As our elected officials continue the biggest game of chicken Washington has seen is some time, the perceived negative financial ramifications of allowing the U.S. to default is beginning to take its toll on the psyche of traders and investors as the deadline to avert such a disaster is now only hours away.

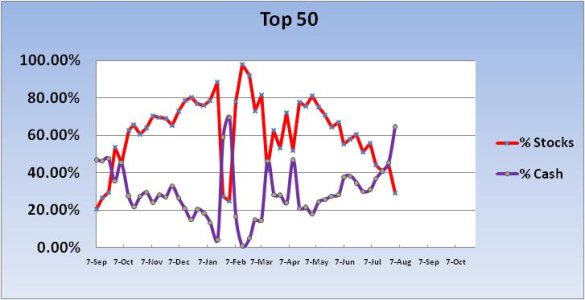

Of the two groups of TSPers that I track, one group is definitely taking a much more conservative approach this week as a result of the debt ceiling impasse.

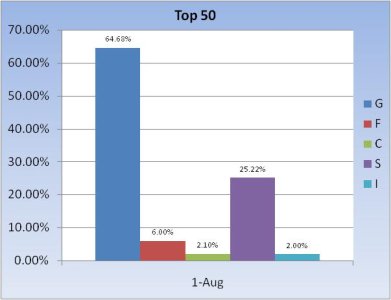

The Top 50 dropped their collective stock allocation by over 15% this week. They now hold a fairly modest 29.32% stock allocation, while loading up the G fund to the tune of 64.68%.

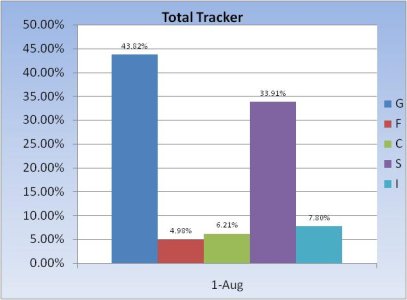

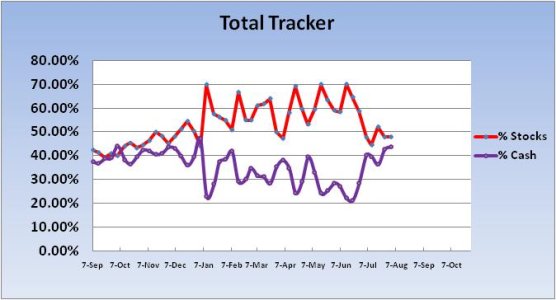

The herd on the other hand, is pretty much holding steady from the previous week, but their collective stock allocation is still only moderately bullish at 47.93%.

Our sentiment survey is on a hold (buy) for this coming week after showing a 36% Bullish reading, while the Bearish number is 55%. Is this good news? Often it is, but we were on a hold (buy) last week too only to see the C fund drop 3.91%, while the S fund fell a whopping 4.90%. Will it be wrong two weeks in a row?

We may know the answer to that question by Tuesday. And it could be quite a ride depending on what happens (or doesn't happen).