___

Good morning

1st trading day of the Month is always exciting and sometimes can be a trendsetter. If you recall, the first 2 days of February were the biggest gainers, while the second day of January was the biggest loser.

___

1st trading day of March, 2014 closed counter to the norm

___

Mondays are dreadful…

___

AGG, Daily

___

SPX, Daily

___

W4500, Daily

___

Transports, Daily

___

NASDAQ 100, Daily

___

Last Friday's close left some unanswered questions, in particular with the "tug of war" with bonds. Now I'm entitled to change my mind at any time, but as of this writing, I'm looking for a pullback, perhaps something in the 3-5% range. Prefacing this, I haven't successfully picked a top in a very long time, with much of 2014 spent getting out too early, having been forced to chase the price action. And in case you haven't noticed, roughly 1/3rd of the top 100 are premium subscribers, in both Jan & Feb, both Intrepid Timer and the Plus SS system have "killed it"

Trade what you see, not what you read…Jason

Trading the Stats: Historical Performance of March

Good morning

1st trading day of the Month is always exciting and sometimes can be a trendsetter. If you recall, the first 2 days of February were the biggest gainers, while the second day of January was the biggest loser.

___

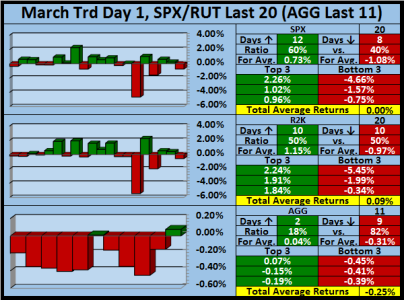

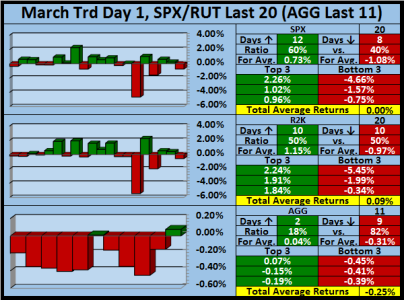

1st trading day of March, 2014 closed counter to the norm

- SPX, 60% winning ratio with 0.00% average returns

- R2K, 50% winning ratio with .09% average returns

- AGG, 18% winning ratio with -.25% average returns

___

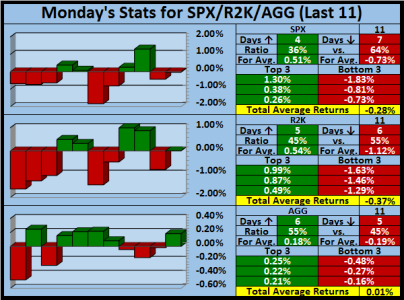

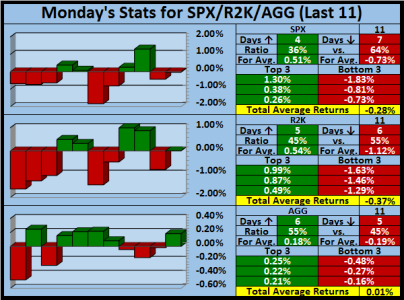

Mondays are dreadful…

- SPX, 36% winning ratio with -.28% average returns

- R2K, 45% winning ratio with -.37% average returns

- AGG, 55% winning ratio with .01% average returns

___

AGG, Daily

- Previous spike in volume at C, marked a top

- Heavy volume on the last hour's close with little price movement "tug of war"

- Price is wedged under 50% of wave CD and trendline BD "short-term compression"

___

SPX, Daily

- Three consecutive days down "Large cap Oil"

- Slight ramp-up in volume over the past 4 days "not a good sign"

- Must not close under the 20-Feb's 2085.44 tail, this may trigger a fresh round of sell orders

___

W4500, Daily

- Price band 1072-1082 is a 25% retrace of wave 1B "semi-important"

- Price band 1050-1062 is a 50% retrace of wave 1B and 25% retrace of wave AB "important"

- Sine wave is attached to the A1 bottom & top, it fits very well on this time-scale "almost too good to be true"

___

Transports, Daily

- Three consecutive days down "Unions"

- Price band 8883-8957 is a 25% retrace of wave A1 and 50% retrace of wave 1/2 "important"

- Origin of wave 1/2, leads down into the triangle pattern "may hint towards another test of the bottom"

___

NASDAQ 100, Daily

- Six days of flat price & volume "indecision"

- Breach of line CD suggest a test of line EF "interesting"

- Line CD is a 25% retrace of wave 2B, line EF is a 25% retrace of wave AB "key levels"

___

Last Friday's close left some unanswered questions, in particular with the "tug of war" with bonds. Now I'm entitled to change my mind at any time, but as of this writing, I'm looking for a pullback, perhaps something in the 3-5% range. Prefacing this, I haven't successfully picked a top in a very long time, with much of 2014 spent getting out too early, having been forced to chase the price action. And in case you haven't noticed, roughly 1/3rd of the top 100 are premium subscribers, in both Jan & Feb, both Intrepid Timer and the Plus SS system have "killed it"

Trade what you see, not what you read…Jason

Trading the Stats: Historical Performance of March