Did Santa ever go back to the North Pole? Apparently not.

The market started off in negative territory again today, and again the dip buyers stepped in to drive it back up later in the session.

I don't think the SOTU had anything to do with it and while Apple blew away quarterly estimates the broader market didn't respond to that either. It wasn't until the latest FOMC policy statement was released that buyers really stepped in.

The Fed announced that it would keep its federal funds rate at the current 0.00% to 0.25% and likely would keep them there until at least late 2014. The Fed also announced that they downgraded their expectations for GDP this year from 2.5% to 2.9% to a revised 2.2% to 2.7%. And QE3 is still on the table too.

Treasuries rallied too, which means the bond ghouls are still bearish. No surprise there.

There was a bit of domestic data today. Monthly pending home sales showed December sales were down 3.5%, which was a bit lower than estimates looking for a decline of 3.0%.

Here's today's charts:

Back to buys for NAMO and NYMO. I can't call that bearish either.

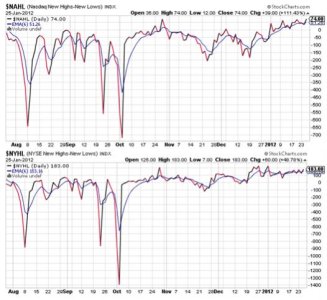

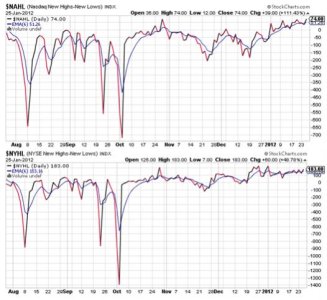

NAHL and NYHL also flipped to buys.

TRIN and TRINQ both dropped below their 13 day EMAs, which puts them on buys.

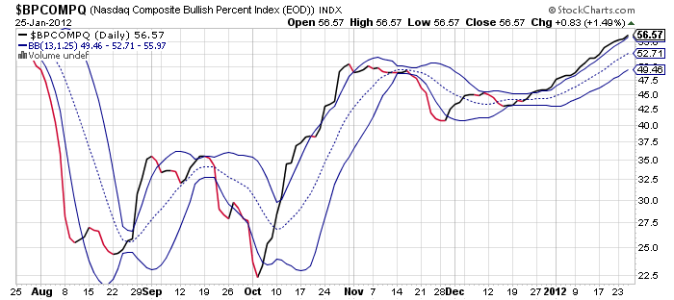

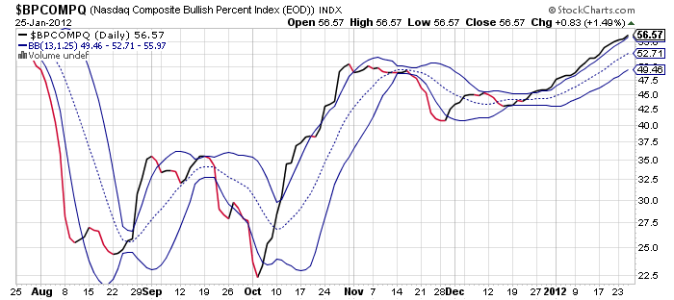

BPCOMPQ took a turn North and may be starting another up-leg.

Yesterday I had said that while the signals were mixed, all were near their trigger points and could flip to sells rather easily. Instead, the market went the other way. But I also mentioned I had little confidence in looking lower.

It seems even when this market chops sideways it's only to gather strength to plow through resistance. It's up until it's not and after today's action the Seven Sentinels are a hair away of leading the S fund pack to the top of the tracker.

The market started off in negative territory again today, and again the dip buyers stepped in to drive it back up later in the session.

I don't think the SOTU had anything to do with it and while Apple blew away quarterly estimates the broader market didn't respond to that either. It wasn't until the latest FOMC policy statement was released that buyers really stepped in.

The Fed announced that it would keep its federal funds rate at the current 0.00% to 0.25% and likely would keep them there until at least late 2014. The Fed also announced that they downgraded their expectations for GDP this year from 2.5% to 2.9% to a revised 2.2% to 2.7%. And QE3 is still on the table too.

Treasuries rallied too, which means the bond ghouls are still bearish. No surprise there.

There was a bit of domestic data today. Monthly pending home sales showed December sales were down 3.5%, which was a bit lower than estimates looking for a decline of 3.0%.

Here's today's charts:

Back to buys for NAMO and NYMO. I can't call that bearish either.

NAHL and NYHL also flipped to buys.

TRIN and TRINQ both dropped below their 13 day EMAs, which puts them on buys.

BPCOMPQ took a turn North and may be starting another up-leg.

Yesterday I had said that while the signals were mixed, all were near their trigger points and could flip to sells rather easily. Instead, the market went the other way. But I also mentioned I had little confidence in looking lower.

It seems even when this market chops sideways it's only to gather strength to plow through resistance. It's up until it's not and after today's action the Seven Sentinels are a hair away of leading the S fund pack to the top of the tracker.