Exciting times, I've already done a blog this weekend which focused on past performance.

Blog: Week-14's Hard-Stats

From 1962 we've closed the year down 17 times, with an average loss of -13.16%

Transposed for 2025, we've breached this level, our next test will be the average intra-year low of negative closes at -16.43%.

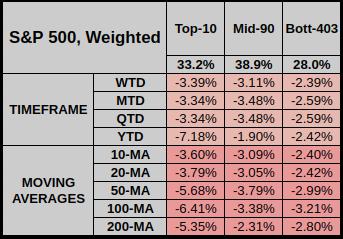

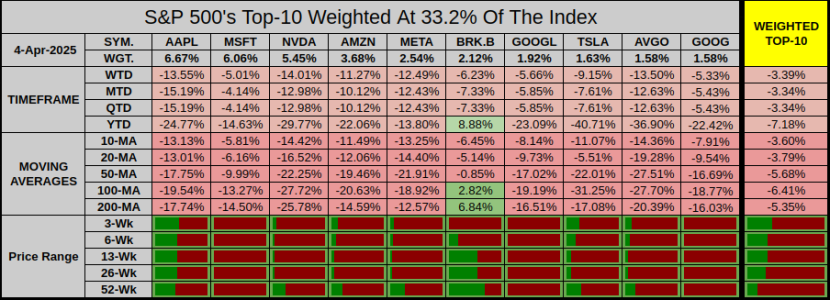

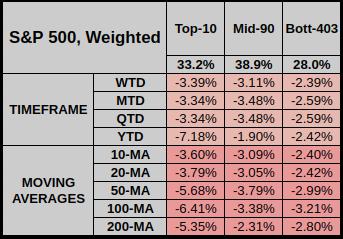

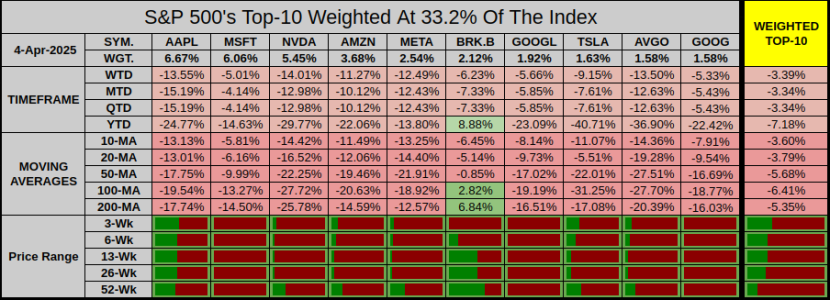

As we know, it's mostly been the Large Caps dragging us down, our Top-10 have a 33.2% weighted impact on the index.

YTD, the Top-10 have lost -7.18% which is about 62% of the indexes total losses derived from just these 10 stocks.

YTD 7 of our Top-10 are <-20%

There are 283 stocks <-20% below their 52-Week Highs, by index weight they comprise 65.7% of the index.

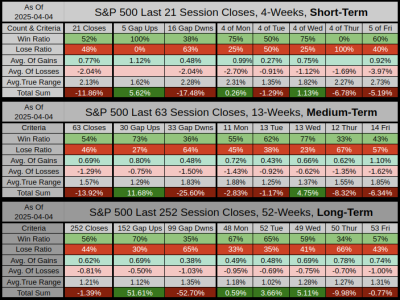

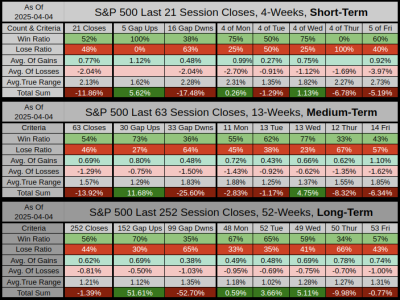

Over the past 21-Sessions, the Index has gaped down 16 times closing down 10 times for a cumulative loss of -17.48%.

Across all time frames Thursday is abnormally weak, our last 7 have closed down giving us a cumulative loss of -10.58%.

Blog: Week-14's Hard-Stats

From 1962 we've closed the year down 17 times, with an average loss of -13.16%

Transposed for 2025, we've breached this level, our next test will be the average intra-year low of negative closes at -16.43%.

As we know, it's mostly been the Large Caps dragging us down, our Top-10 have a 33.2% weighted impact on the index.

YTD, the Top-10 have lost -7.18% which is about 62% of the indexes total losses derived from just these 10 stocks.

YTD 7 of our Top-10 are <-20%

There are 283 stocks <-20% below their 52-Week Highs, by index weight they comprise 65.7% of the index.

Over the past 21-Sessions, the Index has gaped down 16 times closing down 10 times for a cumulative loss of -17.48%.

Across all time frames Thursday is abnormally weak, our last 7 have closed down giving us a cumulative loss of -10.58%.

Last edited: