Pre-Bell  Brief

Brief

Time: 05-Nov-2025 09:25 (ET)

Key Takeaway

Key Takeaway

• Big Tech weakness pulled the major U.S. indices lower yesterday, with SPX,

NDX, and DJI all backing off recent highs. [1]

• Overnight trade stayed cautious, as Asia and Europe followed through on the tech-led selloff while safe-haven flows

supported gold and high-quality bonds. [2]

• For diversified retirement savers, cash-like government holdings remain a slow positive,

while broad U.S. and international equity exposures are under pressure this week. [3]

What Moved Overnight

What Moved Overnight

• Asia - Major benchmarks fell sharply, with Japan and South Korea leading losses as investors reassessed

expensive AI and tech names. [2]

• Europe - The regional STOXX 600 slipped again, led by technology and growth shares, extending Tuesday’s pullback. [2]

• U.S. futures - SPX futures are up about +0.04%, NDX futures roughly +0.01%,

and DJI futures near +0.06%, signaling a tentative bounce. [5]

• FX / rates / commodities - DXY is holding just above 100, the 10Y Yield hovers near 4.09%,

gold futures are up around +1.02%, while WTI crude trades about -0.68% lower. [2][5]

How the Prior Session Closed

How the Prior Session Closed

• SPX -1.20% | NDX -2.00% | DJI -0.50% | 10Y Yield about 4.09% | DXY near 100. [1]

• Sector leadership - Defensive areas held up best, while technology, communication services,

and consumer discretionary led the downside as investors rotated away from high-valuation growth. [1][2]

• Stock highlights - EXPD jumped roughly +10.84% as an upside outlier in industrials,

while NCLH slumped about -15.28%, underscoring wide single-name dispersion beneath the indices. [1]

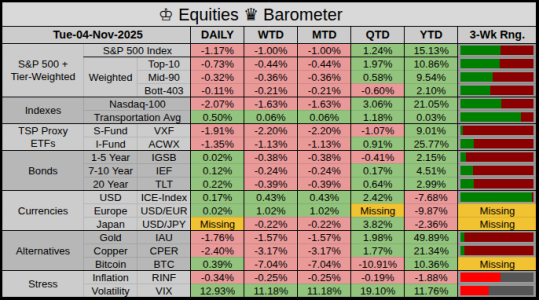

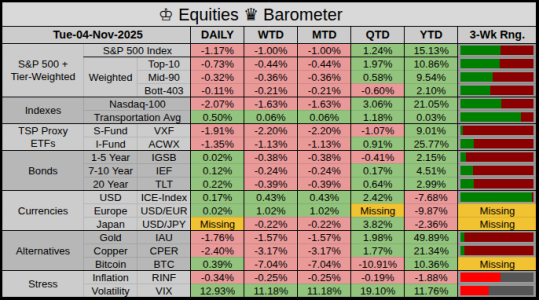

♔ Equities ♛ Barometer

• Broad large-cap exposure lost about -1.17% on the day, with the heaviest pressure on mega-cap growth

as the NDX dropped a little more than -2.00%.

• Breadth was weak, with the most damage in the top tier of the index, while mid-pack names held up relatively better

and the deepest laggards saw slightly smaller moves.

• Small-cap and international proxies finished solidly in the red, but transports managed a gain,

hinting at ongoing concern over valuations more than an abrupt macro slowdown.

• Volatility spiked, with VIX jumping over +12.64% from low levels and the dollar firming,

tilting financial conditions slightly tighter into today’s data.

G-Fund Estimated Forward Returns [3]

G-Fund Estimated Forward Returns [3]

• Daily estimator: +0.0118% per trading day, based on recent G-Fund closes and excluding first-after-break sessions.

• Next 5 sessions: +0.059%.

• Next month (December): +0.26%.

• Next 3 months: +0.75%.

• Next year: around +3.03% based on the current G-Fund path.

Based on a trailing-12-month U.S. inflation rate near 3.01%,

Based on a trailing-12-month U.S. inflation rate near 3.01%,

real-world G-Fund returns are currently closer to roughly +0.02% per year. [4]

TSP Stats [3]

TSP Stats [3]

• Past 5 sessions:

• F -0.71%

• C -1.72%

• S -2.98%

• I -1.80%

Today’s 1st Hour of Trading

Today’s 1st Hour of Trading

• 08:15 - The October ADP private payrolls report showed about +42,000 jobs added,

a modest rebound that still fits a cooler hiring trend. [5][6]

• 10:00 - ISM Services PMI for October is due,

and any surprise in new orders or prices could quickly sway rate-cut expectations and early trade. [2][7]

• Theme - In the first hour, watch whether AI and broader tech see further de-risking or a relief bounce,

and how financials react to fresh warnings about stretched valuations. [1][2]

Upcoming Headlines

Upcoming Headlines

• 11/05 WED 08:15 / 10:00 - ADP Employment (Oct) and ISM Services PMI (Oct),

key reads on labor and services momentum. [6][7]

• 11/06 THU 08:30 / 10:00 - Productivity & Labor Costs (Q3) and Wholesale Inventories (Sep),

important for growth and margin dynamics. [7]

• 11/07 FRI 08:30 / 10:00 - Employment Report (Oct) and Univ. of Michigan Sentiment (Nov prelim),

the week’s main checks on jobs and demand. [7]

Off in the Distance

Off in the Distance

• 11/13 THU 08:30 - CPI Release (October),

a central inflation checkpoint following recent 3.0% year-on-year readings. [4][7]

• 12/09-10 - FOMC Meeting (final 2025 rate decision with updated projections and press conference). [8]

Wrap

Wrap

• Futures point to a flat-to-slightly-higher open, with sentiment fragile after the tech shakeout

and macro data firmly in focus for the rest of the week.

• No new allocation signals until the incoming data clarify whether this pullback stays an orderly reset

or develops into a broader correction.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 04-Nov-2025: Virginia Business Losses for Big Tech pull Wall Street lower

[2] 05-Nov-2025: Reuters Stocks drop, as investors fret over tech valuations; gold rallies

[3] 05-Nov-2025: TSPtalk Daily TSP share prices and G, F, C, S, I fund data

[4] 30-Sep-2025: Slickcharts United States Inflation Rate, trailing 12-month

[5] 05-Nov-2025: Markets Insider Premarket Trading November 05, U.S. stock index futures and commodities

[6] 05-Nov-2025: ADP Research ADP National Employment Report, October 2025

[7] 27-Oct-2025: Scotiabank Economics Calendar of Economic Release Dates (November 2025)

[8] 10-Dec-2025: Federal Reserve Board FOMC Meeting Calendar, December 2025

Time: 05-Nov-2025 09:25 (ET)

• Big Tech weakness pulled the major U.S. indices lower yesterday, with SPX,

NDX, and DJI all backing off recent highs. [1]

• Overnight trade stayed cautious, as Asia and Europe followed through on the tech-led selloff while safe-haven flows

supported gold and high-quality bonds. [2]

• For diversified retirement savers, cash-like government holdings remain a slow positive,

while broad U.S. and international equity exposures are under pressure this week. [3]

• Asia - Major benchmarks fell sharply, with Japan and South Korea leading losses as investors reassessed

expensive AI and tech names. [2]

• Europe - The regional STOXX 600 slipped again, led by technology and growth shares, extending Tuesday’s pullback. [2]

• U.S. futures - SPX futures are up about +0.04%, NDX futures roughly +0.01%,

and DJI futures near +0.06%, signaling a tentative bounce. [5]

• FX / rates / commodities - DXY is holding just above 100, the 10Y Yield hovers near 4.09%,

gold futures are up around +1.02%, while WTI crude trades about -0.68% lower. [2][5]

• SPX -1.20% | NDX -2.00% | DJI -0.50% | 10Y Yield about 4.09% | DXY near 100. [1]

• Sector leadership - Defensive areas held up best, while technology, communication services,

and consumer discretionary led the downside as investors rotated away from high-valuation growth. [1][2]

• Stock highlights - EXPD jumped roughly +10.84% as an upside outlier in industrials,

while NCLH slumped about -15.28%, underscoring wide single-name dispersion beneath the indices. [1]

♔ Equities ♛ Barometer

• Broad large-cap exposure lost about -1.17% on the day, with the heaviest pressure on mega-cap growth

as the NDX dropped a little more than -2.00%.

• Breadth was weak, with the most damage in the top tier of the index, while mid-pack names held up relatively better

and the deepest laggards saw slightly smaller moves.

• Small-cap and international proxies finished solidly in the red, but transports managed a gain,

hinting at ongoing concern over valuations more than an abrupt macro slowdown.

• Volatility spiked, with VIX jumping over +12.64% from low levels and the dollar firming,

tilting financial conditions slightly tighter into today’s data.

• Daily estimator: +0.0118% per trading day, based on recent G-Fund closes and excluding first-after-break sessions.

• Next 5 sessions: +0.059%.

• Next month (December): +0.26%.

• Next 3 months: +0.75%.

• Next year: around +3.03% based on the current G-Fund path.

real-world G-Fund returns are currently closer to roughly +0.02% per year. [4]

• Past 5 sessions:

• F -0.71%

• C -1.72%

• S -2.98%

• I -1.80%

• 08:15 - The October ADP private payrolls report showed about +42,000 jobs added,

a modest rebound that still fits a cooler hiring trend. [5][6]

• 10:00 - ISM Services PMI for October is due,

and any surprise in new orders or prices could quickly sway rate-cut expectations and early trade. [2][7]

• Theme - In the first hour, watch whether AI and broader tech see further de-risking or a relief bounce,

and how financials react to fresh warnings about stretched valuations. [1][2]

• 11/05 WED 08:15 / 10:00 - ADP Employment (Oct) and ISM Services PMI (Oct),

key reads on labor and services momentum. [6][7]

• 11/06 THU 08:30 / 10:00 - Productivity & Labor Costs (Q3) and Wholesale Inventories (Sep),

important for growth and margin dynamics. [7]

• 11/07 FRI 08:30 / 10:00 - Employment Report (Oct) and Univ. of Michigan Sentiment (Nov prelim),

the week’s main checks on jobs and demand. [7]

• 11/13 THU 08:30 - CPI Release (October),

a central inflation checkpoint following recent 3.0% year-on-year readings. [4][7]

• 12/09-10 - FOMC Meeting (final 2025 rate decision with updated projections and press conference). [8]

• Futures point to a flat-to-slightly-higher open, with sentiment fragile after the tech shakeout

and macro data firmly in focus for the rest of the week.

• No new allocation signals until the incoming data clarify whether this pullback stays an orderly reset

or develops into a broader correction.

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

▶ Citation Block

[1] 04-Nov-2025: Virginia Business Losses for Big Tech pull Wall Street lower

[2] 05-Nov-2025: Reuters Stocks drop, as investors fret over tech valuations; gold rallies

[3] 05-Nov-2025: TSPtalk Daily TSP share prices and G, F, C, S, I fund data

[4] 30-Sep-2025: Slickcharts United States Inflation Rate, trailing 12-month

[5] 05-Nov-2025: Markets Insider Premarket Trading November 05, U.S. stock index futures and commodities

[6] 05-Nov-2025: ADP Research ADP National Employment Report, October 2025

[7] 27-Oct-2025: Scotiabank Economics Calendar of Economic Release Dates (November 2025)

[8] 10-Dec-2025: Federal Reserve Board FOMC Meeting Calendar, December 2025