A positive close might have triggered a buy signal for the Seven Sentinels today, but of course the market had other plans as an initial gap down was reversed by good market data, but it wasn't enough to overcome the continued pessimism in terms of the global fiscal malaise. Towards the end of the trading day selling intensified and the major indexes closed at their worst levels of the day.

On the U.S. data front, the ISM Manufacturing Index for May came in at 59.7, just a tad better than forcasts. Construction spending for April jumped 2.7%, which was much higher than the estimated 0.1% monthly increase.

While the Seven Sentinels moved away from a buy signal today, they do not look bad. This volatility is making it tough for either side to play the market and it seems large moves are becoming the norm. One green close can still trigger a buy signal in spite of today's ugly close.

Here's the charts:

Both signals dropped back down near their 6 day EMAs today, with NAMO flipping back to a sell and NYMO holding its buy.

NAHL and NYHL are also very near their 6 day EMAs. I'd say they are still on a buy for now.

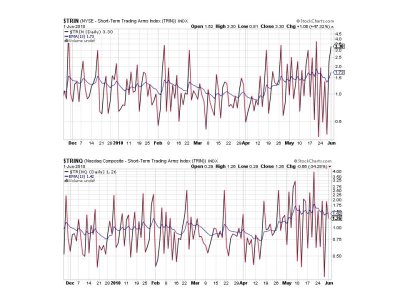

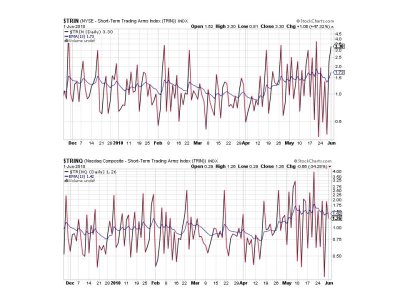

TRIN remained on a sell, but TRINQ actually flipped to a buy.

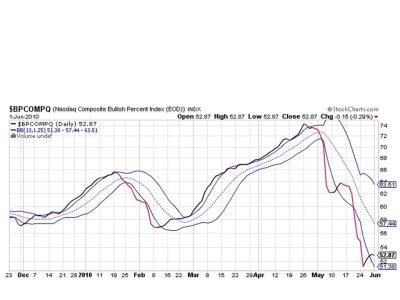

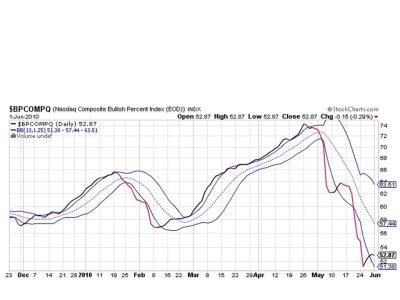

BPCOMPQ dipped a bit lower today, but remains on a buy.

So we have 5 of 7 signals remaining on a buy, but all of them are close to their trigger points.

It's a tough call right now as to what happens next. I continue to believe we are seeing bottoming action, but it's certainly possible we could drop much lower. That's not my expectation, but we can't go much lower before more sell signals get triggered in other systems.

I have been holding 100% S since last month after whipsawed into a buy signal and not wanting to go to the G fund with more than half the month left to go. As you've seen, reversals can be fast and steep in either direction. We are at the lower end of the channel now, so it's make or break time.

That's it for this evening. Good luck to you on your trades and see you tomorrow.

On the U.S. data front, the ISM Manufacturing Index for May came in at 59.7, just a tad better than forcasts. Construction spending for April jumped 2.7%, which was much higher than the estimated 0.1% monthly increase.

While the Seven Sentinels moved away from a buy signal today, they do not look bad. This volatility is making it tough for either side to play the market and it seems large moves are becoming the norm. One green close can still trigger a buy signal in spite of today's ugly close.

Here's the charts:

Both signals dropped back down near their 6 day EMAs today, with NAMO flipping back to a sell and NYMO holding its buy.

NAHL and NYHL are also very near their 6 day EMAs. I'd say they are still on a buy for now.

TRIN remained on a sell, but TRINQ actually flipped to a buy.

BPCOMPQ dipped a bit lower today, but remains on a buy.

So we have 5 of 7 signals remaining on a buy, but all of them are close to their trigger points.

It's a tough call right now as to what happens next. I continue to believe we are seeing bottoming action, but it's certainly possible we could drop much lower. That's not my expectation, but we can't go much lower before more sell signals get triggered in other systems.

I have been holding 100% S since last month after whipsawed into a buy signal and not wanting to go to the G fund with more than half the month left to go. As you've seen, reversals can be fast and steep in either direction. We are at the lower end of the channel now, so it's make or break time.

That's it for this evening. Good luck to you on your trades and see you tomorrow.