___

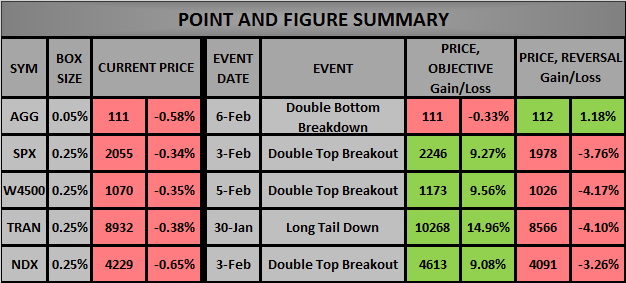

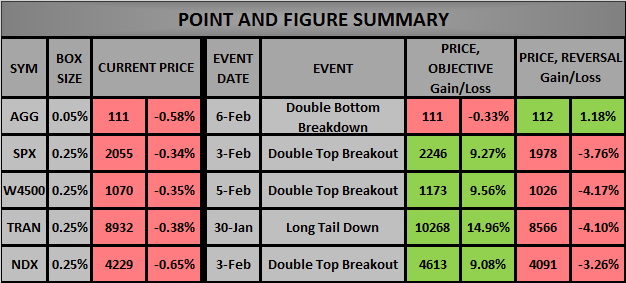

For the PnF Market Summary, bonds are on a sell, while equities are on a buy and based of the .25% box price scale, I show the S-Fund to be stronger than the C-Fund (yet perhaps riskier). This week, I'll be keeping my eye on both the Transports and the NASDAQ 100, which (upon Monday's open) are likely to create a new column of Os, with the Transports establishing a lower high

___

AGG triggers two consecutive Double Bottom Breakdowns, with a -.33% bearish price objective

___

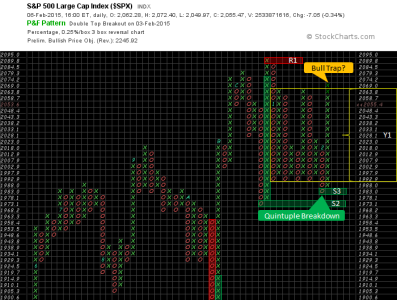

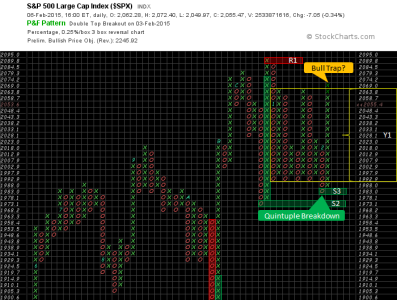

S&P 500 triggered a Double Top Breakout on 3-Feb, with a 9.27% bullish price objective

___

W4500 triggered a Double Top Breakout on 5-Feb, with a 9.56% bullish price objective

___

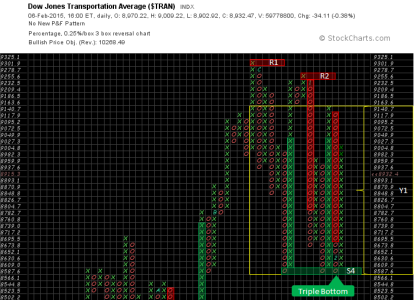

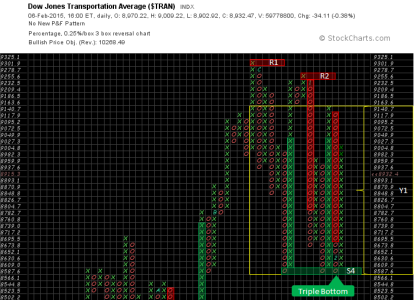

Transports have a 14.96% bullish price objective

___

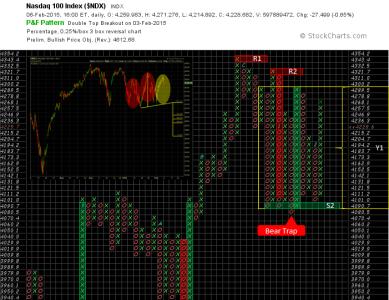

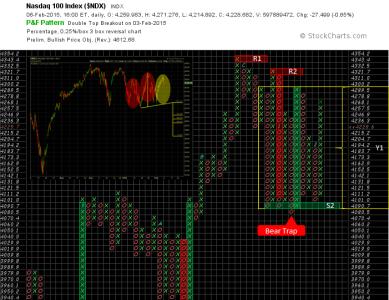

NASDAQ 100 triggered a Double Top Breakout on 3-Feb, with a 9.08% bullish price objective

___

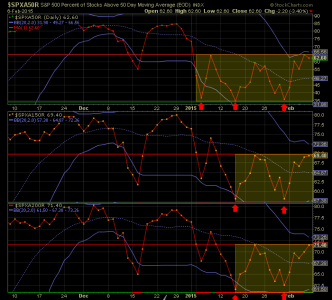

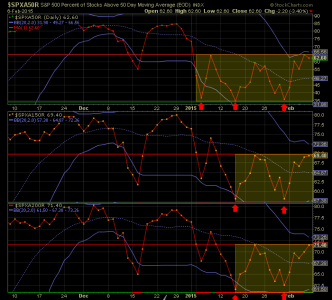

Examining the number of S&P 500 stocks trading above their 50/150/200 day moving averages

___

Going forward into this week, I'd like to see some strong follow-through, perhaps giving us enough momentum to get us over the statistically weaker weeks which follow. Over the past 25 days, the C-Fund has closed down 14 times, giving us a below average 44% winning ratio. At this time, I suspect we are "out of balance" and need to equalize back to the traditional 54% winning ratio and this week would be a great time to normalize those stats.

Trade Hard…Jason

Trading the Stats: Week 6

For the PnF Market Summary, bonds are on a sell, while equities are on a buy and based of the .25% box price scale, I show the S-Fund to be stronger than the C-Fund (yet perhaps riskier). This week, I'll be keeping my eye on both the Transports and the NASDAQ 100, which (upon Monday's open) are likely to create a new column of Os, with the Transports establishing a lower high

___

AGG triggers two consecutive Double Bottom Breakdowns, with a -.33% bearish price objective

- From my perspective, this isn't the proper season for an entry into a declining bond market

- Closing below box Y1, AGG has breached the previous 5 lows

- AGG pulled back roughly -1.02% over the past 4 days, this is the largest 4-day decline since September 2013

- For the month of February, the last time AGG, had a 4-day -1% (or greater) decline, was in 2011 (1st week)

- Continuing this theme, in February 2011, AGG closed the month flat, while the S&P 500 closed up 3.20%

- The 10-year Treasury yield recorded its largest one-week gain since June 2013 Friday, snapping five weeks of declines after the Labor Department’s nonfarm payrolls report for January came in stronger than expected.

___

S&P 500 triggered a Double Top Breakout on 3-Feb, with a 9.27% bullish price objective

- Remembering the quintuple breakdown which proved to be a false sell signal…

- We broke above box Y1 by just one stinking X, the question we need answered, is this a bull trap?

___

W4500 triggered a Double Top Breakout on 5-Feb, with a 9.56% bullish price objective

- Continuing the box Y1 theme (which I've drawn across all the indexes) this Index is the strongest

- We also have a fresh 52-week high, with no historical price resistance, will the other indexes follow?

___

Transports have a 14.96% bullish price objective

- There's a nice bounce off a Triple Bottom, but we're contained within box Y1 and setting up for a lower X

- I estimate this index to be the most volatile and the furthest away from a breakout

___

NASDAQ 100 triggered a Double Top Breakout on 3-Feb, with a 9.08% bullish price objective

- The only remaining index which still has potential for a Head & Shoulders pattern

___

Examining the number of S&P 500 stocks trading above their 50/150/200 day moving averages

- We are at the top of the recent range, compression on the Bollinger Bands is tightening

- Whichever direction breaks first, should provide a strong move for stocks

___

Going forward into this week, I'd like to see some strong follow-through, perhaps giving us enough momentum to get us over the statistically weaker weeks which follow. Over the past 25 days, the C-Fund has closed down 14 times, giving us a below average 44% winning ratio. At this time, I suspect we are "out of balance" and need to equalize back to the traditional 54% winning ratio and this week would be a great time to normalize those stats.

Trade Hard…Jason

Trading the Stats: Week 6