___

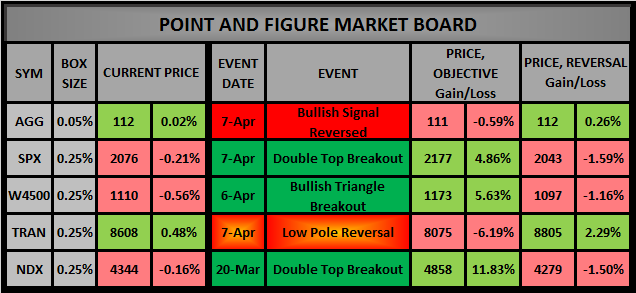

We have two reversals today, Bonds breakdown, while the S&P 500 breaks out. I should preface this with a warning. This hasn't been much a trending market so much as it is an oscillating range-bound trader's market. Considering these circumstances & price-scale, following a PnF platform under TSP's limitations can prove to be very difficult.

___

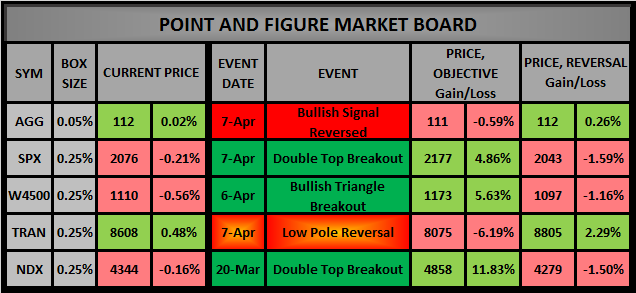

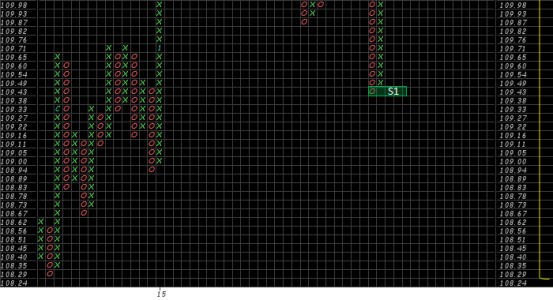

AGG

___

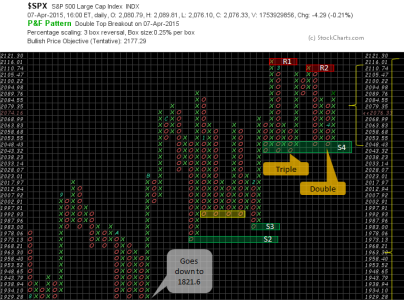

SPX

___

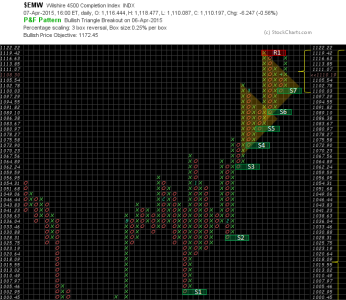

W4500

___

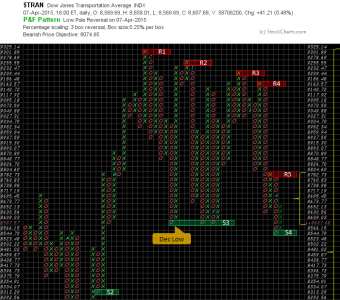

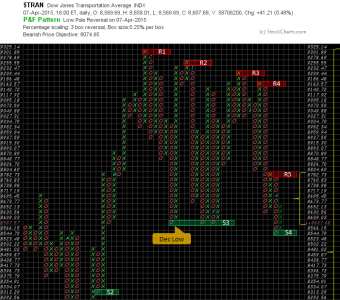

Transports

___

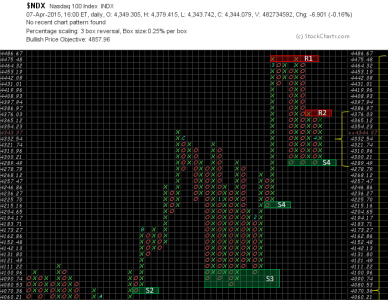

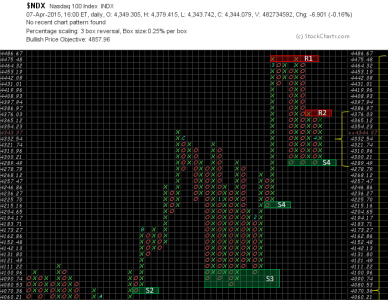

NASDAQ 100

The markets put in a mid-day reversal on Tuesday, which confirmed my short-term analysis, but how all this plays out remains to be seen. As for myself, I chose to side-step out into the F-Fund and will re-evaluate the price action from a less risky point of view

Trade safe…Jason

We have two reversals today, Bonds breakdown, while the S&P 500 breaks out. I should preface this with a warning. This hasn't been much a trending market so much as it is an oscillating range-bound trader's market. Considering these circumstances & price-scale, following a PnF platform under TSP's limitations can prove to be very difficult.

___

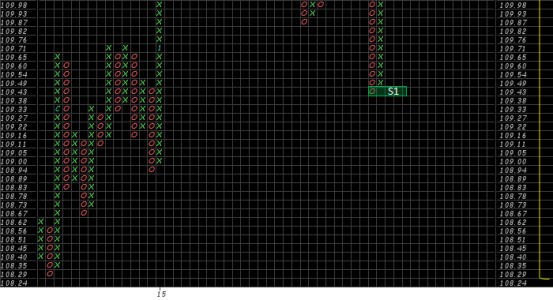

AGG

- Triggering a Bullish Signal Reversed, the previously well-established uptrend is now broken, off the original 12 March Double Top Breakout, AGG topped out at 1.15%

- We now have 5 higher Xs followed by 1 lower O, a 110.86 bearish price objective, with a reversal triggered at 111.81 (-.59% vs. .26%)

- Long-term Bullish - Price is greater than 110.09 or 50% of the entire chart

- Short-term Neutral - Price is even with 50% of the S3/R2 price columns

___

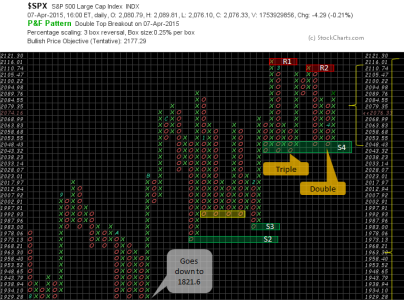

SPX

- Triggering a Double Top Breakout, we now have a higher X, preceded by a double low O

- We have a 2177 bullish price objective, with a reversal triggered at 2043 (4.86% vs. -1.59)

- Long-term Bullish - Price is greater than 1963 or 50% of the entire chart

- Short-term neutral & range-bound - Price is greater than 50% of the S4/R2 price columns

___

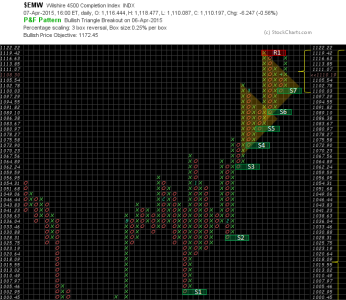

W4500

- This is the 2nd Bullish Triangle Breakout

- We have an 1172 bullish price objective, with a reversal triggered at 1097 (5.63% vs. -1.16%)

- Long-term Bullish - Price is greater than 1015 or 50% of the entire chart

- Short-term bullish - Price is greater than 50% of the S7/R1 price columns

___

Transports

- Prices are descending with the recent Double Bottom Breakdown, giving us 3 lower Os & 2 lower Xs

- We have an 8074 bearish price objective, with a reversal triggered at 8804 (-6.19% vs. 2.29%)

- Long-term Bullish & receding - Price is greater than 8460 or 50% of the entire chart

- Short-term Bearish & descending - Price is less than 50% of the S3/R5 price columns

- WARNING: 5 more Os below S4 is a 10% correction off the R1 top

___

NASDAQ 100

- Prices has been range bound between the S4 triple low O and R2

- We have a 4858 bullish price objective, with a reversal triggered at 4279 (11.83% vs. -1.50%)

- Long-term Bullish - Price is greater than 4070 or 50% of the entire chart

- Short-term Bullish and compressed - Price is greater than 50% of the S4/R2 price columns

The markets put in a mid-day reversal on Tuesday, which confirmed my short-term analysis, but how all this plays out remains to be seen. As for myself, I chose to side-step out into the F-Fund and will re-evaluate the price action from a less risky point of view

Trade safe…Jason