Or so it feels like it. After being hit hard by the market yesterday and unable to lighten up, the market reversed course today in a big way and reclaimed most of yesterday's losses. And I took to the opportunity to sell into it.

I've repeated myself on numerous occasions about how difficult it is being "nimble" with TSP when volatility is high or when the market decides to quickly and decisively reverse course in either direction. The seven sentinels gets whipsawed by such action and it's no fluke. Not too awful long ago a 1.5% decline in a week was considered a bad week or vice versa for a rally. Now we can see 5, 6, 8, or 10% in the same amount of time either up or down. That kind of action is going to trigger many mechanical systems to flip their position and drive traders crazy. Especially longer term traders who don't want to move too often, but still want to protect their positions. That would be me.

With the limitations we have in TSP a buy and hold strategy works better in such an environment. The problem is knowing how long you can hold either cash or stocks depending on whether it's a bear or bull market. And that can take guts and conviction.

Is the market ready to resume its upward march? Is this where we tack on 10 - 15% gains in the next few trading days like previous months?

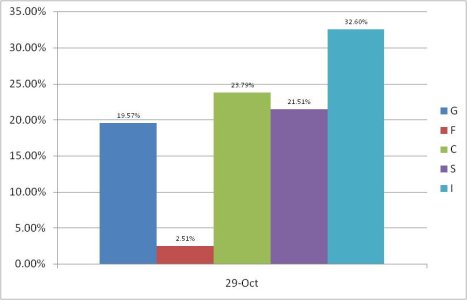

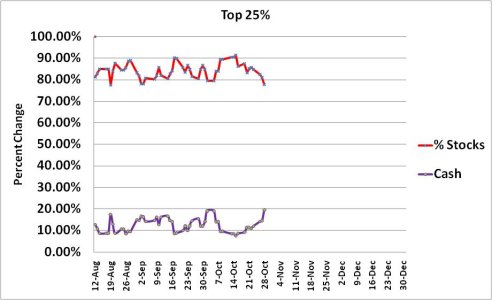

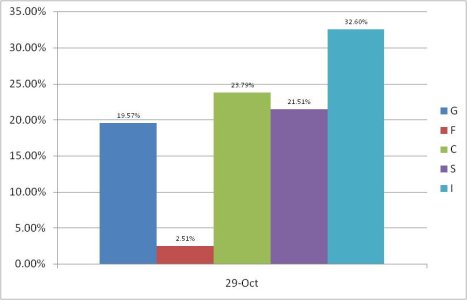

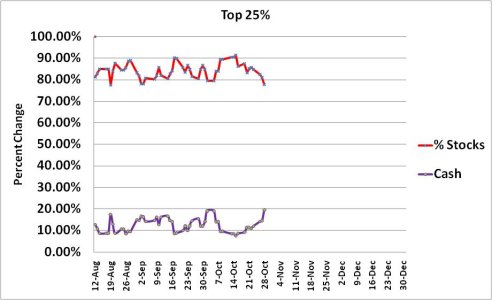

That would be a definite maybe. And that's why I chose to keep some exposure to the market today. 30% stocks, but that's all the risk I'm willing to take. There's too much complacency. Too many longs are convinced the sell-offs won't last long or go too deep. I agreed with that mindset for quite awhile until recently, but look at our own top 25%. They're hanging on like bulldogs. Is it complacency? Or are they that savvy?

Two new IFTs next week helped me make that decision too. I can wait a couple extra days while the seven sentinels is in a sell condition. But now I'm playing both sides of the market as a hedge.

To the charts:

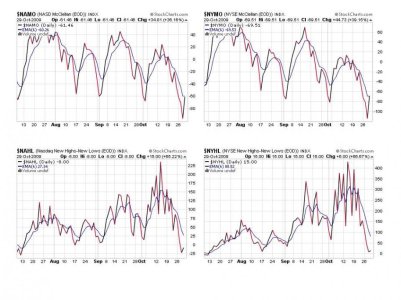

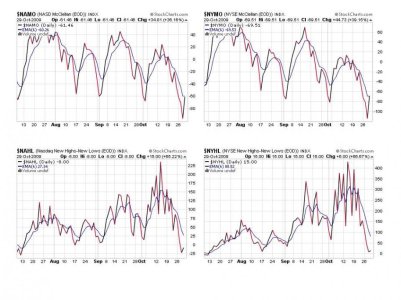

Not surprisingly these four signals improved today, but only modestly for NAHL and NYHL. While NYMO is a borderline buy, the rest are sells. But upside follow-through tomorrow could change that. And the 6 day EMA is moving lower quickly, so moving these signals back to a buy won't be difficult.

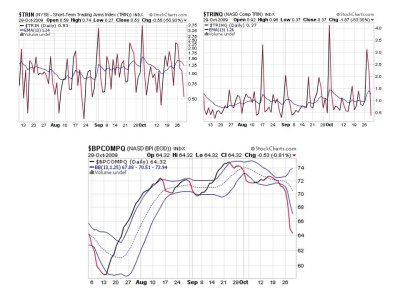

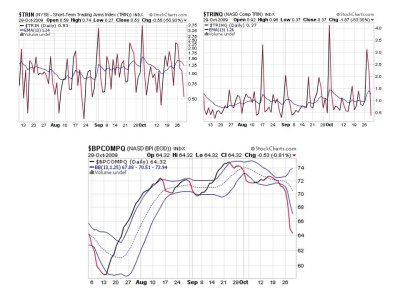

And upside follow-through looks likely as I look at TRIN and TRINQ. BPCOMPQ took a breather today, but remains on a sell.

I was a little surprised when I looked at the Top 25% positions for today's trading. Apparently some of them got their IFTs in the day before. We can see some cash was raised and a trend is starting to take shape. This is about as bearish as we've seen this bunch since mid-August. And it ain't bearish. But if this is a dead cat bounce I would think we'd see continued defensive action as a result.

So we have 3 buy signals today, and four still flashing sells. I'm expecting follow-through action to the upside tomorrow, but it may only last intraday or at most it might last until Monday. That's assuming da boyz want to shake out stronger hands. I would not be surprised if we turn back up again, but I'm looking lower before we challenge this years highs again. But I need a seven sentinels buy signal first. And so I wait.

I've repeated myself on numerous occasions about how difficult it is being "nimble" with TSP when volatility is high or when the market decides to quickly and decisively reverse course in either direction. The seven sentinels gets whipsawed by such action and it's no fluke. Not too awful long ago a 1.5% decline in a week was considered a bad week or vice versa for a rally. Now we can see 5, 6, 8, or 10% in the same amount of time either up or down. That kind of action is going to trigger many mechanical systems to flip their position and drive traders crazy. Especially longer term traders who don't want to move too often, but still want to protect their positions. That would be me.

With the limitations we have in TSP a buy and hold strategy works better in such an environment. The problem is knowing how long you can hold either cash or stocks depending on whether it's a bear or bull market. And that can take guts and conviction.

Is the market ready to resume its upward march? Is this where we tack on 10 - 15% gains in the next few trading days like previous months?

That would be a definite maybe. And that's why I chose to keep some exposure to the market today. 30% stocks, but that's all the risk I'm willing to take. There's too much complacency. Too many longs are convinced the sell-offs won't last long or go too deep. I agreed with that mindset for quite awhile until recently, but look at our own top 25%. They're hanging on like bulldogs. Is it complacency? Or are they that savvy?

Two new IFTs next week helped me make that decision too. I can wait a couple extra days while the seven sentinels is in a sell condition. But now I'm playing both sides of the market as a hedge.

To the charts:

Not surprisingly these four signals improved today, but only modestly for NAHL and NYHL. While NYMO is a borderline buy, the rest are sells. But upside follow-through tomorrow could change that. And the 6 day EMA is moving lower quickly, so moving these signals back to a buy won't be difficult.

And upside follow-through looks likely as I look at TRIN and TRINQ. BPCOMPQ took a breather today, but remains on a sell.

I was a little surprised when I looked at the Top 25% positions for today's trading. Apparently some of them got their IFTs in the day before. We can see some cash was raised and a trend is starting to take shape. This is about as bearish as we've seen this bunch since mid-August. And it ain't bearish. But if this is a dead cat bounce I would think we'd see continued defensive action as a result.

So we have 3 buy signals today, and four still flashing sells. I'm expecting follow-through action to the upside tomorrow, but it may only last intraday or at most it might last until Monday. That's assuming da boyz want to shake out stronger hands. I would not be surprised if we turn back up again, but I'm looking lower before we challenge this years highs again. But I need a seven sentinels buy signal first. And so I wait.