It was another good day for the bulls as the S&P 500 managed to settle above its 200 DMA for the first time in a month.

Volume was on the light side, but if you saw my last blog you'd know many folks aren't buying this rally. And if they aren't buying this rally volume would be light. No surprise there.

So expect the bulls to press their advantage.

Here's the charts:

We're really seeing some upside movement in the momo here.

NAHL and NYHL are getting more bullish.

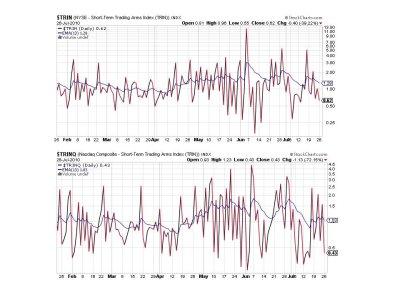

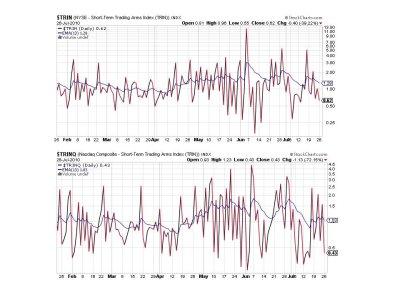

TRIN and TRINQ are on buy.

BPCOMPQ looks like it may go parabolic. It's on a buy too.

So we have 7 of 7 signals on a buy, but the system remains on a buy anyway.

I see no reason for the market to stall at this point. We could see some backing and filling, but that would be healthy and probably create a buying opportunity for those on the sidelines. More mechanical systems are triggering buy signals too, so it's probably just a matter of time before this rally gets accepted to a larger extent. Expect more upside.

Still 100% S and holding tight.

Volume was on the light side, but if you saw my last blog you'd know many folks aren't buying this rally. And if they aren't buying this rally volume would be light. No surprise there.

So expect the bulls to press their advantage.

Here's the charts:

We're really seeing some upside movement in the momo here.

NAHL and NYHL are getting more bullish.

TRIN and TRINQ are on buy.

BPCOMPQ looks like it may go parabolic. It's on a buy too.

So we have 7 of 7 signals on a buy, but the system remains on a buy anyway.

I see no reason for the market to stall at this point. We could see some backing and filling, but that would be healthy and probably create a buying opportunity for those on the sidelines. More mechanical systems are triggering buy signals too, so it's probably just a matter of time before this rally gets accepted to a larger extent. Expect more upside.

Still 100% S and holding tight.