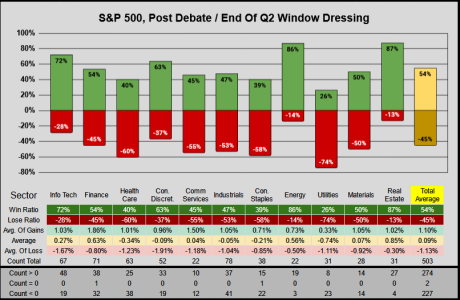

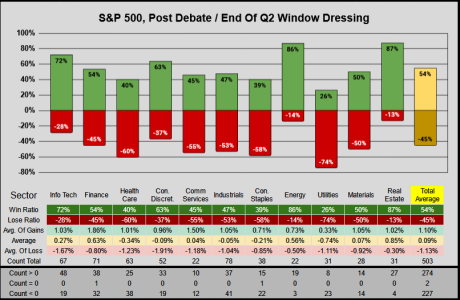

It's an interesting circumstance, when the day after a high-press Presidential debate and the End of Quarter 2 both fall on the same day. So are we speculating for the next election, or the next quarter? The chart(s) below are not weighted, it's just the 503 holdings sorted by the 11 sectors and performance.

The first chart shows the results from Friday 28-June, from this our Top-3 winners were:

Real Estate, with an 87% win ratio across 31 holdings, and average gain of .85%

Energy, with an 86% win ratio across 22 holdings, and average gain of .56%

Information Technology, with a 67% win ratio across 22 holdings, and average gain of .27%

The biggest loser was the Utilities Sector with a 26% win ratio across 31 holdings and a -.74% average loss.

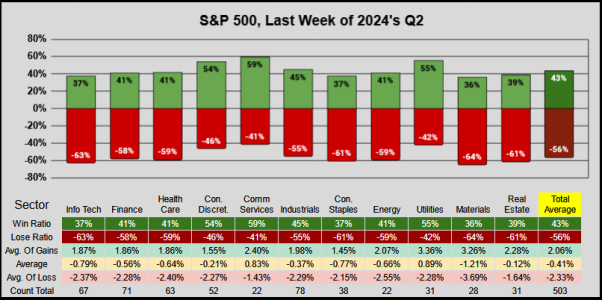

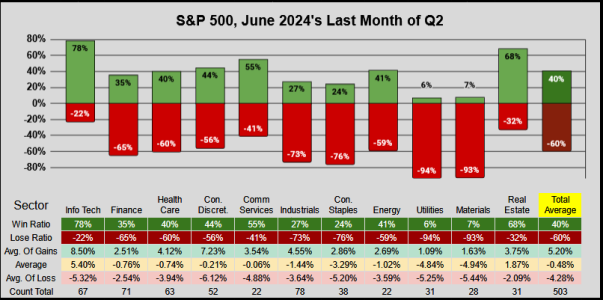

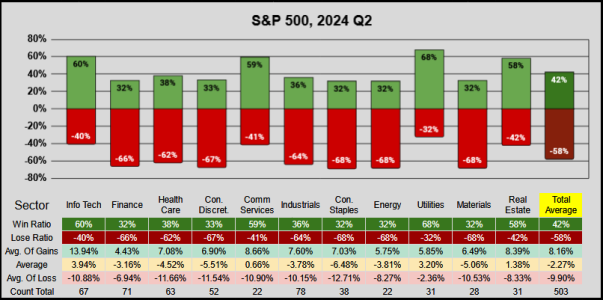

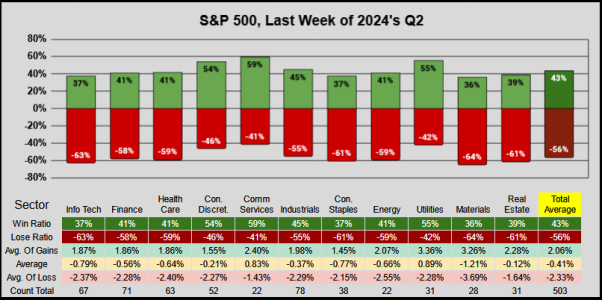

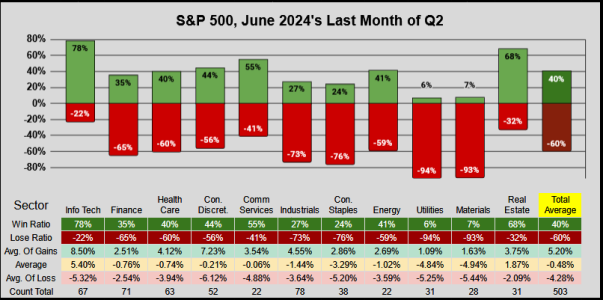

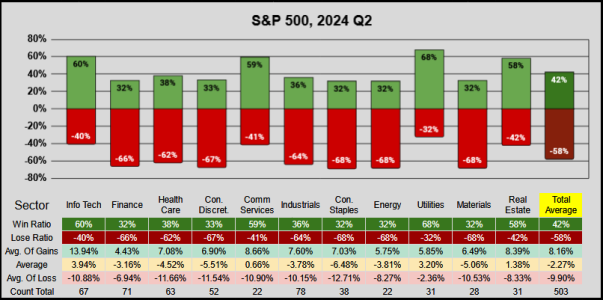

I don't typically track window dressing, so it will be interesting to see Q3's results and how they compare with the last day of Q2. I'm not going to get into the details, but for comparison's sake the next 3 charts are the last week of Q2, the Month of June, and all of Q2.

Of note, there's some interesting fluctuations with Energy & Utilities, and a nice climb with Consumer Discretionary.

Thanks for reading, have a great holiday week....Jason

The first chart shows the results from Friday 28-June, from this our Top-3 winners were:

Real Estate, with an 87% win ratio across 31 holdings, and average gain of .85%

Energy, with an 86% win ratio across 22 holdings, and average gain of .56%

Information Technology, with a 67% win ratio across 22 holdings, and average gain of .27%

The biggest loser was the Utilities Sector with a 26% win ratio across 31 holdings and a -.74% average loss.

I don't typically track window dressing, so it will be interesting to see Q3's results and how they compare with the last day of Q2. I'm not going to get into the details, but for comparison's sake the next 3 charts are the last week of Q2, the Month of June, and all of Q2.

Of note, there's some interesting fluctuations with Energy & Utilities, and a nice climb with Consumer Discretionary.

Thanks for reading, have a great holiday week....Jason