After starting out modestly negative at the open, stocks slowly made their way higher till midday before chopping sideways and finishing with some decent gains.

Today's trading did not seem to reflect last week's market character. In fact, the Dow closed at a new two-year high and ended the day just a little south of 12,000.

And the market's strength once again illustrated how difficult it is for the bears to gain any headway. It doesn't seem to take much weakness to entice sideline money into the market. But I think what's really driving this strength early on this week is tomorrow evening's State of Union Address. If the President can continue his recent momentum with this SOTU address, that could spike the major averages by mid-week.

While I have not been overly bearish given the recent Seven Sentinels Sell Signal, I'm certainly not expecting another quick buy signal either. For now, I'm just respecting this bull market, even while anticipating more weakness in the days and perhaps weeks ahead.

Here's today's charts:

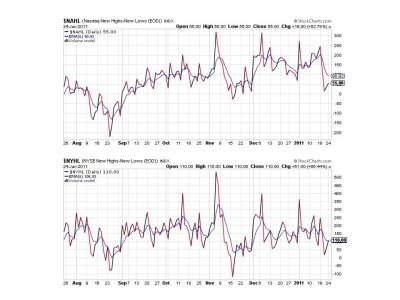

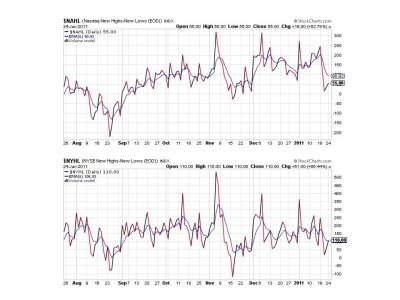

No surprises here. After today's rally, NAMO improved, but remains on a sell, while NYMO flipped to a buy.

NAHL remains on sell, while NYHL tagged the neutral line.

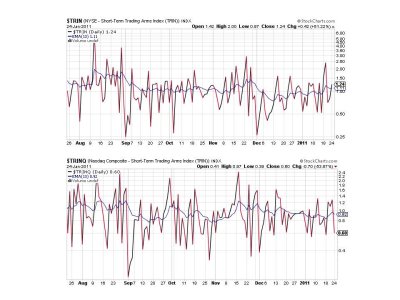

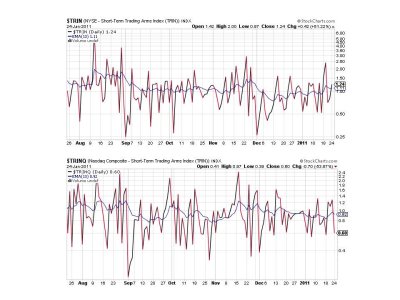

TRIN is on a sell and TRINQ a buy.

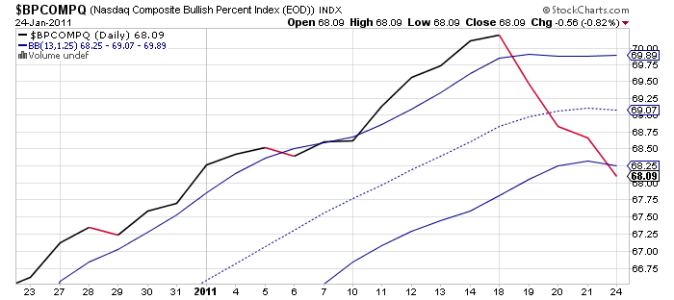

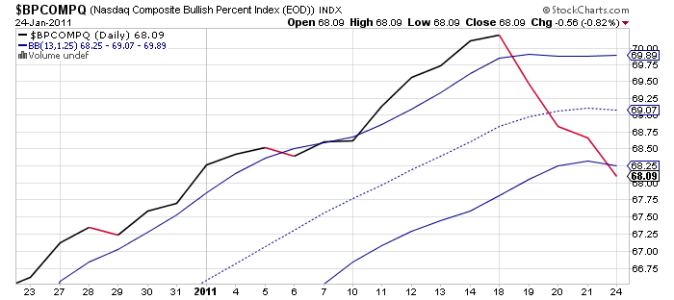

BPCOMPQ dropped lower and remains on a sell. This signal seems to be suggesting more weakness to come, but any follow-through strength tomorrow could turn this signal back up.

So the sentinels are mixed, but remain on a sell regardless. That said, I continue to be wary of this bull and would not go short if I had that option in TSP. I am reminded of that buy signal from our sentiment survey for this week too. It's on target right off the bat. Is the SOTU going to support this market all week or will it be used as a bull trap? We should know the answer by Thursday.

Today's trading did not seem to reflect last week's market character. In fact, the Dow closed at a new two-year high and ended the day just a little south of 12,000.

And the market's strength once again illustrated how difficult it is for the bears to gain any headway. It doesn't seem to take much weakness to entice sideline money into the market. But I think what's really driving this strength early on this week is tomorrow evening's State of Union Address. If the President can continue his recent momentum with this SOTU address, that could spike the major averages by mid-week.

While I have not been overly bearish given the recent Seven Sentinels Sell Signal, I'm certainly not expecting another quick buy signal either. For now, I'm just respecting this bull market, even while anticipating more weakness in the days and perhaps weeks ahead.

Here's today's charts:

No surprises here. After today's rally, NAMO improved, but remains on a sell, while NYMO flipped to a buy.

NAHL remains on sell, while NYHL tagged the neutral line.

TRIN is on a sell and TRINQ a buy.

BPCOMPQ dropped lower and remains on a sell. This signal seems to be suggesting more weakness to come, but any follow-through strength tomorrow could turn this signal back up.

So the sentinels are mixed, but remain on a sell regardless. That said, I continue to be wary of this bull and would not go short if I had that option in TSP. I am reminded of that buy signal from our sentiment survey for this week too. It's on target right off the bat. Is the SOTU going to support this market all week or will it be used as a bull trap? We should know the answer by Thursday.