We've broken out to the upside, but because it was on OPEX the breakout may be suspect. At least in the short term anyway, because it can create a deceptive market environment. But don't take my comments as either bullish or bearish, only that technicals can change once OPEX is over.

As we've been hearing most of the week, this weekend there will be a EU summit, the first of two, where EU leaders hope to craft a plan to address their debt issues. It's been all talk so far and no action, but the market has largely held together in spite of the uncertainty that continues to plague the markets over the EU's financial crisis.

Here's the charts:

NAMO and NYMO bounced back up today and flipped back to buy conditions. There's room for these signals to go either way, but I'm leaning lower for next week.

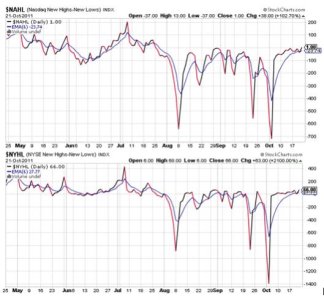

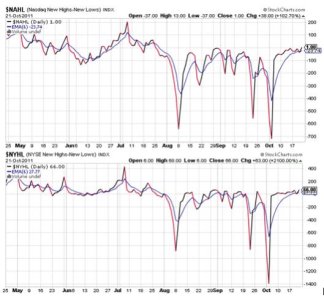

NAHL and NYHL also flipped back to buys today.

TRIN moved bit higher and flipped but retained its buy status, while TRINQ moved a bit lower and flipped back to a buy.

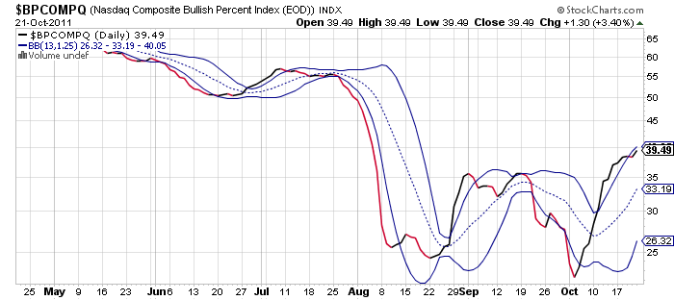

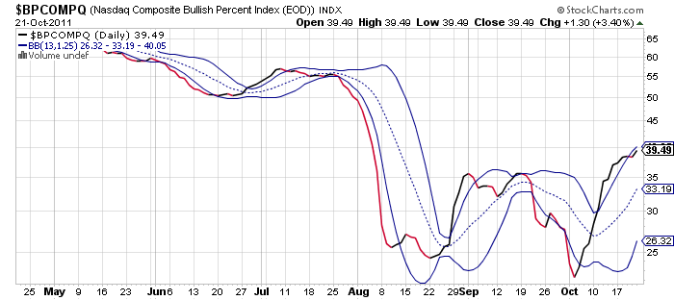

BPCOMPQ remained on a sell, but notice that it moved higher today along that upper bollinger band. That's why I said yesterday that I wasn't entirely comfortable calling this signal a sell when it fell below that bollinger band in sideways action. It really didn't move lower in any meaningful way and then today it rose again. If it can clear that bollinger it can flip back to a buy, but I'd take the sell signal with a grain of salt for now.

So the signals are mixed with BPCOMPQ being the only one on a sell and that keeps the Seven Sentinels in a buy condition.

I remain bullish in the intermediate term, but I am now bearish short term. With today's breakout to the upside I opted to sell my S fund position and go to 100% G fund. I had planned on selling when the S&P 500 approached 1230 - 1250. Shortly before our IFT deadline the markets were near their highs of the day, with the S&P not far from 1240. Given it appeared we were seeing a short squeeze, I had to anticipate that prices might go much higher than where they were prior to 1200 EST. Therefore, I decided to sell my position. I also took note of the fact that we are not far from November and two fresh IFTs, so I decided to take the bird in the hand for the short term and hopefully reload at lower prices the following week. It's a calculated risk, but we've come a long way and sooner or later I would think the big money will want to reload before we head into the holiday season.

Stop by Sunday evening and I'll have the tracker charts posted. See you then.

As we've been hearing most of the week, this weekend there will be a EU summit, the first of two, where EU leaders hope to craft a plan to address their debt issues. It's been all talk so far and no action, but the market has largely held together in spite of the uncertainty that continues to plague the markets over the EU's financial crisis.

Here's the charts:

NAMO and NYMO bounced back up today and flipped back to buy conditions. There's room for these signals to go either way, but I'm leaning lower for next week.

NAHL and NYHL also flipped back to buys today.

TRIN moved bit higher and flipped but retained its buy status, while TRINQ moved a bit lower and flipped back to a buy.

BPCOMPQ remained on a sell, but notice that it moved higher today along that upper bollinger band. That's why I said yesterday that I wasn't entirely comfortable calling this signal a sell when it fell below that bollinger band in sideways action. It really didn't move lower in any meaningful way and then today it rose again. If it can clear that bollinger it can flip back to a buy, but I'd take the sell signal with a grain of salt for now.

So the signals are mixed with BPCOMPQ being the only one on a sell and that keeps the Seven Sentinels in a buy condition.

I remain bullish in the intermediate term, but I am now bearish short term. With today's breakout to the upside I opted to sell my S fund position and go to 100% G fund. I had planned on selling when the S&P 500 approached 1230 - 1250. Shortly before our IFT deadline the markets were near their highs of the day, with the S&P not far from 1240. Given it appeared we were seeing a short squeeze, I had to anticipate that prices might go much higher than where they were prior to 1200 EST. Therefore, I decided to sell my position. I also took note of the fact that we are not far from November and two fresh IFTs, so I decided to take the bird in the hand for the short term and hopefully reload at lower prices the following week. It's a calculated risk, but we've come a long way and sooner or later I would think the big money will want to reload before we head into the holiday season.

Stop by Sunday evening and I'll have the tracker charts posted. See you then.