The Seven Sentinels managed to retain their buy status today, but not by much. But before I go over the particulars, let's take a quick look at today's events.

The started off relatively flat at the open as it continued to digest the December payrolls data. Nonfarm payrolls increased by 103,000, while private payrolls were up 113,000. Neither hit expected targets of 150,000 and 162,000 respectively. Of course CNBC had analysts debating why the overall unemployment rate dropped to 9.4% given the overall weak payroll numbers. Lower participation, unemployment benefits and seasonality were cited as factors.

Fed Chairman Ben Bernanke was also in the news early on he was providing testimony to the Senate Banking Committee. He contends that economic recovery should be stronger in 2011 than 2010, but that the pace of recovery is insufficient to significantly reduce the unemployment rate.

But the biggest knee jerk reaction came after word got out that Massachusetts Supreme Court ruled against Wells Fargo and US Bancorp in a case regarding the treatment of mortgage securitization by the banks. Financials took an immediate hit and were down over 2% at one point before partially recovering later in the session.

The dollar was up again today, this time by 0.3% against a basket of competing currencies. Most of the dollar's weekly gain of 2.6% came at the expense of the euro, which continues to struggle in the debt plagued eurozone.

Now let's take a look at the charts.

Both NAMO and NYMO are flashing sells and do suggest we may see additional weakness in coming sessions.

NAHL and NYHL are also flashing sells, but still look healthy in the big picture.

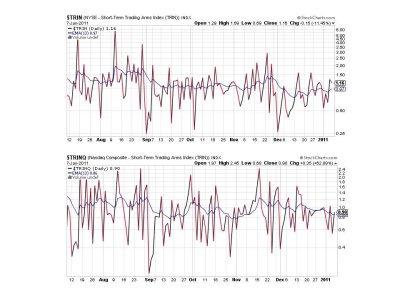

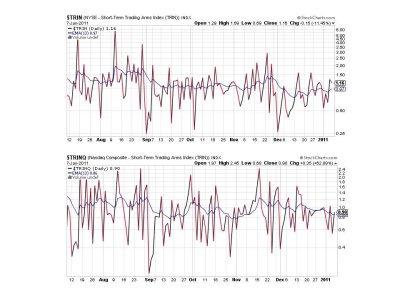

TRIN and TRINQ are now both flashing sells, but only barely.

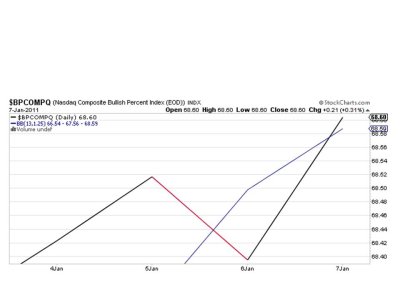

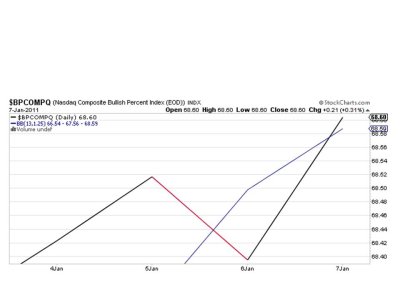

Surprise, surprise, BPCOMPQ managed to just barely turn high enough to cross back through that upper bollinger band, which triggers a buy signal. And that keeps the system on a buy. So volatility is back in the market and we're back to the same old story. Is the current volatility and weakness enough to develop into a significant correction?

Perhaps. But I don't get the impression the market is ready just yet. It's still showing a lot of resilience and while the seven sentinels suggest a sell signal is developing, QE2 is still being deployed, which may keep a lid on any decline.

So both the Sentinels and our own sentiment survey are on buys for next week, which keeps me in my comfort zone as I'm 100% I fund.

I'll be posting the tracker charts over the weekend. See you then.

The started off relatively flat at the open as it continued to digest the December payrolls data. Nonfarm payrolls increased by 103,000, while private payrolls were up 113,000. Neither hit expected targets of 150,000 and 162,000 respectively. Of course CNBC had analysts debating why the overall unemployment rate dropped to 9.4% given the overall weak payroll numbers. Lower participation, unemployment benefits and seasonality were cited as factors.

Fed Chairman Ben Bernanke was also in the news early on he was providing testimony to the Senate Banking Committee. He contends that economic recovery should be stronger in 2011 than 2010, but that the pace of recovery is insufficient to significantly reduce the unemployment rate.

But the biggest knee jerk reaction came after word got out that Massachusetts Supreme Court ruled against Wells Fargo and US Bancorp in a case regarding the treatment of mortgage securitization by the banks. Financials took an immediate hit and were down over 2% at one point before partially recovering later in the session.

The dollar was up again today, this time by 0.3% against a basket of competing currencies. Most of the dollar's weekly gain of 2.6% came at the expense of the euro, which continues to struggle in the debt plagued eurozone.

Now let's take a look at the charts.

Both NAMO and NYMO are flashing sells and do suggest we may see additional weakness in coming sessions.

NAHL and NYHL are also flashing sells, but still look healthy in the big picture.

TRIN and TRINQ are now both flashing sells, but only barely.

Surprise, surprise, BPCOMPQ managed to just barely turn high enough to cross back through that upper bollinger band, which triggers a buy signal. And that keeps the system on a buy. So volatility is back in the market and we're back to the same old story. Is the current volatility and weakness enough to develop into a significant correction?

Perhaps. But I don't get the impression the market is ready just yet. It's still showing a lot of resilience and while the seven sentinels suggest a sell signal is developing, QE2 is still being deployed, which may keep a lid on any decline.

So both the Sentinels and our own sentiment survey are on buys for next week, which keeps me in my comfort zone as I'm 100% I fund.

I'll be posting the tracker charts over the weekend. See you then.