Stocks managed to break a string of losses today as the market had become quite oversold, which often leads to at least a short term relief rally. At the close, the DOW posted a gain of 0.63%, while the S&P 500 and Nasdaq were up 0.74% and 0.35% respectively. Our S fund saw a 0.56% gain, while the I fund was up 1.03%. Bonds took a hit, with the F fund down -0.15%.

Prior to the open, initial jobless claims for the week ending June 4 totaled 427,000, which was higher than the 423,000 initial claims economists were looking for, but not by much.

U.S. exports were up 1.3% in April, but that was much lower than March's 4.9%. And the U.S. trade deficit for April came in at $43.7 billion, which was lower than the $48.7 billion number that was expected.

Overseas, the European Central Bank left its target interest rate unchanged at 1.25%.

Let's take a look at the charts:

Since this selling pressure began, the 6 day EMA for NAMO and NYMO has been dropping. And today's moderate selling pressure pushed NAMO's signal back over its 6 day EMA as a result, which flips it back to a buy. NYMO didn't quite make it that far and remains on a sell.

The 6 day EMAs for NAHL and NYHL are also quite low, with NAHL in particular hitting a level not seen since last August. Both are not far off a buy signal should this market finally hit a bottom.

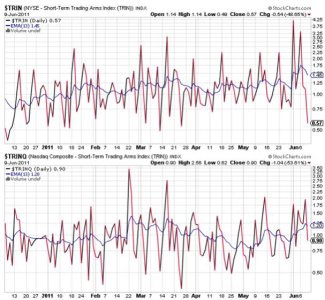

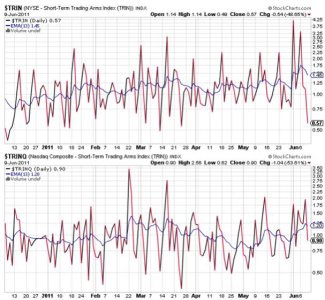

TRIN spiked lower today, to a level that suggests it is modestly overbought. It remains in a buy condition. TRINQ flipped to a buy on today's action, but is not implying an overbought condition.

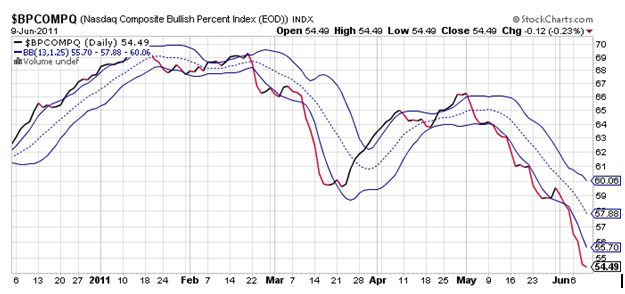

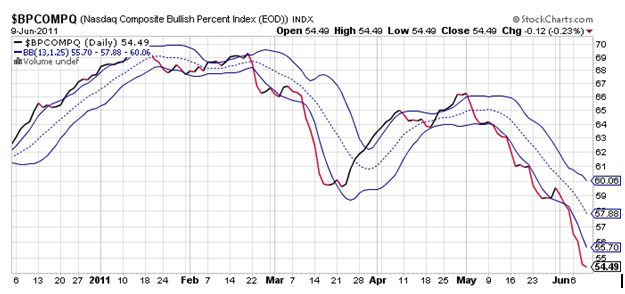

BPCOMPQ ebbed just a bit lower and remains on a sell.

So the Seven Sentinels remain in a sell condition. Today's action suggests a bottoming process is in progress, but it could still take some time before an actual bottom is put in. You've heard me say for while now that I'm looking for that bottom during OPEX week. That's based on where the market found its lows from the previous months and is simply a target time frame. I also wouldn't be surprised by another scary decline to wash out any remaining weak handed bulls as the big money tries to set the table for the next leg up. That's my expectation anyway. As always the market will have the final say.

Prior to the open, initial jobless claims for the week ending June 4 totaled 427,000, which was higher than the 423,000 initial claims economists were looking for, but not by much.

U.S. exports were up 1.3% in April, but that was much lower than March's 4.9%. And the U.S. trade deficit for April came in at $43.7 billion, which was lower than the $48.7 billion number that was expected.

Overseas, the European Central Bank left its target interest rate unchanged at 1.25%.

Let's take a look at the charts:

Since this selling pressure began, the 6 day EMA for NAMO and NYMO has been dropping. And today's moderate selling pressure pushed NAMO's signal back over its 6 day EMA as a result, which flips it back to a buy. NYMO didn't quite make it that far and remains on a sell.

The 6 day EMAs for NAHL and NYHL are also quite low, with NAHL in particular hitting a level not seen since last August. Both are not far off a buy signal should this market finally hit a bottom.

TRIN spiked lower today, to a level that suggests it is modestly overbought. It remains in a buy condition. TRINQ flipped to a buy on today's action, but is not implying an overbought condition.

BPCOMPQ ebbed just a bit lower and remains on a sell.

So the Seven Sentinels remain in a sell condition. Today's action suggests a bottoming process is in progress, but it could still take some time before an actual bottom is put in. You've heard me say for while now that I'm looking for that bottom during OPEX week. That's based on where the market found its lows from the previous months and is simply a target time frame. I also wouldn't be surprised by another scary decline to wash out any remaining weak handed bulls as the big money tries to set the table for the next leg up. That's my expectation anyway. As always the market will have the final say.