OPEX week is never a time where a trader can be sure he/she knows which direction the market is headed. It's typically volatile action and this week was no different. But post OPEX action will generally provide for a better indication of the trading bias to come. At the moment it is down for the intermediate term, and so far nothing has changed that outlook.

Here's this evening's charts:

Moderating some, which is to be expected, but both signals remain on a sell.

Two sells here too.

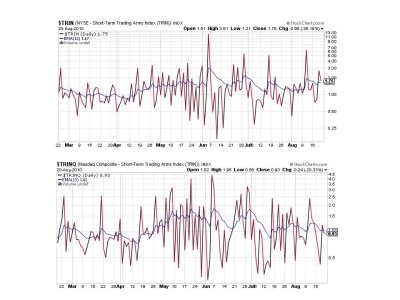

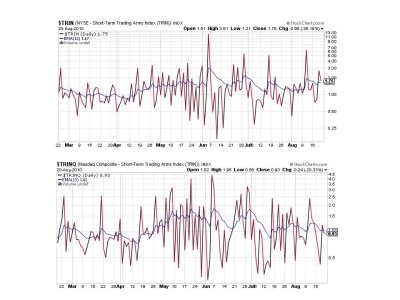

TRIN remains on a sell, but TRINQ flipped to a buy. Still, this is largely a neutral reading.

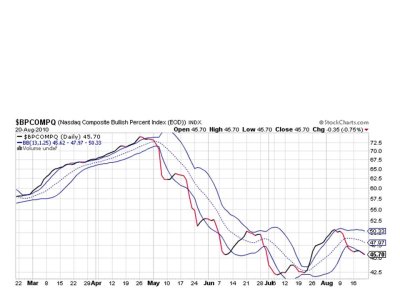

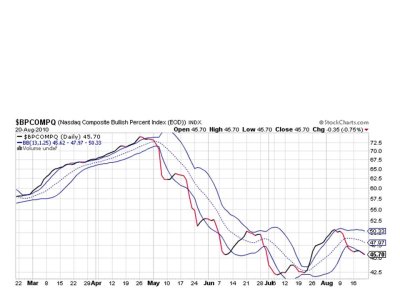

BPCOMPQ remains on a sell with a downward bias.

So we have 6 of 7 signals flashing sells, which keeps the system on a sell. I am anticipating continued downward pressure on prices for next week and remain 100% G fund.

See you this weekend when I post the tracker charts. They should be interesting again.

Here's this evening's charts:

Moderating some, which is to be expected, but both signals remain on a sell.

Two sells here too.

TRIN remains on a sell, but TRINQ flipped to a buy. Still, this is largely a neutral reading.

BPCOMPQ remains on a sell with a downward bias.

So we have 6 of 7 signals flashing sells, which keeps the system on a sell. I am anticipating continued downward pressure on prices for next week and remain 100% G fund.

See you this weekend when I post the tracker charts. They should be interesting again.