On Wednesday it seemed the market might be breaking out to higher highs as we headed towards the end of the quarter, but yesterday's market activity cast renewed doubt that a continued breakout was in the cards. And now today's trading threw cold water on that notion all together as the Seven Sentinels rolled over to a sell condition.

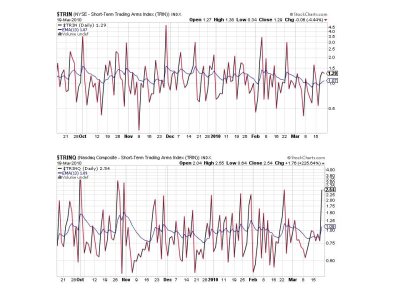

Take a look:

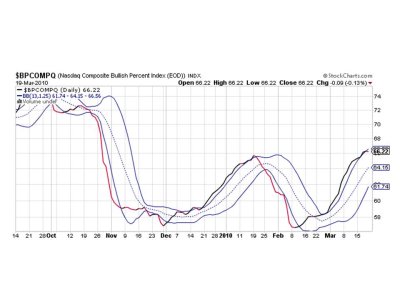

NAMO and NYMO are now moving back towards negative territory. Both are in a sell condition.

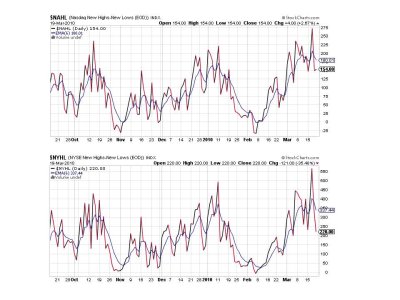

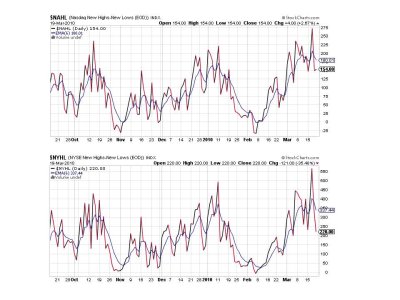

NAHL and NYHL are also flashing sells.

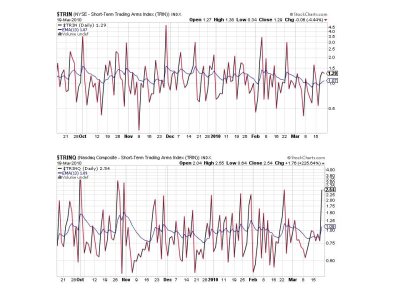

TRIN remained on a sell, but TRINQ rolled over from a buy yesterday to a sell today.

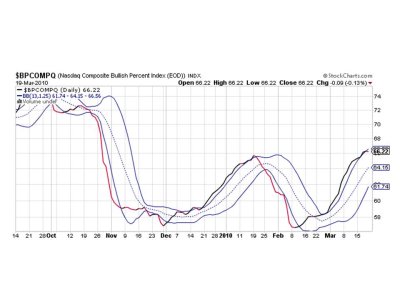

And there it is. See that little red mark poking out past the upper bollinger band? That's sell signal number seven.

So the stars are aligned once again with all seven signals flashing sells simultaneously, which flips the system to a sell condition.

I'll be updating the Top 15 and Top 50 later this weekend. See you then.

Take a look:

NAMO and NYMO are now moving back towards negative territory. Both are in a sell condition.

NAHL and NYHL are also flashing sells.

TRIN remained on a sell, but TRINQ rolled over from a buy yesterday to a sell today.

And there it is. See that little red mark poking out past the upper bollinger band? That's sell signal number seven.

So the stars are aligned once again with all seven signals flashing sells simultaneously, which flips the system to a sell condition.

I'll be updating the Top 15 and Top 50 later this weekend. See you then.