I was a little concerned about how Monday's trading action would fare after last week's OPEX, but once again the market showed some resilience in spite of the selling pressure today. This was welcome action as we need to consolidate the recent gains in a manner that won't trigger another Seven Sentinels sell signal. The closer we get to October 1st without a sell condition, the better. I don't have any IFTs to give other than go to G fund, so every day brings me that much closer to greater flexibility.

The selling pressure may not be done this week, but I'm expecting some buying pressure too, so a choppy market is more than likely what we'll see. The Seven Sentinels are still on a buy and they even managed to pick up one more buy signal from Friday. Here they are:

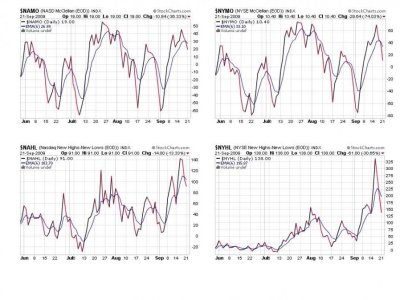

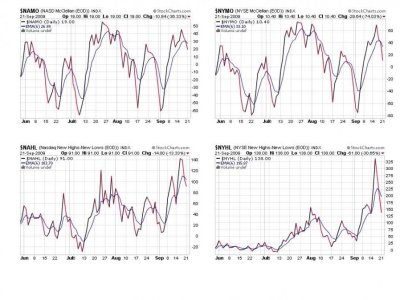

Just like Friday, all four of these signals are still in a sell condition.

]

]

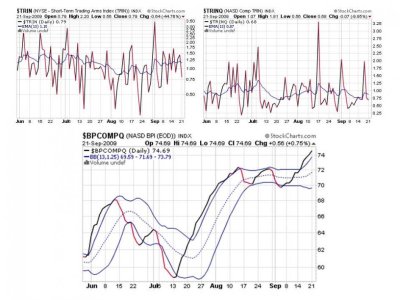

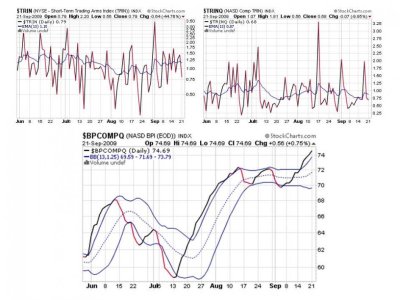

This is where we picked up a buy signal. All three are currently flashing buys now.

So we have 3 of 7 signals in buy mode, which keeps the system on a buy.

There is not much change in our top 25% for tomorrow's action so I'll hold off posting those charts for now. Those folks are still very bullish.

The selling pressure may not be done this week, but I'm expecting some buying pressure too, so a choppy market is more than likely what we'll see. The Seven Sentinels are still on a buy and they even managed to pick up one more buy signal from Friday. Here they are:

Just like Friday, all four of these signals are still in a sell condition.

]

]This is where we picked up a buy signal. All three are currently flashing buys now.

So we have 3 of 7 signals in buy mode, which keeps the system on a buy.

There is not much change in our top 25% for tomorrow's action so I'll hold off posting those charts for now. Those folks are still very bullish.