'm testing (after all, i'm here to test it so i have to follow the guidelines 100%)

NiteFlyer

Market Tracker

- Reaction score

- 3

You'll have to stand in line to enter the infamous I fund - it's only a two seat potty.

I've been in I since 1/4. I'm expecting a nice move up from 79th on the AT today. Depending on the currencies, there's an outside chance I could move to 3rd. However, I do hope the funds all move in a way beneficial to most of us (can't be all if some are on the sidelines waiting for a dip and others are in hoping to not have one).

wavecoder

TSP Pro

- Reaction score

- 24

You'll have to stand in line to enter the infamous I fund - it's only a two seat potty.

no need for a potty or outhouse, i got my entrenching tool and a roll of toilet paper

wavecoder

TSP Pro

- Reaction score

- 24

I've been in I since 1/4. I'm expecting a nice move up from 79th on the AT today. Depending on the currencies, there's an outside chance I could move to 3rd. However, I do hope the funds all move in a way beneficial to most of us (can't be all if some are on the sidelines waiting for a dip and others are in hoping to not have one).

I've been watching your moves, you seem to be good at this. nice work!

NiteFlyer

Market Tracker

- Reaction score

- 3

I've been watching your moves, you seem to be good at this. nice work!

Thanks for the compliment Sniper. Your posts are some that have helped me alot.

I see the different funds as lanes of traffic on an interstate. The "G" fund is the slow train next to it. In driving, I am pretty good about reading the actions of other drivers to determine the best lane to be in. On here, with all of the charts you all put together, it really feels like I can determine the best "lane" (fund) to be in. The only problem I run into is the damn steering wheel only works about twice a month!

MrJohnRoss

Market Veteran

- Reaction score

- 58

Thanks for the compliment Sniper. Your posts are some that have helped me alot.

I see the different funds as lanes of traffic on an interstate. The "G" fund is the slow train next to it. In driving, I am pretty good about reading the actions of other drivers to determine the best lane to be in. On here, with all of the charts you all put together, it really feels like I can determine the best "lane" (fund) to be in. The only problem I run into is the damn steering wheel only works about twice a month!

Good analogy bro.

wavecoder

TSP Pro

- Reaction score

- 24

Thanks for the compliment Sniper. Your posts are some that have helped me alot.

I see the different funds as lanes of traffic on an interstate. The "G" fund is the slow train next to it. In driving, I am pretty good about reading the actions of other drivers to determine the best lane to be in. On here, with all of the charts you all put together, it really feels like I can determine the best "lane" (fund) to be in. The only problem I run into is the damn steering wheel only works about twice a month!

haha, never thought of it that way, but I do a similar type of thing. I just picked wrong between S & I but it happens

NiteFlyer

Market Tracker

- Reaction score

- 3

I was in S until 1/4. I moved to I a little early and lost some ground. I'm thinking I'll stay in I for a bit and then back to S or possibly C if the large caps really do pick up. I only want to go to G if the market appears to be correcting more than about 2% but by the time I figure that out, it could be too late. I'd hate to jump out right after a 2% drop and see it bounce back, looking out the slow-train windows.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

If we pulled back 4-5%, it would feel like death. But in truth, it would do little to the bull market technicals. Most of the areas of this market are in bull market mode. Look toward April - the SPX has risen every April for the past five years and making it the best month for the market by far - unless you count this January.

wavecoder

TSP Pro

- Reaction score

- 24

If we pulled back 4-5%, it would feel like death. But in truth, it would do little to the bull market technicals. Most of the areas of this market are in bull market mode. Look toward April - the SPX has risen every April for the past five years and making it the best month for the market by far - unless you count this January.

If we pulled back 4-5% it would actually be awesome cause I just bought TZA shares today

NiteFlyer

Market Tracker

- Reaction score

- 3

... Depending on the currencies, there's an outside chance I could move to 3rd...

Hmmm, with that afternoon fade, I'm thinking I'll make it to 7th... again depending on currencies and any fair value adjustment.

wavecoder

TSP Pro

- Reaction score

- 24

Hmmm, with that afternoon fade, I'm thinking I'll make it to 7th... again depending on currencies and any fair value adjustment.

awesome, if you end up in the top 5 for the month you'll get a coffee cup or t-shirt i think

ILoveTDs

TSP Analyst

- Reaction score

- 10

Hmmm, with that afternoon fade, I'm thinking I'll make it to 7th... again depending on currencies and any fair value adjustment.

Whereever you end up, I'm pretty sure we'll be neighbors

wavecoder

TSP Pro

- Reaction score

- 24

gronk007

Market Tracker

- Reaction score

- 1

Sniper...

Just a casual observation from a noob. Today's statement about being nervous because of the NASDAQ's head and shoulders pattern seems a little out of sync. Shouldn't folks have long since been nervous based on the basic RSI and the Stochastic indicators? Or am I missing a nuance on chart patterns vice indicators? Note: I submit that I have only made 3.8% in 2013 so I am asking the question to learn.

Just a casual observation from a noob. Today's statement about being nervous because of the NASDAQ's head and shoulders pattern seems a little out of sync. Shouldn't folks have long since been nervous based on the basic RSI and the Stochastic indicators? Or am I missing a nuance on chart patterns vice indicators? Note: I submit that I have only made 3.8% in 2013 so I am asking the question to learn.

NiteFlyer

Market Tracker

- Reaction score

- 3

Whereever you end up, I'm pretty sure we'll be neighbors

Yep, I saw you drafting

wavecoder

TSP Pro

- Reaction score

- 24

Sniper...

Just a casual observation from a noob. Today's statement about being nervous because of the NASDAQ's head and shoulders pattern seems a little out of sync. Shouldn't folks have long since been nervous based on the basic RSI and the Stochastic indicators? Or am I missing a nuance on chart patterns vice indicators? Note: I submit that I have only made 3.8% in 2013 so I am asking the question to learn.

head & shoulders patterns are generally bad news, while no pattern is 100% accurate, these are usually pretty high%. I make a lot of my trades playing h&s patterns, and win on most of em. If the same holds true for the nasdaq, watch for the other indexes to follow. If not, then we're still in a pretty strong market, that's just something to keep an eye on.

Head and shoulders (chart pattern) - Wikipedia, the free encyclopedia

Similar threads

- Replies

- 2

- Views

- 532

- Replies

- 0

- Views

- 567

- Replies

- 0

- Views

- 82

- Replies

- 1

- Views

- 751