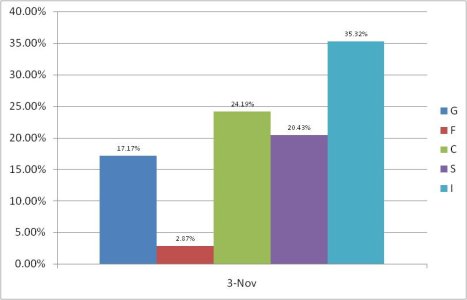

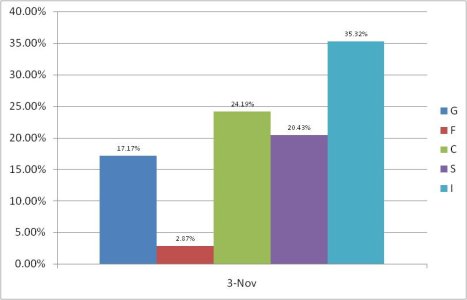

Another odd day. Yesterday, the C fund finished the day with moderate gains, while the S fund finished in much more modest fashion. Today it was greatly reversed. The C fund had a very modest gain today, while the S fund hit it out of the park.

So just like that the flight to quality evaporates and risk is back in vogue. Or is it?

While impressive, the S funds performance today has to be seen for what it is. One day's performance. It remains to be seen if there is to be a more lasting trend.

By contrast the I fund had a moderately down day. But the I fund may very well play catch up tomorrow.

Speaking of tomorrow, the FOMC will make its rate and policy announcement tomorrow afternoon. As touchy as this market has been lately, the annoucement could conceivably add to recent volatility. It's one of the more difficult days to initiate an IFT as market conditions can change dramatically after an announcement. While no revelations are expected, this market is acting skittish just the same.

So how do the charts look today?

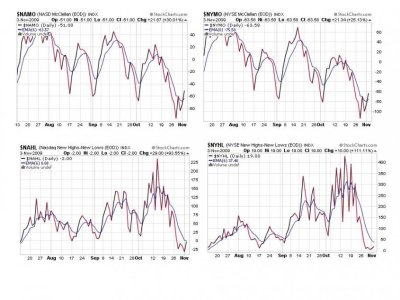

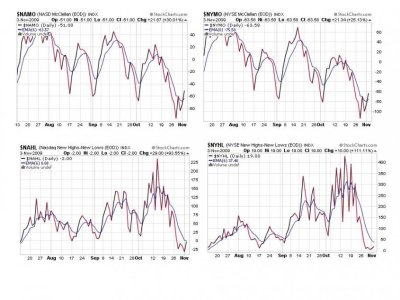

NAMO and NYMO both managed to flash buy signals today. But NAHL and NYHL remain on a sell, but the 6 day EMA is catching up to them, so any follow through to the upside tomorrow will probably flip them to buys.

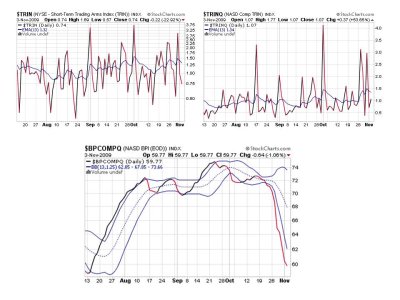

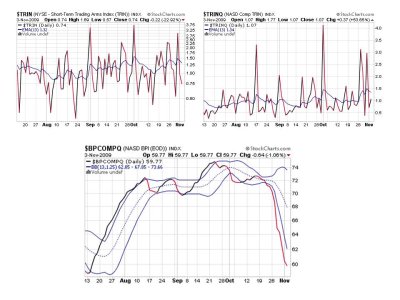

TRIN and TRINQ remained on a buy today, but BPCOMPQ is still dropping, albeit modestly.

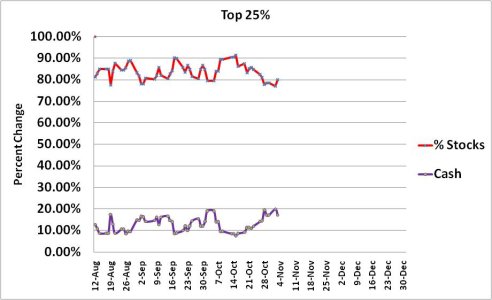

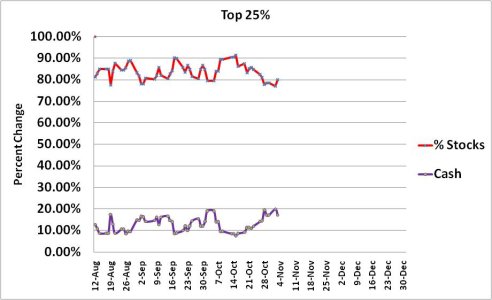

Not much change from our top 25% today.

So we have 4 buy signals and 3 sell signals, which keeps the system on a sell.

These indicators are starting to improve enough that the system appears it may issue a buy in the next few days. But sentiment is not as bearish as one might expect. There are still a lot of bulls who think it's time for another reversal. And if the charts suggest as much, which they are beginning to, then sentiment may get too bullish and there's a good chance we'll see more selling instead.

This market is acting odd with the VIX ramping up again. I think it's undergoing a change of character, but what that means I'm not sure. What I do know is that I can't expect to see another big move to the upside on successive days as we'd seen in previous months. It may happen, but I'm not betting on it happening without a better sentiment set-up.

But I have to let the seven sentinels guide me. And right now the caution flag is still out.

So just like that the flight to quality evaporates and risk is back in vogue. Or is it?

While impressive, the S funds performance today has to be seen for what it is. One day's performance. It remains to be seen if there is to be a more lasting trend.

By contrast the I fund had a moderately down day. But the I fund may very well play catch up tomorrow.

Speaking of tomorrow, the FOMC will make its rate and policy announcement tomorrow afternoon. As touchy as this market has been lately, the annoucement could conceivably add to recent volatility. It's one of the more difficult days to initiate an IFT as market conditions can change dramatically after an announcement. While no revelations are expected, this market is acting skittish just the same.

So how do the charts look today?

NAMO and NYMO both managed to flash buy signals today. But NAHL and NYHL remain on a sell, but the 6 day EMA is catching up to them, so any follow through to the upside tomorrow will probably flip them to buys.

TRIN and TRINQ remained on a buy today, but BPCOMPQ is still dropping, albeit modestly.

Not much change from our top 25% today.

So we have 4 buy signals and 3 sell signals, which keeps the system on a sell.

These indicators are starting to improve enough that the system appears it may issue a buy in the next few days. But sentiment is not as bearish as one might expect. There are still a lot of bulls who think it's time for another reversal. And if the charts suggest as much, which they are beginning to, then sentiment may get too bullish and there's a good chance we'll see more selling instead.

This market is acting odd with the VIX ramping up again. I think it's undergoing a change of character, but what that means I'm not sure. What I do know is that I can't expect to see another big move to the upside on successive days as we'd seen in previous months. It may happen, but I'm not betting on it happening without a better sentiment set-up.

But I have to let the seven sentinels guide me. And right now the caution flag is still out.