Well, I said yesterday the Seven Sentinels were looking toppy, and today we got some selling pressure. It's still OPEX, and it's only one trading day, but if the market holds true to its recent form, we're probably in for some more downside action. The Seven Sentinels issued a sell signal today, so my front-running of a potential sell signal yesterday paid some dividends. But now I'm stuck on the sidelines till the 1st of December, and it's possible we reverse before then.

Still, I managed to hold on to about 4% of my gains this last up-leg. If I did that every month I'd be on top of the leaderboard. Point being, small monthly gains add up to large yearly gains.

But I've had to do some front-running of the signals lately to make it happen.

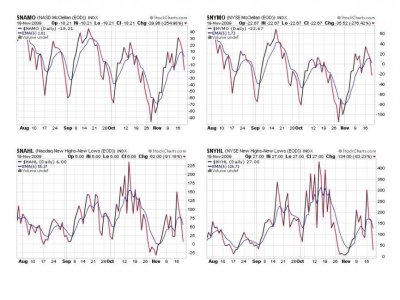

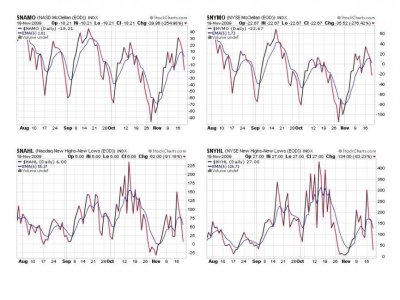

Here's today's charts:

All four are now flashing sell signals here.

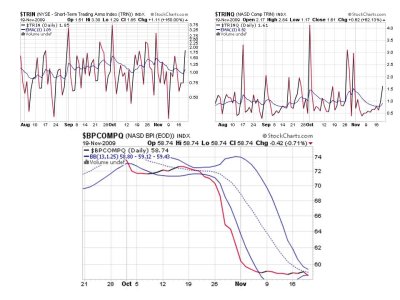

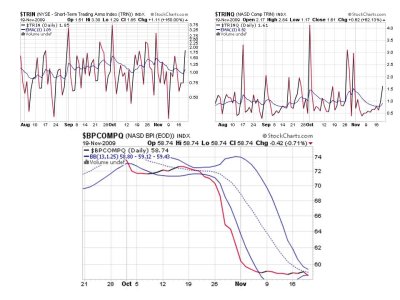

All three are on sells here too. You can see the lower bollinger band on BPCOMPQ now and we just touched it today, flipping the signal to a sell.

Chances are there will be more selling in store for the market before any potential new highs are reached. Next week is a holiday week and black Friday is coming. Things could get very interesting by next weeks end.

Still, I managed to hold on to about 4% of my gains this last up-leg. If I did that every month I'd be on top of the leaderboard. Point being, small monthly gains add up to large yearly gains.

But I've had to do some front-running of the signals lately to make it happen.

Here's today's charts:

All four are now flashing sell signals here.

All three are on sells here too. You can see the lower bollinger band on BPCOMPQ now and we just touched it today, flipping the signal to a sell.

Chances are there will be more selling in store for the market before any potential new highs are reached. Next week is a holiday week and black Friday is coming. Things could get very interesting by next weeks end.