And the train keeps rolling. It may not be moving very fast, but it's moving in the right direction. The Seven Sentinels remain on a buy this holiday session, but they are getting extended. Because of the seasonality influence I cannot read too much into those charts except to say that if one is in stocks you might as well hold until the market says otherwise.

But sentiment continues to be overly bullish and that's a potential problem. But as long as da boyz stay away we should keep drifting higher.

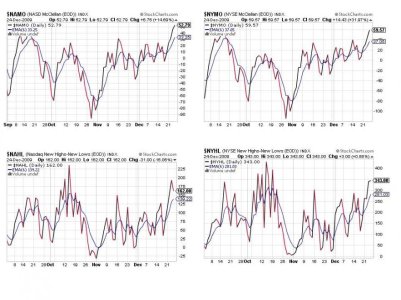

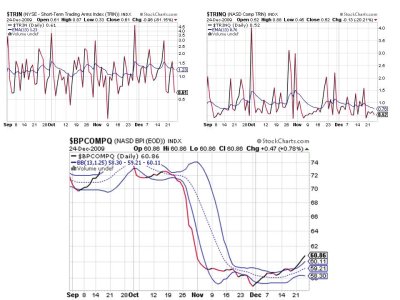

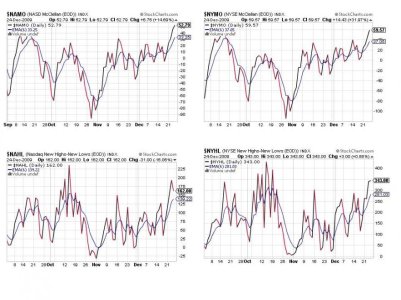

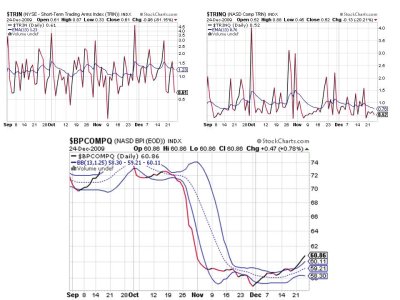

Here's the charts from Thursday's action:

These signals remain on a buy and we can see they are at high levels as measued these past few months.

All three of these signals remain on a buy as well.

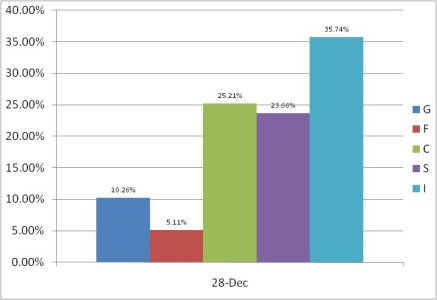

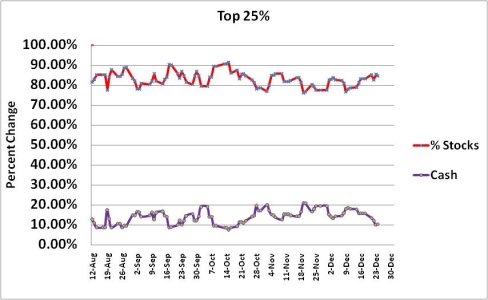

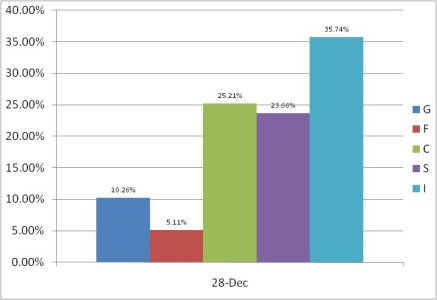

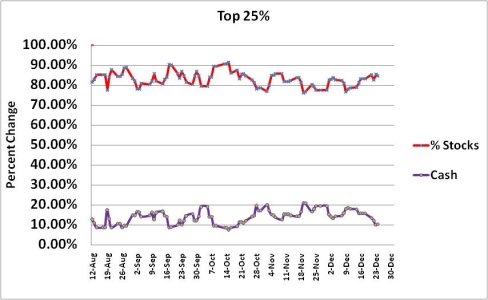

Our Top 25% are working this rally for all it's worth. And the I fund allocation continues to move higher.

So the Seven Sentinels system remains on a buy with all seven signals in buy territory. I can only caution that sentiment is very bullish, which can be a big negative, but seasonalty is trumping sentiment right now. I'll check on next week's sentiment picture later this weekend and we'll see how it's shaping up. See you then.

But sentiment continues to be overly bullish and that's a potential problem. But as long as da boyz stay away we should keep drifting higher.

Here's the charts from Thursday's action:

These signals remain on a buy and we can see they are at high levels as measued these past few months.

All three of these signals remain on a buy as well.

Our Top 25% are working this rally for all it's worth. And the I fund allocation continues to move higher.

So the Seven Sentinels system remains on a buy with all seven signals in buy territory. I can only caution that sentiment is very bullish, which can be a big negative, but seasonalty is trumping sentiment right now. I'll check on next week's sentiment picture later this weekend and we'll see how it's shaping up. See you then.