Or at least it probably felt that way to those folks invested in stocks.

I've been saying that after this run-up the market was very vulnerable to a pullback and that the smart money could be using the end of quarter window dressing expectation as a hook to bail while the dumb money keeps buying.

At least that's a viable theory. And so far the Seven Sentinels could be interpreted that way too.

The dollar, down as much as 0.5% at one point today, rallied in the afternoon to post a 0.2% gain. Initial jobless claims for the week ended Mar. 20 came in at 442,000, which was a little bit under the 450,000 that was anticipated, while continuing claims was pegged at 4.65 million, above the 4.56 million that was expected.

Today's charts:

We remain in a sell condition here.

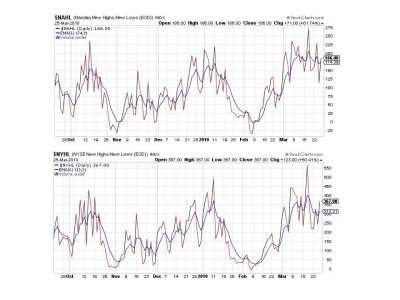

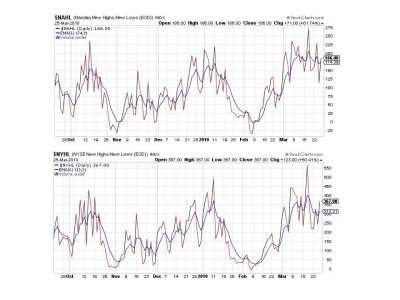

Interestingly, both NAHL and NYHL posted gains in spite of the late day sell-off. Both are have flipped to buys.

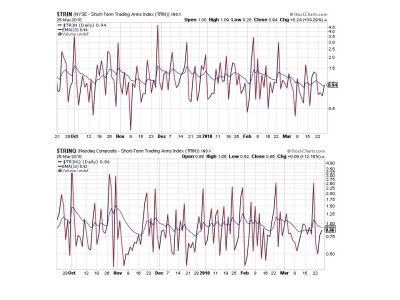

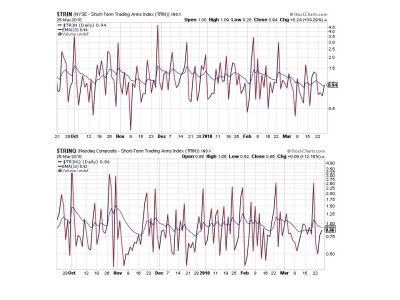

TRIN came close to flipping to a sell, but sits at its 6 day EMA and remains a buy, while TRINQ turned up, but also remained on a buy.

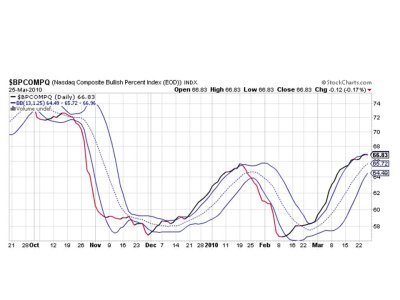

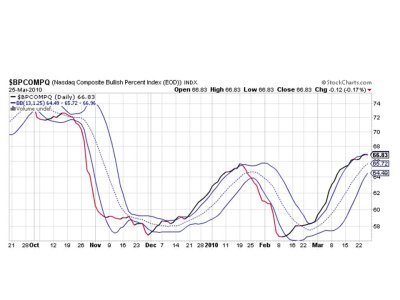

This indicator tends to get my attention a little more than the others. It turned back down a bit and flipped to a sell after being a borderline buy the past two days. This sure looks like topping action to me.

So I still think a die hard bull can interpret this weeks borderline buy as a valid signal, but I'm not in that camp. I think we're still in a sell condition, but whipsaw action is going to keep some traders guessing. We might see one last poke higher. Might. But I think this up-leg is due for some serious selling pressure soon.

I thought bonds would be a good place to take a position (I'm 100% F fund) in the event the market went south, but I'm getting hit pretty hard right now. I've also noticed that in spite of the dollars 10 month highs, gas prices seem to be holding at high levels. That's not the way it's suppose to work. At least not for prolonged periods. Interesting.

That's it for this evening. See you Friday.

I've been saying that after this run-up the market was very vulnerable to a pullback and that the smart money could be using the end of quarter window dressing expectation as a hook to bail while the dumb money keeps buying.

At least that's a viable theory. And so far the Seven Sentinels could be interpreted that way too.

The dollar, down as much as 0.5% at one point today, rallied in the afternoon to post a 0.2% gain. Initial jobless claims for the week ended Mar. 20 came in at 442,000, which was a little bit under the 450,000 that was anticipated, while continuing claims was pegged at 4.65 million, above the 4.56 million that was expected.

Today's charts:

We remain in a sell condition here.

Interestingly, both NAHL and NYHL posted gains in spite of the late day sell-off. Both are have flipped to buys.

TRIN came close to flipping to a sell, but sits at its 6 day EMA and remains a buy, while TRINQ turned up, but also remained on a buy.

This indicator tends to get my attention a little more than the others. It turned back down a bit and flipped to a sell after being a borderline buy the past two days. This sure looks like topping action to me.

So I still think a die hard bull can interpret this weeks borderline buy as a valid signal, but I'm not in that camp. I think we're still in a sell condition, but whipsaw action is going to keep some traders guessing. We might see one last poke higher. Might. But I think this up-leg is due for some serious selling pressure soon.

I thought bonds would be a good place to take a position (I'm 100% F fund) in the event the market went south, but I'm getting hit pretty hard right now. I've also noticed that in spite of the dollars 10 month highs, gas prices seem to be holding at high levels. That's not the way it's suppose to work. At least not for prolonged periods. Interesting.

That's it for this evening. See you Friday.