Good evening

For the S&P 500, the last 100 times the 1st trading day of all months closed up, the 2nd trading day has a 60% winning ratio, with .12% average returns.

___

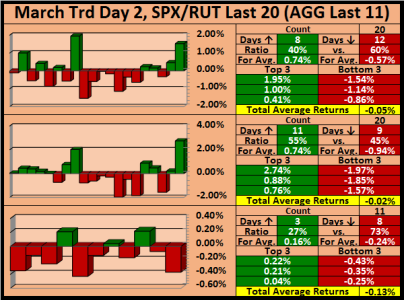

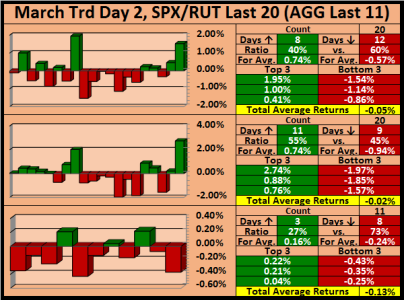

2nd trading day of March

___

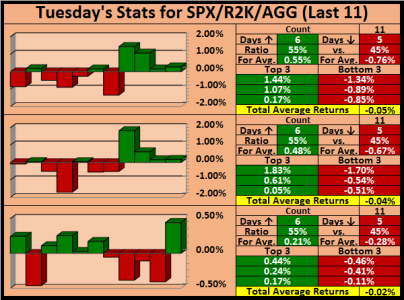

Tuesday's are getting better…

___

AGG, 30-min

___

SPX, 30-min

___

W4500, 30-min

___

Transports, 30-min

___

NASDAQ 100, 30-min

___

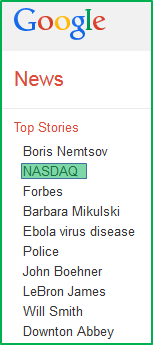

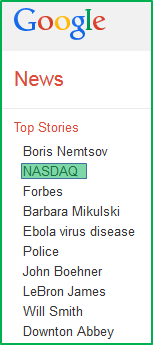

This is a picture of my Google News Feed's Top Stories. Normally it is full of junk like Kanye West or Taylor Swift, today it's listed "NASDAQ" if this isn't a warning of a top, I don't know what is.

As for AGG, today's volatile close was in the bottom 4% of all 2800+ trading days and today's volume was the heaviest ever!

Trade what you see, not what you read…Jason

For the S&P 500, the last 100 times the 1st trading day of all months closed up, the 2nd trading day has a 60% winning ratio, with .12% average returns.

___

2nd trading day of March

- SPX, 40% winning ratio with -.05% average returns (last 2 closed up)

- R2K, 55% winning ratio with -.02% average returns (last 2 closed up)

- AGG, 27% winning ratio with -.13% average returns (last 2 closed down)

___

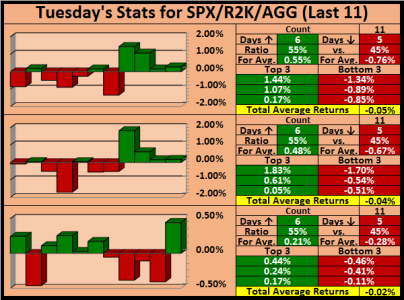

Tuesday's are getting better…

- SPX, 55% winning ratio with -.05% average returns (last 4 closed up)

- R2K, 55% winning ratio with -.04% average returns (last 4 closed up)

- AGG, 55% winning ratio with .02% average returns

___

AGG, 30-min

- Price failed to recapture 50% of wave AB and has dropped out of the blue box

- A measured move down from wave 1-2 suggest a re-test of the bottom at B

- Heavy volume (I'll talk about that at the bottom of the page)

___

SPX, 30-min

- 2103 has been tested 4 times (QUAD support)

- Trendline 1-3 was tested for a 2nd time, and for the 2nd time, buyers stepped in (Vol-Spike)

___

W4500, 30-min

- Priced closed off the highs, creating a Triple Top

___

Transports, 30-min

- Both trendlines 1-2 and 3-4 were breached, with the recovery of trendline 1-2 in progress

___

NASDAQ 100, 30-min

- Fresh set of 52-week highs

___

This is a picture of my Google News Feed's Top Stories. Normally it is full of junk like Kanye West or Taylor Swift, today it's listed "NASDAQ" if this isn't a warning of a top, I don't know what is.

As for AGG, today's volatile close was in the bottom 4% of all 2800+ trading days and today's volume was the heaviest ever!

Trade what you see, not what you read…Jason