Both Asian and European markets showed strength in Friday's trading session, but it didn't carry over to our domestic market. At the close the Nasdaq was down 0.71%, while the DOW and S&P dropped 0.38% and 0.52% respectively.

It's likely the weakness was a response to a looming Government shutdown, which is making some traders nervous and unwilling to hold stocks over the weekend. But it is also true that earnings season starts soon, which is also a contributing factor to trader's skittishness.

And then there's oil prices. They spiked to $112.79 per barrel today, which is a whopping 2.3% gain in just one day.

So take your pick of the reasons for the late week weakness. There's others. Our sentiment survey was on a sell this week, and that finally paid some moderate dividends. Next week it's back on a buy.

Let's take a look at the charts:

NAMO and NYMO remain in a sell condition and have now dropped below the neutral line. I'm not expecting these two signals to drop much more now that bullish sentiment has backed off a bit.

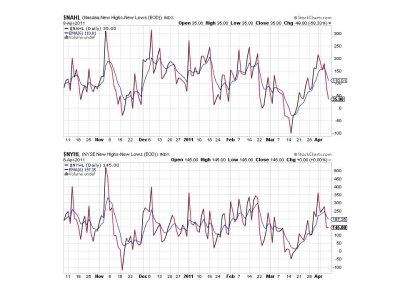

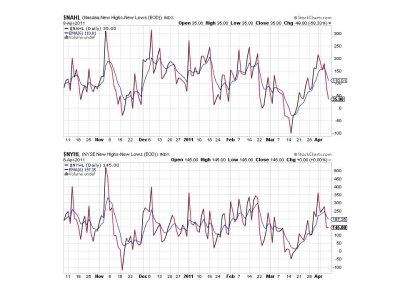

NAHL and NYHL also remain on sells.

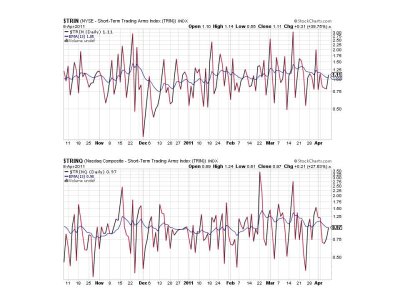

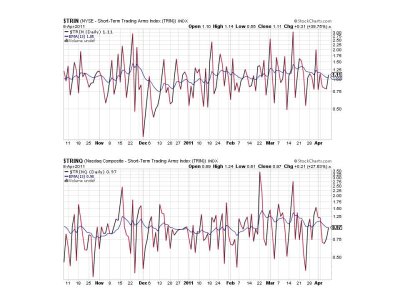

TRIN flipped to a sell today, but TRINQ held its buy status.

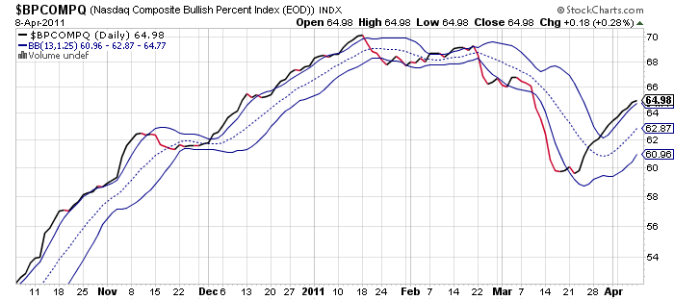

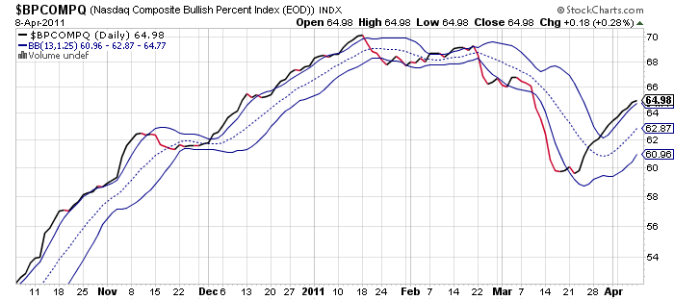

Here's another indication that the uptrend may be intact. BPCOMPQ continued to move higher today, albeit only modestly, but up none the less.

So 2 of 7 signals are in a buy condition, which keeps the system in a buy status.

There's plenty of headline trepidation at the moment, so I'll be looking for some strength next week. We really did need to work off some of that upward momentum we saw, so this consolidation period is welcome. Check back here Sunday evening for next week's tracker charts.

It's likely the weakness was a response to a looming Government shutdown, which is making some traders nervous and unwilling to hold stocks over the weekend. But it is also true that earnings season starts soon, which is also a contributing factor to trader's skittishness.

And then there's oil prices. They spiked to $112.79 per barrel today, which is a whopping 2.3% gain in just one day.

So take your pick of the reasons for the late week weakness. There's others. Our sentiment survey was on a sell this week, and that finally paid some moderate dividends. Next week it's back on a buy.

Let's take a look at the charts:

NAMO and NYMO remain in a sell condition and have now dropped below the neutral line. I'm not expecting these two signals to drop much more now that bullish sentiment has backed off a bit.

NAHL and NYHL also remain on sells.

TRIN flipped to a sell today, but TRINQ held its buy status.

Here's another indication that the uptrend may be intact. BPCOMPQ continued to move higher today, albeit only modestly, but up none the less.

So 2 of 7 signals are in a buy condition, which keeps the system in a buy status.

There's plenty of headline trepidation at the moment, so I'll be looking for some strength next week. We really did need to work off some of that upward momentum we saw, so this consolidation period is welcome. Check back here Sunday evening for next week's tracker charts.