-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Sensei's account talk

- Thread starter Sensei

- Start date

maverick06

Investor

- Reaction score

- 3

i think you are right, timing the market is nearly a fools errand. BUT by saying you will take it off at 1750, then you are at least playing it more than birchtree. I think there is some merit in that, I have been notorious for movign the money too often, Fighting over the nuances of the market's daily fluctations have hurt me some. I need a longer tern view, move it in and ourat lower frequency.

still, a few cautious moves would be beneficial. Leaving it in more than not is clearly the winner!

still, a few cautious moves would be beneficial. Leaving it in more than not is clearly the winner!

ILoveTDs

TSP Analyst

- Reaction score

- 10

Leaving it in more than not is clearly the winner!

At least this year.

I've found for me I do better at market timing in down or low years, then I do in huge up years. I don't think it is I'm a better timer from one year to the next, I just think it is hard to time YTD 30% gains. Of course I always want to beat market, that's the point of timing. However, my personal goal is 10% growth in all years, so if I can get that I am happy.

What I am saying Sensei is it is easy to get frustrated when we are so far behind the market and have invested so much time, but it does come in waves. Stick with it.

Sensei

TSP Pro

- Reaction score

- 27

While the Nikkei finished strong yesterday (up 0.83 % ), the DAX was down 0.38 , and today the Nikkei ended down 0.17 %. So I get the feeling the rest of the world does not share the same bullish outlook as U.S. investors. The Sentiment Survey is very close to 2 to 1 bulls/bears. Ocean's list shows less than 50% of the herd in G & F. So, I'm thinking a move to the sidelines might be warranted in the next day or two. If so, I'll only move 50%.

Sensei

TSP Pro

- Reaction score

- 27

I moved 50% to the G fund effective COB Friday. We'll see how that goes. SPX and W4500 both put in gaps and poked way outside the bollinger bands, so I feel like at least a little sideways consolidation is in order. I still have another IFT this month, so I hope to be 100% invested before Halloween.

On a personal note, I ran my first race since June today. 1/2 marathon on Kadena Air Base, so I was mainly competing with Americans - which was a confidence booster. Japanese runners are pretty fast. I finished with a time of 1:40:25, which was about a minute faster than my previous 1/2 marathon back in April. I will now look to keep building stamina for the Okinawa Marathon in February.

On a personal note, I ran my first race since June today. 1/2 marathon on Kadena Air Base, so I was mainly competing with Americans - which was a confidence booster. Japanese runners are pretty fast. I finished with a time of 1:40:25, which was about a minute faster than my previous 1/2 marathon back in April. I will now look to keep building stamina for the Okinawa Marathon in February.

Sensei

TSP Pro

- Reaction score

- 27

Nice pace for the half...I have no more IFTs so I am battling with pulling out Monday or riding it out through til November

Thanks. If I had only a move to G remaining, I would - as they say - "ride it till it breaks". And given the market we are in, I would always leave 50% in stocks. That's my way of "idiot-proofing" myself. Now, let's see if I can follow my own advice.

Sensei

TSP Pro

- Reaction score

- 27

Sometimes you lose.

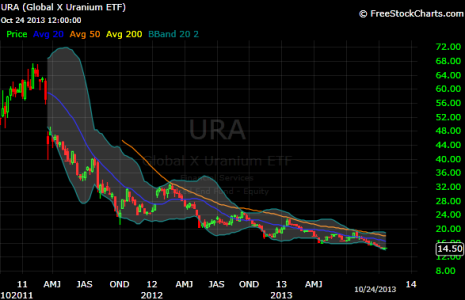

Most of us post our victories. Tonight, I want to post a defeat. In May of 2011, I opened a Sharebuilder account with automatic investments. Little by little I've been DCA'ing into about 10 different stocks/ETFs. One I thought would be a good pick was URA, the ETF for uranium. After the Fukushima meltdown, URA was down about 50%, and there was a huge glaring gap that I was sure would get filled with a little patience. Take a look. Between $55.00 and $49.50. I threw money down the hole, $25 and $40 at a time. Now, I have $984 invested in it, and it is valued at $600. I'm 39% in the red. So, what would you do?

Most of us post our victories. Tonight, I want to post a defeat. In May of 2011, I opened a Sharebuilder account with automatic investments. Little by little I've been DCA'ing into about 10 different stocks/ETFs. One I thought would be a good pick was URA, the ETF for uranium. After the Fukushima meltdown, URA was down about 50%, and there was a huge glaring gap that I was sure would get filled with a little patience. Take a look. Between $55.00 and $49.50. I threw money down the hole, $25 and $40 at a time. Now, I have $984 invested in it, and it is valued at $600. I'm 39% in the red. So, what would you do?

Attachments

Whipsaw

Market Veteran

- Reaction score

- 239

Re: Sometimes you lose.

Seeing how 'The China Syndrome' and 3 Mi. Island stymied nuclear development for decades, Fukushima was pretty much a Flying Suplex from the corner ropes for nuclear power... without doing any research, I remember some talk of a new starts in nuclear power prior to the earthquakes, nothing since. Unless you need the $, forget its there... it may come back someday, unless you can shift it to some other high growth investment to try and recoup losses. Any nuclear power industry types on the board?

Seeing how 'The China Syndrome' and 3 Mi. Island stymied nuclear development for decades, Fukushima was pretty much a Flying Suplex from the corner ropes for nuclear power... without doing any research, I remember some talk of a new starts in nuclear power prior to the earthquakes, nothing since. Unless you need the $, forget its there... it may come back someday, unless you can shift it to some other high growth investment to try and recoup losses. Any nuclear power industry types on the board?

WorkFE

TSP Legend

- Reaction score

- 517

Your call but if the money is blocked out of your mind like you don't have it, let it ride. Nuclear energy use needs to be done more safely but it will not disappear. I've seen in the news where there are proposal to add/refurbish some power plants globally. I think most folks agree that going forward global energy will be a fair mix of sources.

craigerv

Market Tracker

- Reaction score

- 3

Re: Sometimes you lose.

Tough one. I probably would've been disappointed by 2013 and dumped it. But if you feel like playing with it further it looks like you can buy a bounce off the lower bollinger, sell near the 50 MA, rinse, repeat. At least until you see it breaking out past the 50 MA.

Tough one. I probably would've been disappointed by 2013 and dumped it. But if you feel like playing with it further it looks like you can buy a bounce off the lower bollinger, sell near the 50 MA, rinse, repeat. At least until you see it breaking out past the 50 MA.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

I'm pro-nuclear so I would stick with your original strategy especially if this is spill money. It's never easy pouring sound money down a dark and wet rabbit hole - but you'll be accumulating more shares at a lower price and four years from now it'll prove the right thing to do. Your come back will be quick. And if they pay a dividend so much the better.

JimmyJoe

TSP Analyst

- Reaction score

- 8

Pro nuclear? Maybe for some applications. Energize cars, boats. Ok. I can't feel assured for its safely being used generating power for the grid. Solar will be used more often in ten years when permitted, encouraged by politicos.I'm pro-nuclear so I would stick with your original strategy especially if this is spill money. It's never easy pouring sound money down a dark and wet rabbit hole - but you'll be accumulating more shares at a lower price and four years from now it'll prove the right thing to do. Your come back will be quick. And if they pay a dividend so much the better.

WorkFE

TSP Legend

- Reaction score

- 517

SEGS in the Mojave Desert (9 different plants) Largest solar field in US.= Combined 360 MW, takes up 3500 acres and on a good day powers 200,000 homes.

Palo Verde in Arizona (3 Nuclear facilities) Largest in US= Combined 3.3 GW, takes up 4000 acres and powers 4 million homes constantly.

It would take 10 SEGS size solar fields to equal the power output of Palo Verde. Where will the prairie dogs and prong horns live?

Yes, Nuclear has to be safer, but lets not kid ourselves into thinking we will power our nation on solar alone.

Palo Verde in Arizona (3 Nuclear facilities) Largest in US= Combined 3.3 GW, takes up 4000 acres and powers 4 million homes constantly.

It would take 10 SEGS size solar fields to equal the power output of Palo Verde. Where will the prairie dogs and prong horns live?

Yes, Nuclear has to be safer, but lets not kid ourselves into thinking we will power our nation on solar alone.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Sensei

TSP Pro

- Reaction score

- 27

Wow. Interesting and timely. Thanks!

Ultimately, I think this is what I'm going to do. Given that my investment so far has been relatively small over the course of 2+ years, I will resume DCAing small amounts once or twice a month. This will lower my average price per share, and set me up for a bigger gain when uranium does eventually rebound. This is the strategy that currently has me up 65% on my investment in BAC. Thanks to everyone for the discussion and feedback!I'm pro-nuclear so I would stick with your original strategy especially if this is spill money. It's never easy pouring sound money down a dark and wet rabbit hole - but you'll be accumulating more shares at a lower price and four years from now it'll prove the right thing to do. Your come back will be quick. And if they pay a dividend so much the better.

Similar threads

- Replies

- 0

- Views

- 170

- Replies

- 7

- Views

- 990

- Replies

- 0

- Views

- 86