After starting out the trading day with moderate losses, the market quickly turned things up and ended the session with moderate gains. Things were just too beared up this morning to really get any sustained selling pressure. I'm not surprised. That's normal market behavior.

I don't think the market is out of the woods given the latest SS sell signal, but don't be surprised if end of quarter window dressing drags things out for a few days yet.

Today's charts:

Some improvement, but still on a sell here.

Same with NAHL and NYHL.

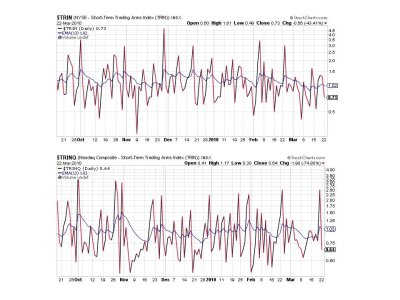

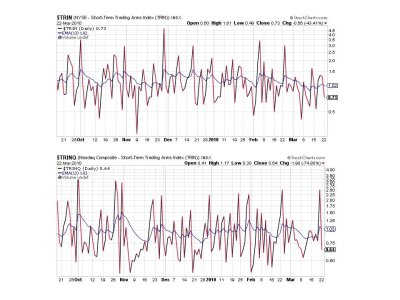

TRIN and TRINQ flipped back to buys today.

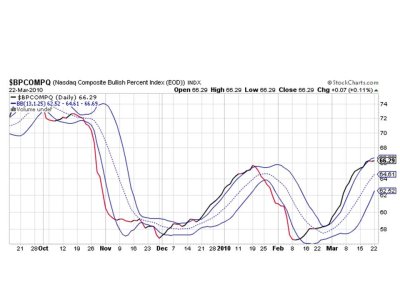

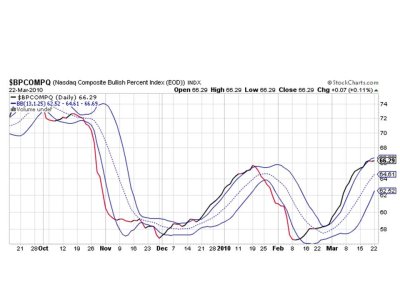

BPCOMPQ, while barely green today, is still flashing a sell.

So we have 5 of 7 signals on a sell, which keeps the system on a sell. I'm a little concerned about window dressing flipping the system back to a buy and then getting another sell signal once the quarter is over or close to over. We could be in for some whipsaw action in the next couple of weeks, so be aware. I'll see you tomorrow.

I don't think the market is out of the woods given the latest SS sell signal, but don't be surprised if end of quarter window dressing drags things out for a few days yet.

Today's charts:

Some improvement, but still on a sell here.

Same with NAHL and NYHL.

TRIN and TRINQ flipped back to buys today.

BPCOMPQ, while barely green today, is still flashing a sell.

So we have 5 of 7 signals on a sell, which keeps the system on a sell. I'm a little concerned about window dressing flipping the system back to a buy and then getting another sell signal once the quarter is over or close to over. We could be in for some whipsaw action in the next couple of weeks, so be aware. I'll see you tomorrow.