RealMoneyIssues

TSP Legend

- Reaction score

- 101

Well, that was a little premature...Hey, what's with that stupid post-1200EST dump...

Sent from my SM-J727V using Tapatalk

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Well, that was a little premature...Hey, what's with that stupid post-1200EST dump...

Is the TSP website down?

Server is down, phones don't work either https://www.isitdownrightnow.com/tsp.gov.html#Is the TSP website down?

THAT didnt last long...Go Gold Go !!!

OUCH...

In multiple accounts... Not a good year to trade, so far

I went from the thrill of victory, on Thursday, to the agony of defeat, today.

Once approved, the projects would hire workers at a minimum salary of $15 an hour with paid family and medical leave, and offer the same retirement, health, and sick and annual leave benefits as other federal employees.

Bernie Sanders to announce plan to guarantee every American a job

https://www.washingtonpost.com/news...n-a-job/?noredirect=on&utm_term=.5e45a65109c8

SMH

Sent from my Samsung-J7 using Tapatalk

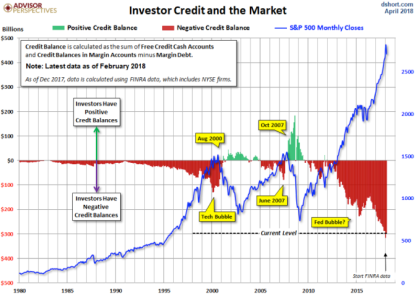

Brad Lamensdorf, manager of the AdvisorShares Ranger Equity Bear ETF HDGE, -0.74% warns this market could be about to get “nasty” for the bulls.

“How much credit is out there, borrowed against stock portfolios? Trillions of dollars,” Lamensdorf said in a report co-written with John Del Vecchio. “As interest rates creep up and more portfolios have been used to finance asset purchases, a huge storm can be created if stocks and bonds take even a minor dip.”

As the old saying goes, you can always buy a boat, but you can’t always sell one. “Shedding assets when everyone else is feeling pain leads to terrible deals for the seller,” Lamensdorf wrote, adding that we may be reaching a tipping point.

Take a look at this chart: