As you probably already know, I'm looking for a pullback early to mid-week this week to catch a lot of the newly minted bulls on the wrong side of the trade. The selling we saw at the end of the trading day today may be the beginning of that decline. It shouldn't last more than a couple of days or so, but it could be just scary enough to chase some weak hands back to the sidelines. This scenario seems to make sense given the surprising upside this market had recently, and one which left a lot of professionals at a loss to explain it.

For the trading day stocks extended their gains from last week early on, but quickly fell into direction-less, choppy trade until the final half hour when some moderate selling pressure kicked in and dropped the major averages to their lows of the day at the close. Of note though was the fact that volume was decidedly low, which suggests many traders are holding their long positions.

Market data didn't do much for trading today either. February personal income came in with a 0.3% increase, which was on target with expectations, while spending was up 0.7%, which was higher than the 0.5% increase analysts were looking for.

Pending home sales were up 2.1% for February, which was dramatically higher than the 0.3% increase that was expected.

So I'm not seeing any surprises at the moment. A pullback makes sense here. If I had an IFT I'd be looking to buy this pullback.

Here's today's charts:

NAMO and NYMO pulled back a bit today, but remain on buys.

NAHL and NYHL are flashing a buy and sell respectively.

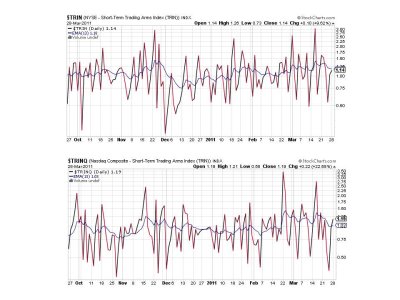

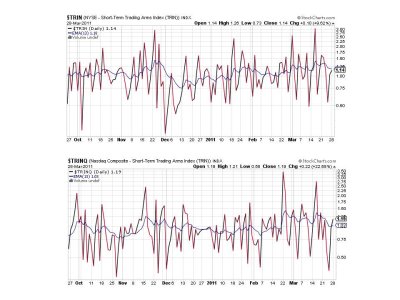

TRIN remained on a buy, while TRINQ flipped to a sell.

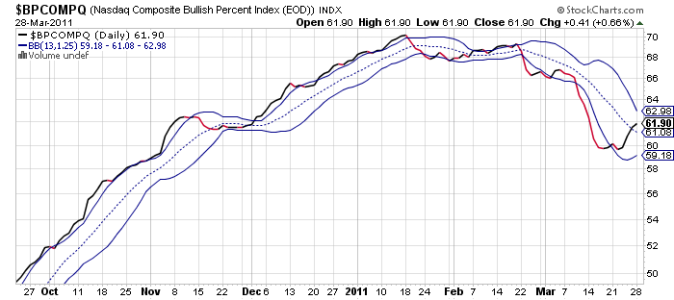

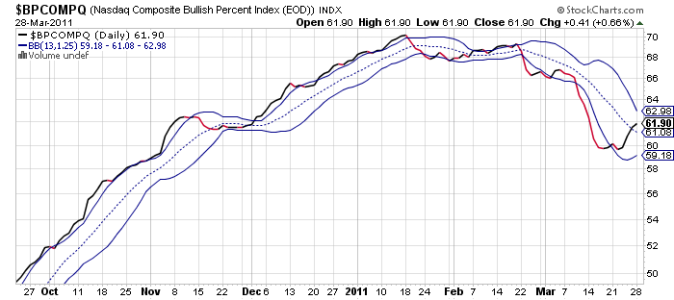

BPCOMPQ remains firmly in buy territory.

So the Seven Sentinels are mixed after three days in a row of being in a buy condition. Officially the system remains on a sell until NYMO hits a fresh 28-day trading high, but I'm confident it will get there in the days ahead.

For the trading day stocks extended their gains from last week early on, but quickly fell into direction-less, choppy trade until the final half hour when some moderate selling pressure kicked in and dropped the major averages to their lows of the day at the close. Of note though was the fact that volume was decidedly low, which suggests many traders are holding their long positions.

Market data didn't do much for trading today either. February personal income came in with a 0.3% increase, which was on target with expectations, while spending was up 0.7%, which was higher than the 0.5% increase analysts were looking for.

Pending home sales were up 2.1% for February, which was dramatically higher than the 0.3% increase that was expected.

So I'm not seeing any surprises at the moment. A pullback makes sense here. If I had an IFT I'd be looking to buy this pullback.

Here's today's charts:

NAMO and NYMO pulled back a bit today, but remain on buys.

NAHL and NYHL are flashing a buy and sell respectively.

TRIN remained on a buy, while TRINQ flipped to a sell.

BPCOMPQ remains firmly in buy territory.

So the Seven Sentinels are mixed after three days in a row of being in a buy condition. Officially the system remains on a sell until NYMO hits a fresh 28-day trading high, but I'm confident it will get there in the days ahead.