Well, the S&P 200 dma fell like a load of bricks. This looks like panic selling now. Even a euro rally for a second consecutive day is not helping to stem the selling pressure.

The S&P 500 is now down more than 10%, which officially marks this a correction. The first since March 2009.

The Volatility Index was up almost 30%.

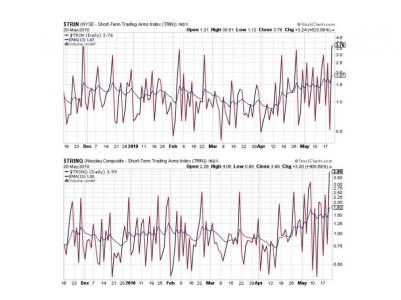

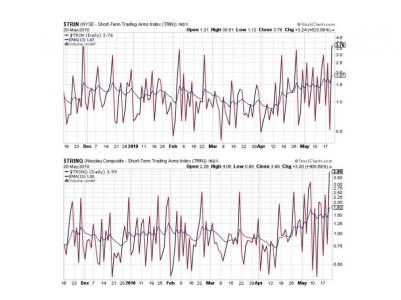

Here's the charts:

The plunge continues here.

And here.

Both flipped to a sell today.

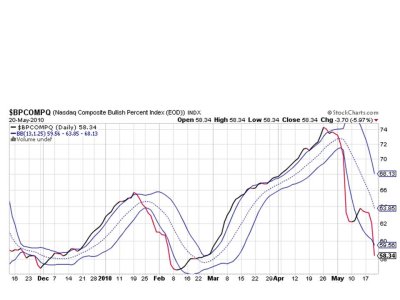

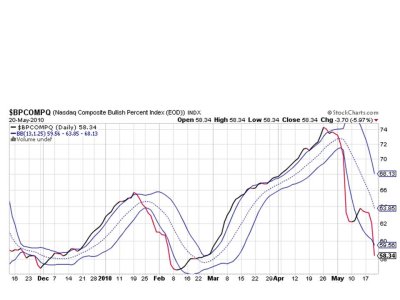

It took significant selling pressure, but BPCOMPQ finally rolled over.

So all 7 signals are flashing sells, which keeps the system on a sell.

I see no end to the selling in sight. If you're in cash, I'd stay there. Right now, our sentiment survey is showing 68% bears and only 23% bulls. If those numbers hold, that certainly suggests some measure of a rally by next week, but it's no guarantee. Good luck on whatever you decide to do. See you tomorrow.

The S&P 500 is now down more than 10%, which officially marks this a correction. The first since March 2009.

The Volatility Index was up almost 30%.

Here's the charts:

The plunge continues here.

And here.

Both flipped to a sell today.

It took significant selling pressure, but BPCOMPQ finally rolled over.

So all 7 signals are flashing sells, which keeps the system on a sell.

I see no end to the selling in sight. If you're in cash, I'd stay there. Right now, our sentiment survey is showing 68% bears and only 23% bulls. If those numbers hold, that certainly suggests some measure of a rally by next week, but it's no guarantee. Good luck on whatever you decide to do. See you tomorrow.