Thanks Tom, I appreciate it!

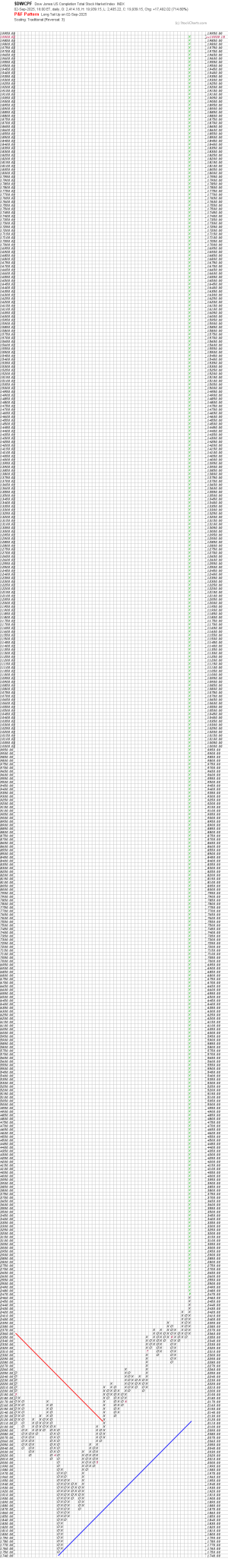

There are a few completion index type of funds that are all basically the same. Here's some limited info on VXF (Vanguard Extended Market Index Fund):

https://finance.yahoo.com/quote/VXF?p=VXF

https://finance.yahoo.com/quote/VXF/profile?p=VXF

https://finance.yahoo.com/quote/VXF/holdings?p=VXF