___

4th trading of March

___

Thursdays are the best day of the week

The price action has been very tight, if you've been reading my blogs this week, then you've seen the indexes deteriorate on a minuet scale.

___

AGG, 30-min

___

SPX, 30-min

___

W4500, 30-min

___

Transports, 30-min

___

NASDAQ 100, 30-min

___

For myself, I have no dog in this fight, I've side-stepped into the G-Fund and will re-evaluate the price action as it unfolds.

Trade what you see, not what you read…Jason

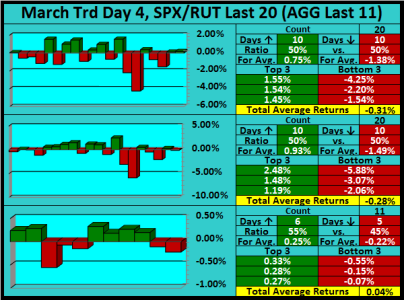

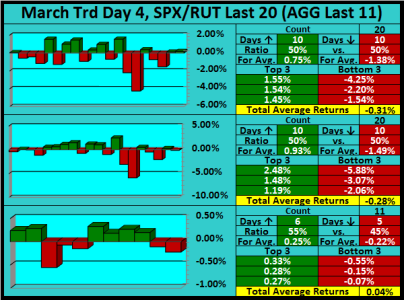

4th trading of March

- SPX, 50% winning ratio with -.31% average returns

- R2K, 50% winning ratio with -.28% average returns

- AGG, 55% winning ratio with .04% average returns

___

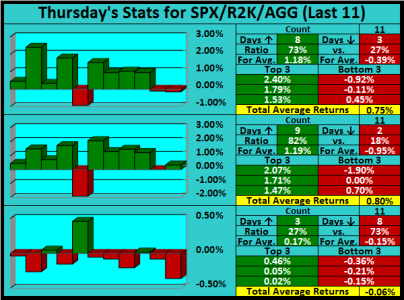

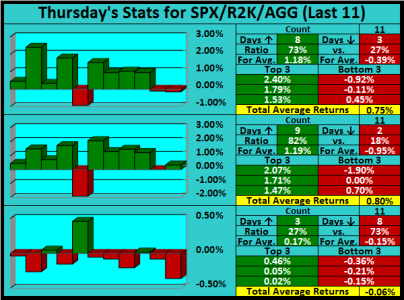

Thursdays are the best day of the week

- SPX, 73% winning ratio with .75% average returns (last 2 closed down)

- R2K, 82% winning ratio with .80% average returns

- AGG, 27% winning ratio with -.06% average returns (last 2 closed down)

The price action has been very tight, if you've been reading my blogs this week, then you've seen the indexes deteriorate on a minuet scale.

___

AGG, 30-min

- Failed to recapture 50% of the BC wave

- Micro Bear Flag suggest a test of the 110.15 bottom at B

- Still looking for a measured move down off wave 1-2 which test the 110.15 bottom at B

___

SPX, 30-min

- Previously mentioned 2103 support is now resistance

- While under 2103, I'll be looking for a test of the 2-4 trendline

___

W4500, 30-min

- Although we managed to close at 1095, it's still dicey, we need a solid close back above 1094

- The 1088 low was tested today with a low of 1089.81 (a breach below this level may rapidly execute sell orders)

___

Transports, 30-min

- Watch the red descending parallel price channel

- Trading below 75% of wave AB (the other indexes are stronger)

- Trendlines 5-6, 3-4, & 1-2 have all been breached and the retest of 1-2 failed

___

NASDAQ 100, 30-min

- Watching for a test of trendline 1-2

- Prices rolling over (watch the leader)

___

For myself, I have no dog in this fight, I've side-stepped into the G-Fund and will re-evaluate the price action as it unfolds.

Trade what you see, not what you read…Jason