Sensei

TSP Pro

- Reaction score

- 27

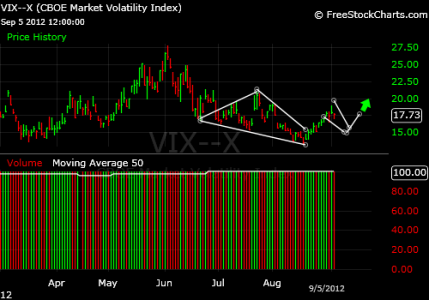

It was nice to have 81% in S today. Not sure though whether the small caps are leading, or failing to follow. I guess we'll find out tomorrow. My annual return is now the highest it's been so far this year, which has me worried that I'm about to take it on the chin.

For those following my adventures in less than 1% trades after running out of IFTs, I didn't really take advantage of it last month. It turns out that only holding 1% of the L funds isn't very helpful. With only mild to moderate action in the market, there wasn't ever enough of a change for those allocations to move up to even 1.01%. My 5% in C, however, did advance to 5.01%, which I was able to buy up to 6%. So, for anyone thinking of using this technique down the road, I'd say you'll probably need 3-5% in each of the funds in order to see enough variation to make a <1% IFT.

For this month, I'm stuck with what I got: 81 S, 6 C, 1 I, 3 L funds, and 9 G. I'll hold that way until it's time to sell, or we get to the end of the month and I can afford to burn an IFT.

For those following my adventures in less than 1% trades after running out of IFTs, I didn't really take advantage of it last month. It turns out that only holding 1% of the L funds isn't very helpful. With only mild to moderate action in the market, there wasn't ever enough of a change for those allocations to move up to even 1.01%. My 5% in C, however, did advance to 5.01%, which I was able to buy up to 6%. So, for anyone thinking of using this technique down the road, I'd say you'll probably need 3-5% in each of the funds in order to see enough variation to make a <1% IFT.

For this month, I'm stuck with what I got: 81 S, 6 C, 1 I, 3 L funds, and 9 G. I'll hold that way until it's time to sell, or we get to the end of the month and I can afford to burn an IFT.

Last edited: