James48843

TSP Talk Royalty

- Reaction score

- 946

[TABLE="width: 100%"]

[TR]

[TD][h=1]UN, US call for ending blockade of oil fields in Libya[/h]

Source: AP

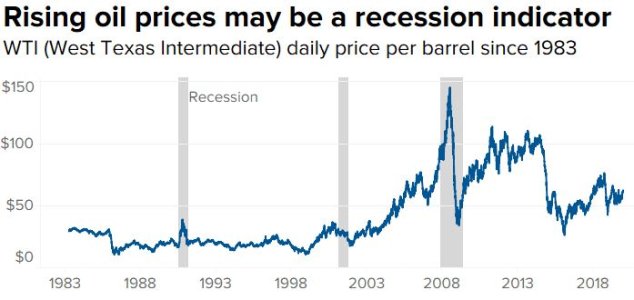

CAIRO (AP) — The United Nations and the United States on Monday called for the lifting of a blockade on oil production at two of Libya’s key oil fields as prices soared to over $130 a barrel.

Stephanie Williams, the U.N. special adviser on Libya, said blocking oil production from the Sharara and el-Feel fields “deprives all Libyans from their major source of revenue.” She tweeted: “The oil blockade should be lifted.”

Richard Norland, the U.S. ambassador to Libya, also called for an immediate end to the shutdown.

The closures have caused Libya’s daily oil production to drop by 330,000 barrels, according to the state-run National Oil Corporation. Before the shutdown, Libya’s production stood at around 1.2 billion barrels a day. The North African nation has the ninth-largest known oil reserves in the world, and the biggest oil reserves in Africa.

Read more: https://apnews.com/article/business...ited-nations-214d20d65ff4e52e5df065942b3ca9c7

[/TD]

[/TR]

[/TABLE]

[TR]

[TD][h=1]UN, US call for ending blockade of oil fields in Libya[/h]

Source: AP

CAIRO (AP) — The United Nations and the United States on Monday called for the lifting of a blockade on oil production at two of Libya’s key oil fields as prices soared to over $130 a barrel.

Stephanie Williams, the U.N. special adviser on Libya, said blocking oil production from the Sharara and el-Feel fields “deprives all Libyans from their major source of revenue.” She tweeted: “The oil blockade should be lifted.”

Richard Norland, the U.S. ambassador to Libya, also called for an immediate end to the shutdown.

The closures have caused Libya’s daily oil production to drop by 330,000 barrels, according to the state-run National Oil Corporation. Before the shutdown, Libya’s production stood at around 1.2 billion barrels a day. The North African nation has the ninth-largest known oil reserves in the world, and the biggest oil reserves in Africa.

Read more: https://apnews.com/article/business...ited-nations-214d20d65ff4e52e5df065942b3ca9c7

[/TD]

[/TR]

[/TABLE]