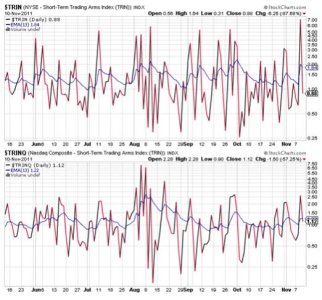

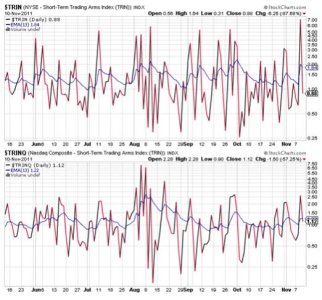

Yesterday, I had mentioned that two signals, TRIN and TRINQ were suggesting oversold conditions (especially TRIN) and that an imminent rally would probably materialize. It did. Although trade was choppy for most of the day.

By the close the S&P 500 posted a healthy 0.86%, while the DOW and Nasdaq gained 0.96% and 0.13% respectively. Note the relatively flat finish for the Nasdaq.

The market was buoyed by an Italian bond auction that showed good demand for that country's debt. Yields were still above 6%, however.

I haven't been mentioning it of late, but I'm sure many of you are aware that oil prices are climbing. Today saw another 2% gain in oil, which now puts a barrel of oil near $98.

We also had some market data early in the day. Weekly initial jobless claims came in at 390,000, which was lower than estimates calling for 400,000 claims. Anything under 400,000 is considered a plus, although the numbers are still robust.

And the trade deficit dropped to $43.1 billion in September. That was under estimates of $45.9 billion.

Here's tonight's charts:

NAMO and NYMO improved a bit, but remain on sells.

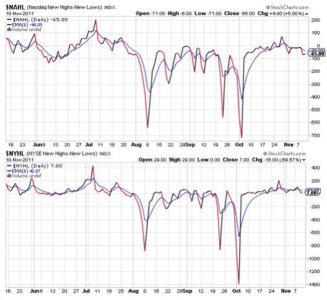

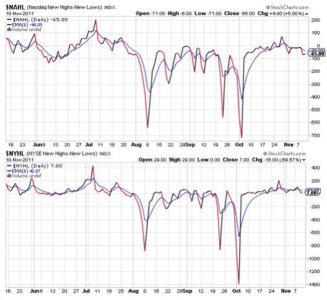

NAHL and NYHL also remain on sells.

TRIN and TRINQ both spiked lower and each flipped back to a buy condition in the process.

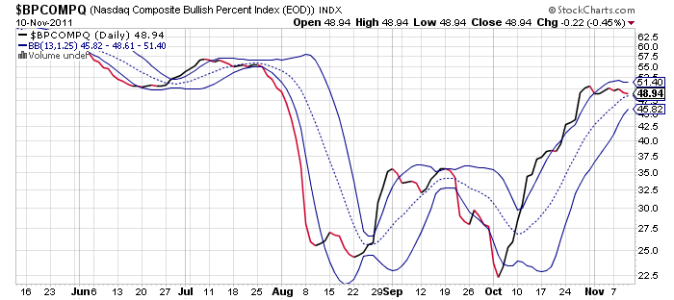

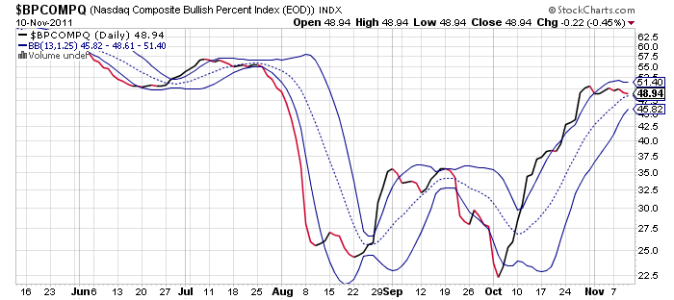

BPCOMPQ moved a tad lower and remains on a sell.

So the signals are mixed, but the Seven Sentinels technically remain in a buy condition. However, there have been two unofficial sell signals over the past two weeks, so caution is warranted.

To my eye the charts suggest we have more work to do on the downside, but it doesn't necessarily mean weakness is imminent. Headline risk continues to be at play, which makes reading the charts more challenging.

I remain 100% G fund and with Friday being a holiday I know I won't be making any moves until at least next week, assuming weakness continues to take this market lower.

By the close the S&P 500 posted a healthy 0.86%, while the DOW and Nasdaq gained 0.96% and 0.13% respectively. Note the relatively flat finish for the Nasdaq.

The market was buoyed by an Italian bond auction that showed good demand for that country's debt. Yields were still above 6%, however.

I haven't been mentioning it of late, but I'm sure many of you are aware that oil prices are climbing. Today saw another 2% gain in oil, which now puts a barrel of oil near $98.

We also had some market data early in the day. Weekly initial jobless claims came in at 390,000, which was lower than estimates calling for 400,000 claims. Anything under 400,000 is considered a plus, although the numbers are still robust.

And the trade deficit dropped to $43.1 billion in September. That was under estimates of $45.9 billion.

Here's tonight's charts:

NAMO and NYMO improved a bit, but remain on sells.

NAHL and NYHL also remain on sells.

TRIN and TRINQ both spiked lower and each flipped back to a buy condition in the process.

BPCOMPQ moved a tad lower and remains on a sell.

So the signals are mixed, but the Seven Sentinels technically remain in a buy condition. However, there have been two unofficial sell signals over the past two weeks, so caution is warranted.

To my eye the charts suggest we have more work to do on the downside, but it doesn't necessarily mean weakness is imminent. Headline risk continues to be at play, which makes reading the charts more challenging.

I remain 100% G fund and with Friday being a holiday I know I won't be making any moves until at least next week, assuming weakness continues to take this market lower.