I knew this market felt different, and today's action provided some proof. As I mentioned in my account thread today, previous Seven Sentinel Buy Signals (SSBS) over the past few months came during periods of intense buying pressure. This time that didn't happen. I can't help but get the feeling da boyz are setting the table for some kind of action this month. Bears are starting to believe (again  ) that

) that

the top is in. They just can't wait to short this market. I gotta say there must be an awful lot of gamblers out there, because shorting this market over the past 9 months or so has, by and large, been a losing trade. And yet they come. Like moths drawn to a flame. :laugh:

I'm seeing it on the boards. So far the sentiment survey on Trader's Talk is 82% bearish, although participation is still ongoing till the open tomorrow. But that's still a lot of bears for any given trading day. I'm very interested in seeing how the daily survey numbers end, but I'm willing to bet they'll still be overly bearish.

Having said this though, that doesn't mean we can't see some weakness. And it could be significant in order to attract more shorts. It just seems a little odd to me that I'd get a SSBS and then the market drops. I smell a rat and I'll point out why below.

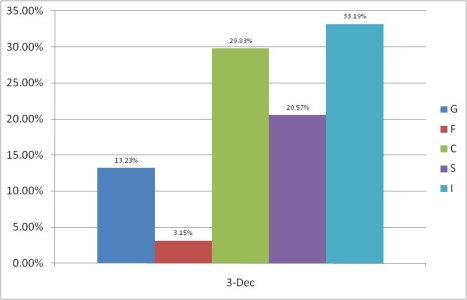

I entered the market today, but let me say this may not be an easy trade to watch unfold.

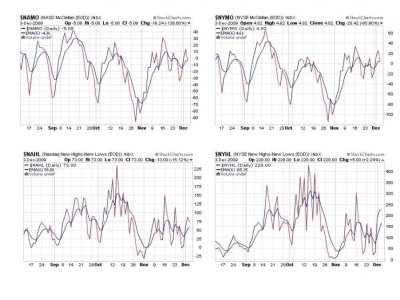

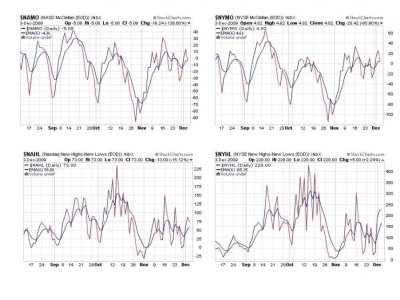

No real damage done today, although we see some deterioration in all but one signal today. NAMO and NYMO are pretty much sitting on their 6 day EMA and they've been moving sideways now for several weeks. Volatility in these charts has also dampened considerably from previous months. So they may not be as bearish as I initially thought.

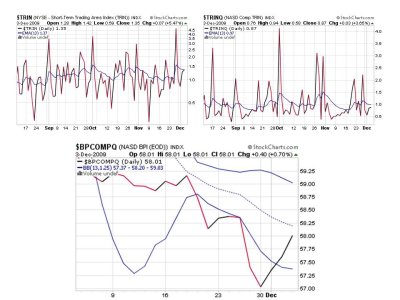

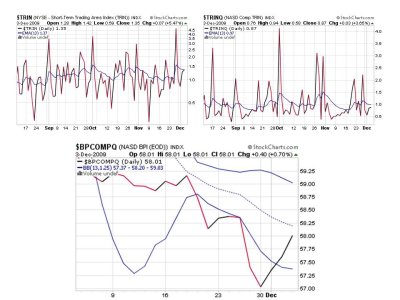

TRIN and TRINQ are still on a buy and also sitting very close to their 13 day EMA. But BPCOMPQ, after dropping for most of the past two months, seems to be modestly and quietly reversing trend, even after today's late day sell-off.

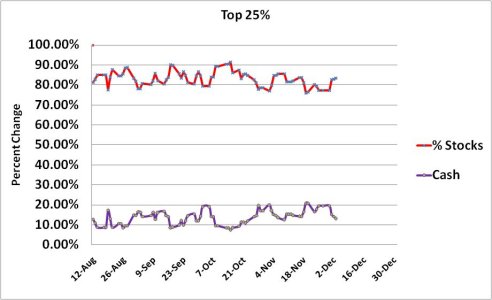

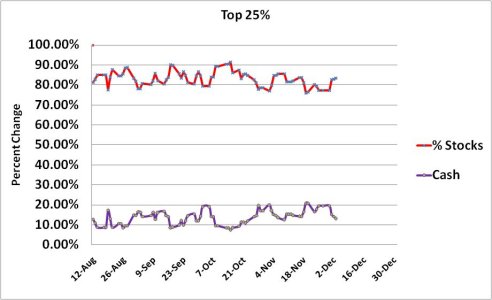

Our Top 25% dropped their collective cash level again for today's trading action. I would not ignore that signal.

So we're still very much on a buy with the seven sentinels, but market character appears to have changed. My bet is we are setting up to break the previous highs for the year, but how far I can't say. I'm inclined to think blow-off top. But da boyz have to set it up, which is why I'm pointing out the moderation of NAMO and NYMO and the stealth uptick of BPCOMPQ. Suck in the shorts, shake loose the weak handed bulls and ram it through the ceiling. That's why this trade may not be easy to watch unfold. It could get emotionally tense if it plays out this way.

And that's also why I point out the declining cash position of our Top 25%. It's early in the month, it's a historically postive month, and we have too many weeks to go for new IFTs to get shaken loose too easily. If those folks start to go bearish on me, then I'll get nervous.

the top is in. They just can't wait to short this market. I gotta say there must be an awful lot of gamblers out there, because shorting this market over the past 9 months or so has, by and large, been a losing trade. And yet they come. Like moths drawn to a flame. :laugh:

I'm seeing it on the boards. So far the sentiment survey on Trader's Talk is 82% bearish, although participation is still ongoing till the open tomorrow. But that's still a lot of bears for any given trading day. I'm very interested in seeing how the daily survey numbers end, but I'm willing to bet they'll still be overly bearish.

Having said this though, that doesn't mean we can't see some weakness. And it could be significant in order to attract more shorts. It just seems a little odd to me that I'd get a SSBS and then the market drops. I smell a rat and I'll point out why below.

I entered the market today, but let me say this may not be an easy trade to watch unfold.

No real damage done today, although we see some deterioration in all but one signal today. NAMO and NYMO are pretty much sitting on their 6 day EMA and they've been moving sideways now for several weeks. Volatility in these charts has also dampened considerably from previous months. So they may not be as bearish as I initially thought.

TRIN and TRINQ are still on a buy and also sitting very close to their 13 day EMA. But BPCOMPQ, after dropping for most of the past two months, seems to be modestly and quietly reversing trend, even after today's late day sell-off.

Our Top 25% dropped their collective cash level again for today's trading action. I would not ignore that signal.

So we're still very much on a buy with the seven sentinels, but market character appears to have changed. My bet is we are setting up to break the previous highs for the year, but how far I can't say. I'm inclined to think blow-off top. But da boyz have to set it up, which is why I'm pointing out the moderation of NAMO and NYMO and the stealth uptick of BPCOMPQ. Suck in the shorts, shake loose the weak handed bulls and ram it through the ceiling. That's why this trade may not be easy to watch unfold. It could get emotionally tense if it plays out this way.

And that's also why I point out the declining cash position of our Top 25%. It's early in the month, it's a historically postive month, and we have too many weeks to go for new IFTs to get shaken loose too easily. If those folks start to go bearish on me, then I'll get nervous.