It was OPEX day today, which makes any meaningful analysis difficult as the Options traders jockey for position for the next round of trading. But during the course of the week a Seven Sentinels sell signal was issued, and that was the main event as far as the sentinels are concerned.

There was no meaningful market data today, so I'll go straight to the charts:

Both NAMO and NYMO remain on sells. We can see the Nasdaq has been under more pressure than the NYSE. Moreover, small and mid-caps felt more pressure than their larger counterparts.

NAHL and NYHL held relatively steady, but also remain in sell conditions.

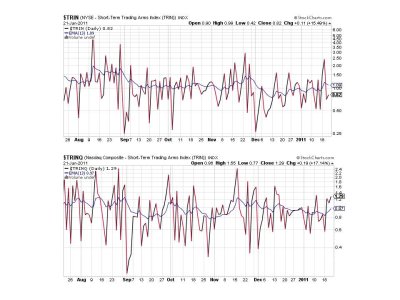

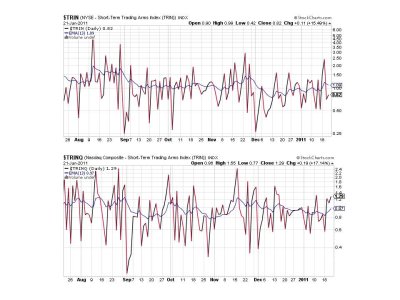

TRIN is showing relative strength as it remained on a buy today, but TRINQ showed more weakness. This correlates well with what we are seeing in NAMO and NYMO.

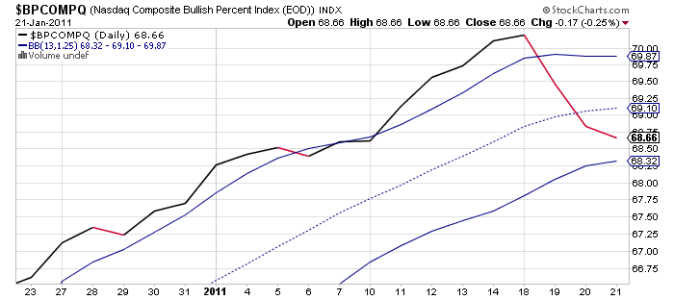

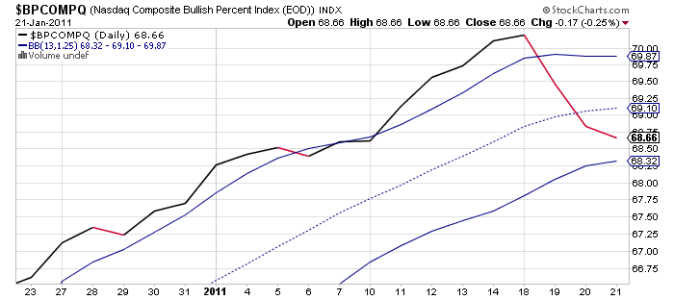

BPCOMPQ dipped a bit lower today, which continues to cast a bearish shadow over the Seven Sentinels.

While the system remains on a sell for the time being, I am not overly bearish. The fact that the sell signal occurred during OPEX coupled with the knowledge that the Fed is still pumping POMO makes it difficult for me to get overly concerned. Yes caution is warranted, which is why I chose to go to cash, but I have a hard time believing that any sell signal will be long lived. That's just my opinion as the Seven Sentinels and by extension the market will have the last word on that, but that's my expectations nonetheless.

I'm looking forward to seeing how much jockeying we did on the tracker this week and I'll be posting those charts sometime over the weekend. Also, our Sentiment Survey is in a buy condition, which leads me to believe we may have gotten a bit defensive.

There was no meaningful market data today, so I'll go straight to the charts:

Both NAMO and NYMO remain on sells. We can see the Nasdaq has been under more pressure than the NYSE. Moreover, small and mid-caps felt more pressure than their larger counterparts.

NAHL and NYHL held relatively steady, but also remain in sell conditions.

TRIN is showing relative strength as it remained on a buy today, but TRINQ showed more weakness. This correlates well with what we are seeing in NAMO and NYMO.

BPCOMPQ dipped a bit lower today, which continues to cast a bearish shadow over the Seven Sentinels.

While the system remains on a sell for the time being, I am not overly bearish. The fact that the sell signal occurred during OPEX coupled with the knowledge that the Fed is still pumping POMO makes it difficult for me to get overly concerned. Yes caution is warranted, which is why I chose to go to cash, but I have a hard time believing that any sell signal will be long lived. That's just my opinion as the Seven Sentinels and by extension the market will have the last word on that, but that's my expectations nonetheless.

I'm looking forward to seeing how much jockeying we did on the tracker this week and I'll be posting those charts sometime over the weekend. Also, our Sentiment Survey is in a buy condition, which leads me to believe we may have gotten a bit defensive.