Well, the widely anticipated (and feared) nonfarm payrolls number for June came in, and was worse than expected. A loss of 100,000 was anticipated, but the actual number came in at 125,000. Private payrolls improved from last month's 33,000 however, as it came in at +83,000.

The unemployment rate dropped from 9.7% to 9.5%, but that was almost entirely due to many unemployed workers ending their job hunt. Now that's what I call a superficial, dubious data point.

May factory orders dropped 1.4%, which is higher than the 1.0% that had been expected.

The action yesterday started out positive, but soon began to decline into an intraday low around 1:00, before staging a recovery effort that took the S&P 500 into positive territory until a final bout of selling took hold in the last 20 minutes of trading and pushed it down almost 0.5% at the close.

So it's been a rough couple of weeks with little good news to stabilized the markets. We are very close to seeing this market turn from bull to bear. A good case can be made for further weakness, but the market is very oversold and there are positive divergences that suggest a turn is close at hand. We will probably know next week whether the bull will take control again or we enter a bear market.

Believe it or not, the Seven Sentinels have still not rolled over. Take a look at the charts:

NAMO and NYMO, while negative, are still well short of the lows we saw in mid-May. I'd like to think that's a bullish sign. But they remain on sells for now.

Both NAHL and NYHL turned positive and flipped to buys. Amazing.

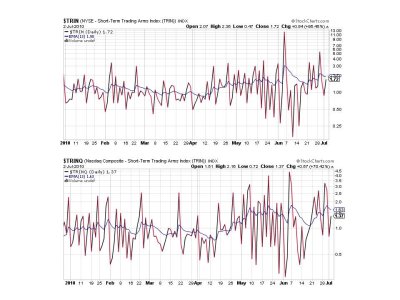

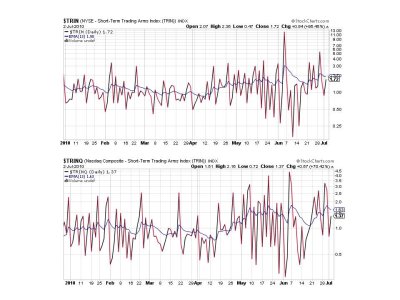

TRIN and TRINQ remain on buys.

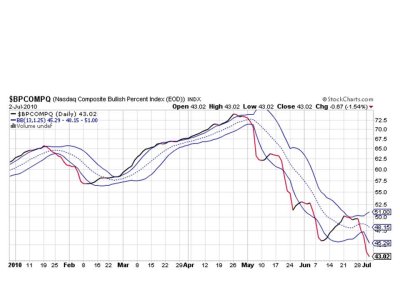

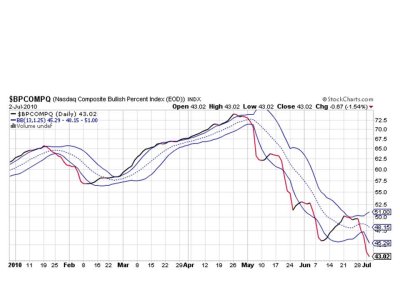

BPCOMPQ remains on a sell.

So we have 4 of 7 signals flashing buys, which keeps the system on a buy.

It's been a strange a market. We've had a lot of selling pressure the past two weeks and yet the SS have held firm to its buy signal. I'm certainly hoping it's correct and that holding my position is the correct strategy. But it shouldn't be long now before we know the answer to that.

I'll be posting the Tracker charts later this weekend. Have a great Independence Day!

The unemployment rate dropped from 9.7% to 9.5%, but that was almost entirely due to many unemployed workers ending their job hunt. Now that's what I call a superficial, dubious data point.

May factory orders dropped 1.4%, which is higher than the 1.0% that had been expected.

The action yesterday started out positive, but soon began to decline into an intraday low around 1:00, before staging a recovery effort that took the S&P 500 into positive territory until a final bout of selling took hold in the last 20 minutes of trading and pushed it down almost 0.5% at the close.

So it's been a rough couple of weeks with little good news to stabilized the markets. We are very close to seeing this market turn from bull to bear. A good case can be made for further weakness, but the market is very oversold and there are positive divergences that suggest a turn is close at hand. We will probably know next week whether the bull will take control again or we enter a bear market.

Believe it or not, the Seven Sentinels have still not rolled over. Take a look at the charts:

NAMO and NYMO, while negative, are still well short of the lows we saw in mid-May. I'd like to think that's a bullish sign. But they remain on sells for now.

Both NAHL and NYHL turned positive and flipped to buys. Amazing.

TRIN and TRINQ remain on buys.

BPCOMPQ remains on a sell.

So we have 4 of 7 signals flashing buys, which keeps the system on a buy.

It's been a strange a market. We've had a lot of selling pressure the past two weeks and yet the SS have held firm to its buy signal. I'm certainly hoping it's correct and that holding my position is the correct strategy. But it shouldn't be long now before we know the answer to that.

I'll be posting the Tracker charts later this weekend. Have a great Independence Day!