My wife (JD) began her Fed career in 1985 and is a GS-14; I (Chris) began my Fed career in 1989 and am a GS-12. She turned 49 and i turned 47 during December of 2015. Here's our short story:

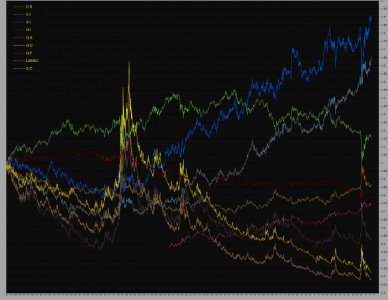

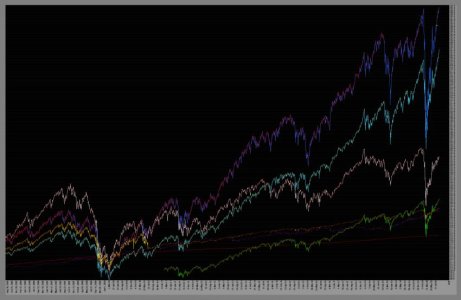

At the end of 2003, we were invested 100% in G with balances of $7,464.40 and $5,120.29, respectively - only Uncle Sam was contributing to our TSP accounts. All of that changed in early 2004: just prior, my best friend (who worked in commercial banking) kicked me in the derriere when, during a discussion about investing, I told him my wife and I hadn't contributed anything to our Fed "401K accounts". :embarrest: SO ... LOL ... I kick started our contributing to both our TSP accounts and began managing them both, though ignorantly moving $ between funds at first because I lacked any real knowledge. I stumbled across TSPTalk not long after, but didn't become a member for a while - I just stood in the shadows and read a LOT of posts, researched cause and effect between market forces, scrutinized member methodologies, and tried to make some sense of all the chatter and banter - but began actively investing ("trading") the funds in our TSP accounts with my new insights.

Over the years, we've contributed between 5% and 10% to our accounts - I recall reducing the 10% to 5% to aggressively pay off the mortgage Christmas of 2005 and then again as markets began crashing during the Great Recession (where we lost a little better than 5% - mild compared to others we knew who were buy and hold types. We're still contributing 5% now). I'm honored to be among those notorious day traders who received the TSP board's "ultimatum" letter back in the day, and I don't regret a day of aggressively managing our funds during that time - it helped me to help US catch up some to where our TSP accounts would have been if we had contributed prior to 2004. Our combined balance hit $300K last quarter, and we're OK with that considering our "late bloomer" statuses. :smile:

My TSP slacker status regrets in 2015: 1) not consistently watching the markets, and 2) not consistently applying my own investing rules when I DO. I hope to be more intentional in 2016 and onward.