Yesterday, I had mentioned that Mondays have been largely green for months and that Friday's rally in the last half hour of trading seemed to indicate that many dip buyers wanted to be "in" for Monday's open. And the open this morning began with a gap higher. But it didn't last too long as the market began to chop lower by about 10 EST. Market breadth, which started out very positive at the beginning, fell dramatically as the day wore on.

This was not typical market character. Neither was the losses suffered on the 1st day of March. But does it spell the end of the bull run we've seen since last September? I doubt it, but we are due for a correction. I'm just not sure it can happen in a QE2 environment.

Let's take a look at today's charts:

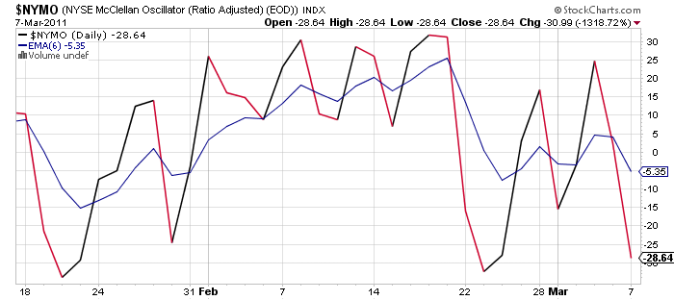

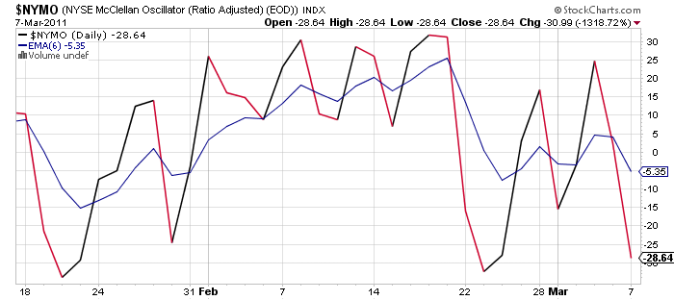

NAMO and NYMO are both flashing sells. NYMO is near its 28-day trading low. More on that in a minute.

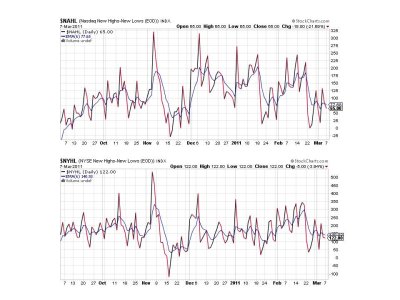

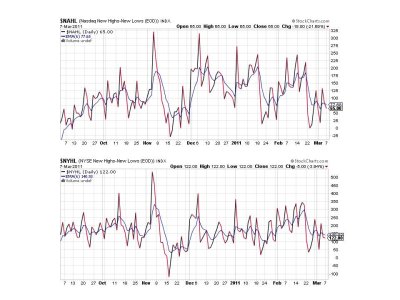

NAHL and NYHL are also on sells.

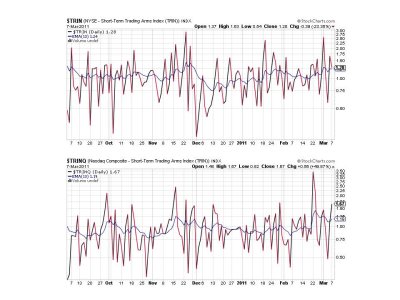

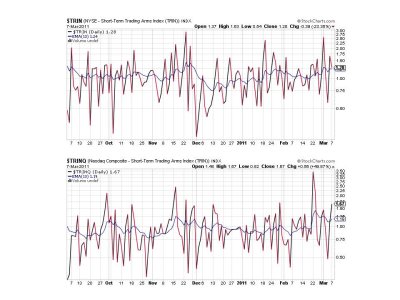

Two more sells for TRIN and TRINQ.

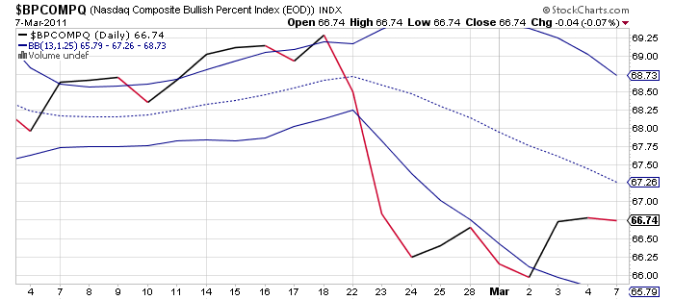

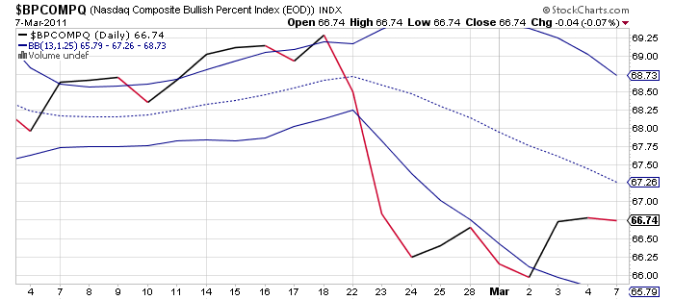

BPCOMPQ did not fall much on today's negative action and remains on a buy.

So 6 of 7 signals are flashing sells, but the system remains on a buy. Now set's look at NYMO and where it's 28-day trading low is.

Today NYMO hit -28.64. It needs to drop below about -32.25 to establish a new 28 day trading low. Since BPCOMPQ remains on a buy at the moment, a trading low here will not matter. But the system is close to a sell signal and that's something to keep a close eye on.

Volatile trade is probably going to remain with us in the immediate future. Obviously it's going to keep everyone guessing market direction as well. The Seven Sentinels are still pointing up, but we're seeing more selling pressure than we've become accustomed to. Market character appears to have changed too.

But the market hasn't rolled over yet, and as long as QE2 keeps churning (which it will), it's difficult to get too bearish. I myself made a decision to split the risk by moving to 50% G fund a few trading days ago just in case the market does correct. I still think the longer term is up, even if the short term is dicey. But by reducing my risk, I still have some money to buy back in should lower prices present themselves. And if that's not the case then I'll still have some skin in the game anyway.

This was not typical market character. Neither was the losses suffered on the 1st day of March. But does it spell the end of the bull run we've seen since last September? I doubt it, but we are due for a correction. I'm just not sure it can happen in a QE2 environment.

Let's take a look at today's charts:

NAMO and NYMO are both flashing sells. NYMO is near its 28-day trading low. More on that in a minute.

NAHL and NYHL are also on sells.

Two more sells for TRIN and TRINQ.

BPCOMPQ did not fall much on today's negative action and remains on a buy.

So 6 of 7 signals are flashing sells, but the system remains on a buy. Now set's look at NYMO and where it's 28-day trading low is.

Today NYMO hit -28.64. It needs to drop below about -32.25 to establish a new 28 day trading low. Since BPCOMPQ remains on a buy at the moment, a trading low here will not matter. But the system is close to a sell signal and that's something to keep a close eye on.

Volatile trade is probably going to remain with us in the immediate future. Obviously it's going to keep everyone guessing market direction as well. The Seven Sentinels are still pointing up, but we're seeing more selling pressure than we've become accustomed to. Market character appears to have changed too.

But the market hasn't rolled over yet, and as long as QE2 keeps churning (which it will), it's difficult to get too bearish. I myself made a decision to split the risk by moving to 50% G fund a few trading days ago just in case the market does correct. I still think the longer term is up, even if the short term is dicey. But by reducing my risk, I still have some money to buy back in should lower prices present themselves. And if that's not the case then I'll still have some skin in the game anyway.