It was a good day to do some backing a filling. We had two intraday declines that helped to work off some of the short term overbought condition in the market and

that may go a long way to build some support under this market as it continues to defy prevailing bearishness.

Not that bearishness is rampant, but it’s more noticeable due to the negative economic tone that continues to permeate the airwaves.

Last night’s positive futures bias obviously did not hold at the open this morning, but we did manage to finish mixed, and that’s good enough for me.

Tomorrow morning, five economic reports are scheduled to be released; Initial Claims, Continuing Claims, PPI, Core PPI, and the Empire Manufacturing Index.

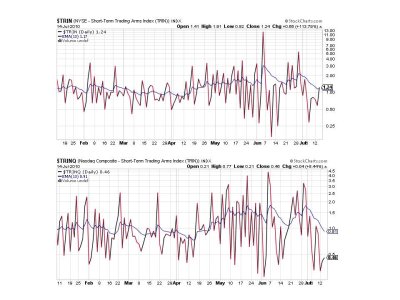

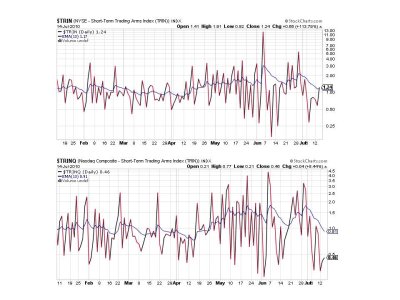

Not too much change in the Sentinels, but one signal did move to a sell. Here’s the charts:

We still have two buys here.

NAHL and NYHL continue to look okay and remain on buys.

TRIN flipped to a sell, but only barely. No concern there whatsoever. TRINQ remains solidly in buy territory.

BPCOMPQ continues to ebb higher, and that's what we want to see.

So 6 of 7 signals remain on buys and that keeps the system on the buy. See you tomorrow.

that may go a long way to build some support under this market as it continues to defy prevailing bearishness.

Not that bearishness is rampant, but it’s more noticeable due to the negative economic tone that continues to permeate the airwaves.

Last night’s positive futures bias obviously did not hold at the open this morning, but we did manage to finish mixed, and that’s good enough for me.

Tomorrow morning, five economic reports are scheduled to be released; Initial Claims, Continuing Claims, PPI, Core PPI, and the Empire Manufacturing Index.

Not too much change in the Sentinels, but one signal did move to a sell. Here’s the charts:

We still have two buys here.

NAHL and NYHL continue to look okay and remain on buys.

TRIN flipped to a sell, but only barely. No concern there whatsoever. TRINQ remains solidly in buy territory.

BPCOMPQ continues to ebb higher, and that's what we want to see.

So 6 of 7 signals remain on buys and that keeps the system on the buy. See you tomorrow.