But how risky is it when (historically) November is the 2nd best performing month for the S&P 500, and 3rd best for the DOW and Nasdaq since 1971? It's the beginning of the best 6 months of the year for the broader market. Of course November comes on the heels of a highly profitable October, which could make this month a bit more tricky than normal.

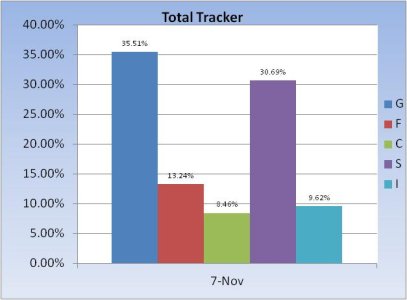

Here's the charts:

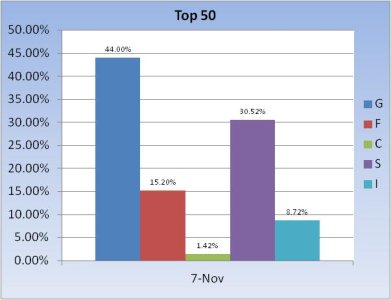

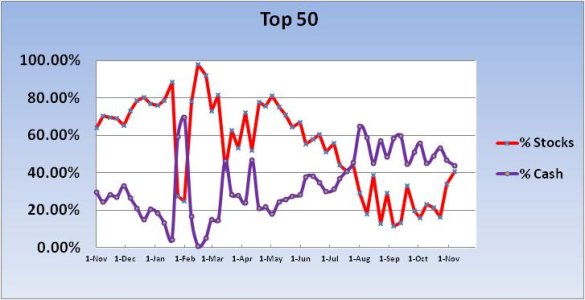

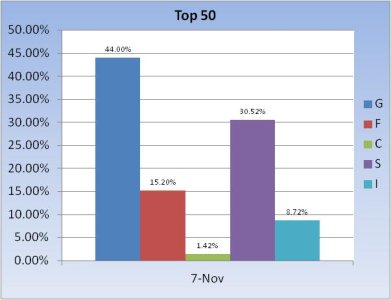

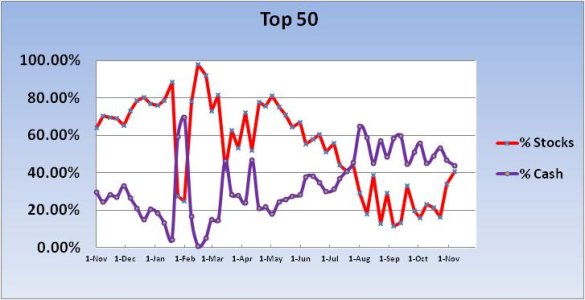

The Top 50 increased their stock position the previous week by 17.82%. This week they added another 6.6%, which brings their total stock allocation to 40.66%. They've dropped their bond allocation a bit from last week's 19.04% to this week's allocation of 15.2%.

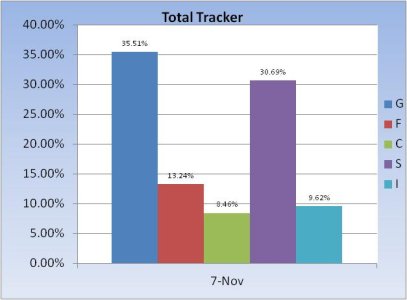

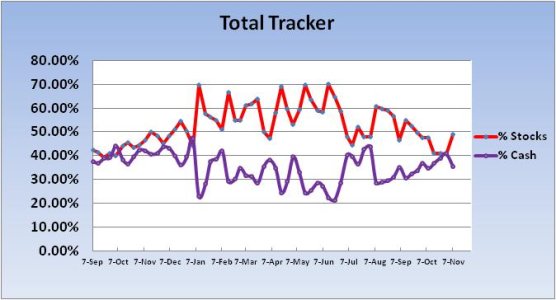

The herd also increased their collective stock exposure. Going into the new week the herd has added 8.2% to their stock position, which brings it up from 40.55% last week to 48.76% this week.

Both groups remain under a 50% stock allocation overall, but I suspect some TSPers are anticipating a year-end rally and moving into position early on. Last week's weakness may have been a good opportunity to begin loading up in that regard.

The Seven Sentinels remain in a buy condition going into the new week and our Sentiment Survey is on back to back sells. Volatility will probably remain with us so trading will continue to be challenging.

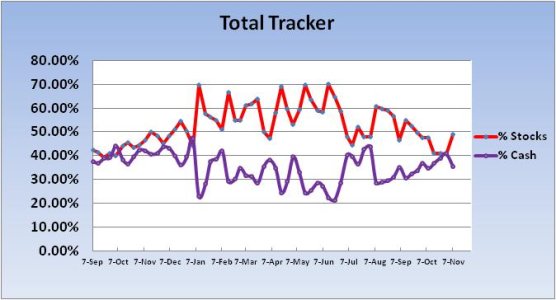

Here's the charts:

The Top 50 increased their stock position the previous week by 17.82%. This week they added another 6.6%, which brings their total stock allocation to 40.66%. They've dropped their bond allocation a bit from last week's 19.04% to this week's allocation of 15.2%.

The herd also increased their collective stock exposure. Going into the new week the herd has added 8.2% to their stock position, which brings it up from 40.55% last week to 48.76% this week.

Both groups remain under a 50% stock allocation overall, but I suspect some TSPers are anticipating a year-end rally and moving into position early on. Last week's weakness may have been a good opportunity to begin loading up in that regard.

The Seven Sentinels remain in a buy condition going into the new week and our Sentiment Survey is on back to back sells. Volatility will probably remain with us so trading will continue to be challenging.