As you know I've been amazed at how much decline we'd seen over the past two weeks without triggering a Seven Sentinels Sell Signal. It is not typical action. But then this isn't a typical market. Still, after being whipsawed yet again the last time I went cash (that one left a mark) there was no way I could afford to let the market trick me again. I know some of you feel the same way. It's a helpless feeling knowing you'd like to buy or sell at a given time, while at the same knowing IFTs are few and far apart. We are forced into making decisions that we might not make in brokerage account. Fact is I'm doing much better in my Scottrade account than TSP. I'm up about 22% in the past year. You probably know my TSP score is quite the opposite. But then I don't have a $7 dollar option in TSP.

But taking an occasional beating is part of active management of one's account. It comes with the territory. It's not a question of "if" one will get caught in a decline, but more of a "when". And that theory is quite in evidence in our own tracker. Every year the top spots usually sport new names. The Top 15 that I track is comprised of traders who did very well over a two year period, not just one year wonders. But this year? As of today only one trader out of those 15 is in the Top 50. One. Uno. There's actually more in the bottom 50 than the top 50.

So let's talk about today's action. I was cautiously optimistic when I saw how the markets traded in the first hour today. But we'd seen enough intraday reversals to know that it's not how we begin, but how we end that counts. I checked volume early on, it wasn't impressive. I was a bit concerned about that, but volume doesn't always tell the story. Trader's are spooked. Most are from the Show-Me state at the moment. As the day wore on though, the volume picked up and revealed some conviction behind the move.

It's only one day, but with this market that's how it starts. And if we continue to move higher I seriously doubt it will be as fast as we declined.

After today's big rally, the Sentinels now look poised for redemption. Let's take a look at the charts:

Just like that, we've flipped to two buys here.

NAHL and NYHL are also flashing buys.

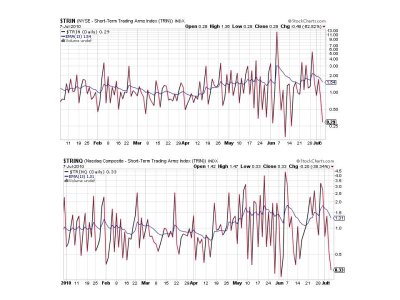

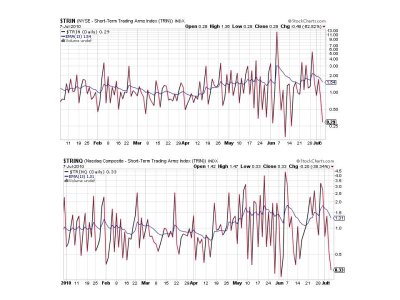

Ditto TRIN and TRINQ.

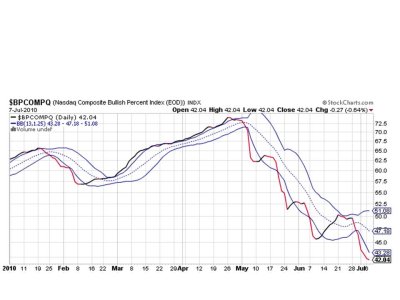

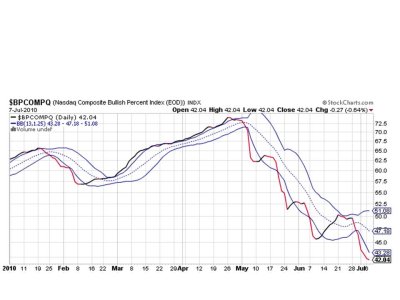

As expected BPCOMPQ is the laggard. But that's how it is with this indicator. But looking at the signal we can see it's not far from moving up and passing through that lower bollinger band, which would trigger a buy.

So we now have 6 of 7 signals flashing buys, but the system remains on a buy from the previous signal. Usually that wouldn't mean much, but in this case after seeing so much decline another buy signal issued now could see significant upside. And that's where I think the risk is now. Not on the downside, but the upside. But there are many bears who would argue with me. All I can say is "Place your bets".

But taking an occasional beating is part of active management of one's account. It comes with the territory. It's not a question of "if" one will get caught in a decline, but more of a "when". And that theory is quite in evidence in our own tracker. Every year the top spots usually sport new names. The Top 15 that I track is comprised of traders who did very well over a two year period, not just one year wonders. But this year? As of today only one trader out of those 15 is in the Top 50. One. Uno. There's actually more in the bottom 50 than the top 50.

So let's talk about today's action. I was cautiously optimistic when I saw how the markets traded in the first hour today. But we'd seen enough intraday reversals to know that it's not how we begin, but how we end that counts. I checked volume early on, it wasn't impressive. I was a bit concerned about that, but volume doesn't always tell the story. Trader's are spooked. Most are from the Show-Me state at the moment. As the day wore on though, the volume picked up and revealed some conviction behind the move.

It's only one day, but with this market that's how it starts. And if we continue to move higher I seriously doubt it will be as fast as we declined.

After today's big rally, the Sentinels now look poised for redemption. Let's take a look at the charts:

Just like that, we've flipped to two buys here.

NAHL and NYHL are also flashing buys.

Ditto TRIN and TRINQ.

As expected BPCOMPQ is the laggard. But that's how it is with this indicator. But looking at the signal we can see it's not far from moving up and passing through that lower bollinger band, which would trigger a buy.

So we now have 6 of 7 signals flashing buys, but the system remains on a buy from the previous signal. Usually that wouldn't mean much, but in this case after seeing so much decline another buy signal issued now could see significant upside. And that's where I think the risk is now. Not on the downside, but the upside. But there are many bears who would argue with me. All I can say is "Place your bets".