I was traveling all day yesterday and largely unable to follow the action. The market managed to make it five for five this week and the Nasdaq had its best week since July 2009. An indication that this strength may stick for awhile.

Here's Friday's charts:

NAMO and NYMO dipped just a bit and suggest this rally may need to take a break soon. That said, any downside may be limited. It's a tough call though, as I still consider this a bear market, but if the market is truly comfortable with the European debt situation we may largely hold these levels for awhile. Both signals remain in buy conditions.

NAHL and NYHL also remain on buys.

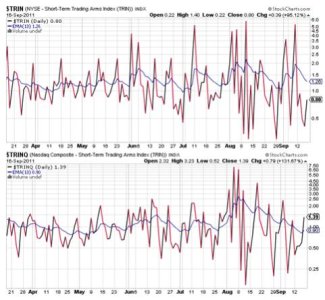

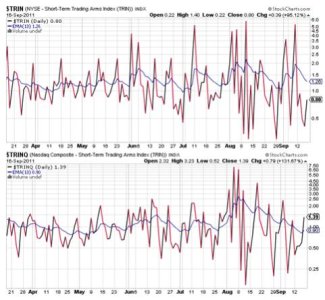

TRIN held its buy status, while TRINQ flipped to a sell. No overdone readings here.

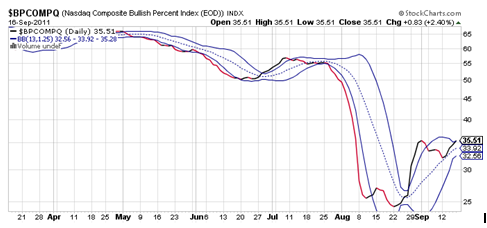

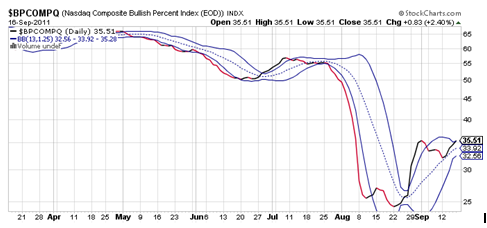

BPCOMPQ poked above that upper bollinger band, which flips the signal back to a buy condition.

So all but one signal are flashing buys. That keeps the system in a buy condition and I'd have to say that the unconfirmed sell signal that came a little over a week ago is now suspect and almost irrelevant. But I'll give a few more days since this was OPEX week we just finished and that can skew the technical picture.

I am still in the F fund, but believe it or not, in the month I've spent in this fund the market is only modestly higher than where I last exited. I'm going to have to have a plan B now that this market has blown the shorts out of the water at the same time the Central Banks have pledged support to the EU.

Stop by tomorrow evening and I'll have the tracker charts posted.

Here's Friday's charts:

NAMO and NYMO dipped just a bit and suggest this rally may need to take a break soon. That said, any downside may be limited. It's a tough call though, as I still consider this a bear market, but if the market is truly comfortable with the European debt situation we may largely hold these levels for awhile. Both signals remain in buy conditions.

NAHL and NYHL also remain on buys.

TRIN held its buy status, while TRINQ flipped to a sell. No overdone readings here.

BPCOMPQ poked above that upper bollinger band, which flips the signal back to a buy condition.

So all but one signal are flashing buys. That keeps the system in a buy condition and I'd have to say that the unconfirmed sell signal that came a little over a week ago is now suspect and almost irrelevant. But I'll give a few more days since this was OPEX week we just finished and that can skew the technical picture.

I am still in the F fund, but believe it or not, in the month I've spent in this fund the market is only modestly higher than where I last exited. I'm going to have to have a plan B now that this market has blown the shorts out of the water at the same time the Central Banks have pledged support to the EU.

Stop by tomorrow evening and I'll have the tracker charts posted.