I found it somewhat odd yesterday, that the market rallied in spite of the EU Summit members coming up seemingly empty on a plan of action. But then last night an agreement was reached and today the market soared to levels not seen in about 3 months. Sell-the-news? Not yet.

If one was a bear who was shorting this market, you got annihilated during this month. If one was a bull and long you were loving life. But the fact is, an awful lot of traders and investors have been watching this market largely from the sidelines. Perceived risk of whipsaws keeping them in check. So frustration is a common theme at the moment.

So now that the European Union has increased the eurozone bailout fund to about $1.4 trillion and agreed to cut Greece's debt by half, what's next? The can has been kicked, but the systemic problems persist. Nuff' said.

On this side of the pond, we got a quarterly GDP reading for the third quarter of 2.5%, which beat estimates of 2.3% growth. Initial jobless claims came in at 402,000, which was in-line with estimates, but remains above the psychological 400,000 number.

September pending home sales fell 4.6%, which was much worse than the 0.9% drop economists were looking for.

So our own economic data is mixed with the jobs and real estate markets still acting as a drag.

Here's today's charts:

NAMO and NYMO are near or above multi-months highs and remain in buy conditions.

NAHL and NYHL are beginning to lift off and also remain on buys.

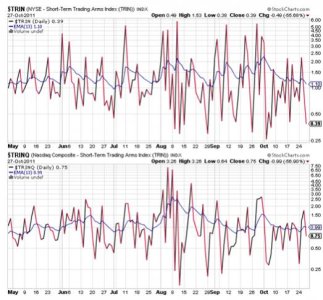

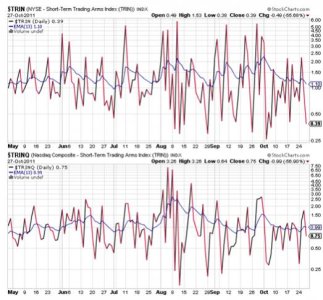

TRIN is on a buy and shows a moderately overbought market, while TRINQ is also on a buy, but only mildly bullish at the moment. We could see some selling pressure tomorrow based on TRIN's reading.

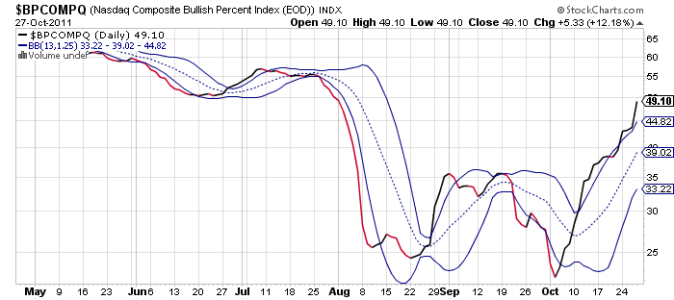

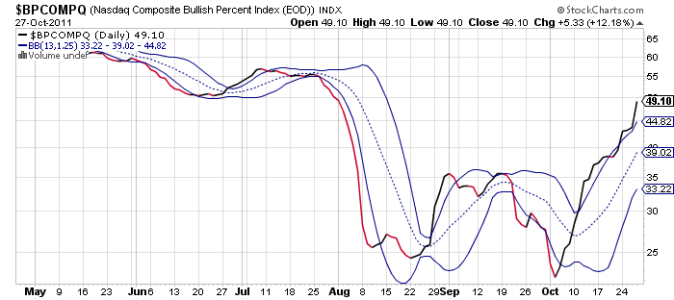

BPCOMPQ moved higher and remains on a buy.

So all signals are on buys, which keeps the system on a buy.

We're extended. Very extended.

While I don't doubt we can't move higher between now and the end of the year, I seriously doubt we can do it without seeing at least one more decline. And headline risk has not gone away in spite of the EU's agreement. My guess is that there was significant capitulation by the bears after today's climatic rout. If true, that could lead to a downward move soon. Especially if those who missed out of these gains begin buying any dip early as a result of rising bullishness. We'll see if that's the case soon enough.

If one was a bear who was shorting this market, you got annihilated during this month. If one was a bull and long you were loving life. But the fact is, an awful lot of traders and investors have been watching this market largely from the sidelines. Perceived risk of whipsaws keeping them in check. So frustration is a common theme at the moment.

So now that the European Union has increased the eurozone bailout fund to about $1.4 trillion and agreed to cut Greece's debt by half, what's next? The can has been kicked, but the systemic problems persist. Nuff' said.

On this side of the pond, we got a quarterly GDP reading for the third quarter of 2.5%, which beat estimates of 2.3% growth. Initial jobless claims came in at 402,000, which was in-line with estimates, but remains above the psychological 400,000 number.

September pending home sales fell 4.6%, which was much worse than the 0.9% drop economists were looking for.

So our own economic data is mixed with the jobs and real estate markets still acting as a drag.

Here's today's charts:

NAMO and NYMO are near or above multi-months highs and remain in buy conditions.

NAHL and NYHL are beginning to lift off and also remain on buys.

TRIN is on a buy and shows a moderately overbought market, while TRINQ is also on a buy, but only mildly bullish at the moment. We could see some selling pressure tomorrow based on TRIN's reading.

BPCOMPQ moved higher and remains on a buy.

So all signals are on buys, which keeps the system on a buy.

We're extended. Very extended.

While I don't doubt we can't move higher between now and the end of the year, I seriously doubt we can do it without seeing at least one more decline. And headline risk has not gone away in spite of the EU's agreement. My guess is that there was significant capitulation by the bears after today's climatic rout. If true, that could lead to a downward move soon. Especially if those who missed out of these gains begin buying any dip early as a result of rising bullishness. We'll see if that's the case soon enough.