There was little news to drive the markets today and volume was quite anemic to boot. As a result the major averages drifted around in mostly negative territory, but did close mixed as the Nasdaq managed to post some modest gains in spite of the negative finish for the S&P and DOW.

One data point of note today was March new home sales, which rose to an annualized rate of 300,000 units from a rate of 270,000 units the prior month. Economists had been looking for a number closer to 280,000.

Let's go to the charts:

NAMO and NYMO remain on a buy and are still North of the neutral line.

NAHL and NYHL also remained on buys.

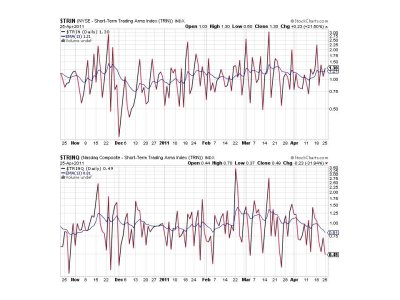

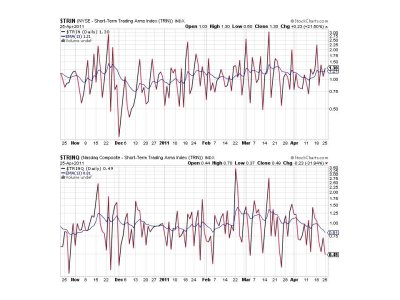

TRIN flipped to a sell, barely, but TRINQ dropped to a 0.49 today, which suggests an overbought condition in the Nasdaq. My guess here is that we have more weakness coming this week.

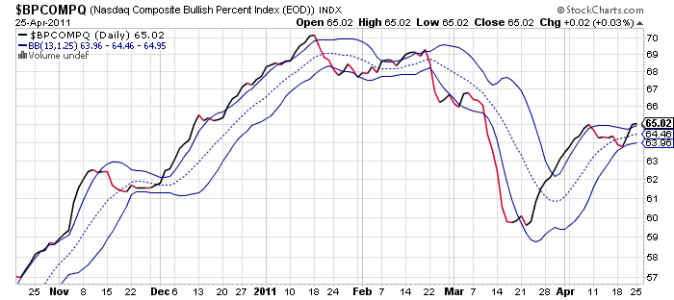

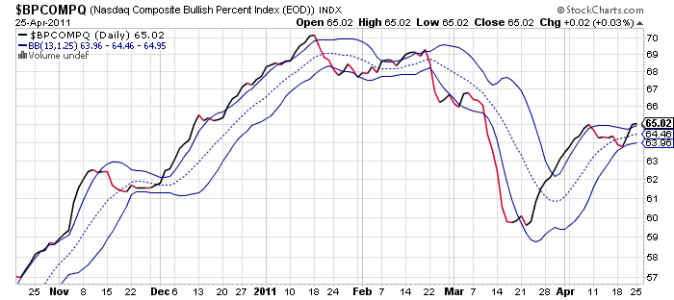

BPCOMPQ tracked a bit sideways today, but remained on a buy.

So all but one signal are flashing buys, which keeps the Seven Sentinels in a buy condition.

Today was a quiet day of trading, which leaves me with few clues on a very short term basis of where the market is headed next. I'm thinking we have more selling ahead, but I don't get the impression this market is going to give up much ground. I also think that as May approaches more money will be heading to less risky investments as the weakest 6 months of the year gets started. But with QE2 still in operation the market should stay buoyant. Keep in mind though, that the S&P hit its last 2 year high in February, and liquidity injections never stopped. I think that says something about risk and how this market feels about it. New highs may be coming, but a lot of water has now passed under the bridge since this bull got started about 2 years ago.

I'm not trying to be bearish, just practical. All eyes continue to watch the Fed as we move forward. What they do in the weeks ahead will chart the market's next course.

One data point of note today was March new home sales, which rose to an annualized rate of 300,000 units from a rate of 270,000 units the prior month. Economists had been looking for a number closer to 280,000.

Let's go to the charts:

NAMO and NYMO remain on a buy and are still North of the neutral line.

NAHL and NYHL also remained on buys.

TRIN flipped to a sell, barely, but TRINQ dropped to a 0.49 today, which suggests an overbought condition in the Nasdaq. My guess here is that we have more weakness coming this week.

BPCOMPQ tracked a bit sideways today, but remained on a buy.

So all but one signal are flashing buys, which keeps the Seven Sentinels in a buy condition.

Today was a quiet day of trading, which leaves me with few clues on a very short term basis of where the market is headed next. I'm thinking we have more selling ahead, but I don't get the impression this market is going to give up much ground. I also think that as May approaches more money will be heading to less risky investments as the weakest 6 months of the year gets started. But with QE2 still in operation the market should stay buoyant. Keep in mind though, that the S&P hit its last 2 year high in February, and liquidity injections never stopped. I think that says something about risk and how this market feels about it. New highs may be coming, but a lot of water has now passed under the bridge since this bull got started about 2 years ago.

I'm not trying to be bearish, just practical. All eyes continue to watch the Fed as we move forward. What they do in the weeks ahead will chart the market's next course.