-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil Slick Stuff

- Thread starter nnuut

- Start date

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Stocks slide after historic oil deal [Video]

The world's largest oil producers agreed to cut production by almost 10%

U.S. equity markets opened with modest losses as investors digested the historic oil deal between OPEC and other oil-producing nations and looked ahead to first-quarter earnings season.

The Dow Jones Industrial Average fell 350 points, or 1.48 percent, while the S&P 500 and Nasdaq Composite were lower by 1.26 percent and 0.73 percent, respectively. The early selling comes after the benchmark S&P 500 gained 12 percent last week, making for its biggest weekly advance since 1974.[more]

https://www.foxbusiness.com/markets/us-stocks-april-13-2020

The world's largest oil producers agreed to cut production by almost 10%

U.S. equity markets opened with modest losses as investors digested the historic oil deal between OPEC and other oil-producing nations and looked ahead to first-quarter earnings season.

The Dow Jones Industrial Average fell 350 points, or 1.48 percent, while the S&P 500 and Nasdaq Composite were lower by 1.26 percent and 0.73 percent, respectively. The early selling comes after the benchmark S&P 500 gained 12 percent last week, making for its biggest weekly advance since 1974.[more]

https://www.foxbusiness.com/markets/us-stocks-april-13-2020

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

National Gas prices!

https://gasprices.aaa.com/

https://gasprices.aaa.com/

- Reaction score

- 2,579

Texas Oil at $2 a Barrel Raises Specter of Negative Prices

https://finance.yahoo.com/news/texas-oil-2-barrel-raises-120000398.htmlIn Texas, prices are heading in that direction. A subsidiary of Plains All American Pipeline bid just $2 a barrel for South Texas Sour on Friday, while Enterprise Products Partners LP offered $4.12 for Upper Texas Gulf Coast crude this week, according to pricing bulletins.

Offers could fall further if benchmark West Texas Intermediate crude futures -- which have lost three-quarters of their value this year -- continue to tumble. WTI closed below $20 a barrel this week for the first time since 2002. That bodes ill for producers locked into contracts with suppliers, as the daily price they earn for their crude moves with the broader market.

bmneveu

TSP Pro

- Reaction score

- 92

With oil in the headlines again this morning, I did some googling to see if there was a correlation between oil and the stock market. Results:

Reuters: "While there is no long-term correlation, oil and stocks can be somewhat correlated over shorter time frames. But this can happen between any two things for short spurts. If you take professional football data and compared them to stock prices, you can likely find short periods when there seems to be some kind of relationship there. But these short flings are still meaningless and won’t help you be a better investor—Sorry, football fans." https://www.reuters.com/sponsored/article/oil-and-stocks

Investopedia: "Researchers at the Federal Reserve Bank of Cleveland looked at movements in the price of oil and stock market prices and discovered, to the surprise of many, that there is little correlation between oil prices and the stock market.

Their study does not necessarily prove that the price of oil has a very limited impact on stock market prices; it does suggest, however, that analysts cannot really predict the way stocks react to changing oil prices." https://www.investopedia.com/ask/answers/030415/how-does-price-oil-affect-stock-market.asp

MarketWatch: "Correlation often intensifies during selloff" https://www.marketwatch.com/story/s...-thanks-to-global-economic-worries-2019-01-03

FXCM: "When it comes to the relationship between oil and stock pricing, at least a moderate correlation does exist. It is often cyclical and can be either positive or negative. The relationship is dependent upon any number of factors and can vary wildly." https://www.fxcm.com/markets/insights/the-relationship-between-oil-and-stock-prices/

Reuters: "While there is no long-term correlation, oil and stocks can be somewhat correlated over shorter time frames. But this can happen between any two things for short spurts. If you take professional football data and compared them to stock prices, you can likely find short periods when there seems to be some kind of relationship there. But these short flings are still meaningless and won’t help you be a better investor—Sorry, football fans." https://www.reuters.com/sponsored/article/oil-and-stocks

Investopedia: "Researchers at the Federal Reserve Bank of Cleveland looked at movements in the price of oil and stock market prices and discovered, to the surprise of many, that there is little correlation between oil prices and the stock market.

Their study does not necessarily prove that the price of oil has a very limited impact on stock market prices; it does suggest, however, that analysts cannot really predict the way stocks react to changing oil prices." https://www.investopedia.com/ask/answers/030415/how-does-price-oil-affect-stock-market.asp

MarketWatch: "Correlation often intensifies during selloff" https://www.marketwatch.com/story/s...-thanks-to-global-economic-worries-2019-01-03

FXCM: "When it comes to the relationship between oil and stock pricing, at least a moderate correlation does exist. It is often cyclical and can be either positive or negative. The relationship is dependent upon any number of factors and can vary wildly." https://www.fxcm.com/markets/insights/the-relationship-between-oil-and-stock-prices/

- Reaction score

- 2,579

May Contract - https://www.cnbc.com/quotes/?symbol=@Cl.1

June Contract - https://www.cnbc.com/quotes/?symbol=@Cl.2

June Contract - https://www.cnbc.com/quotes/?symbol=@Cl.2

- Reaction score

- 2,579

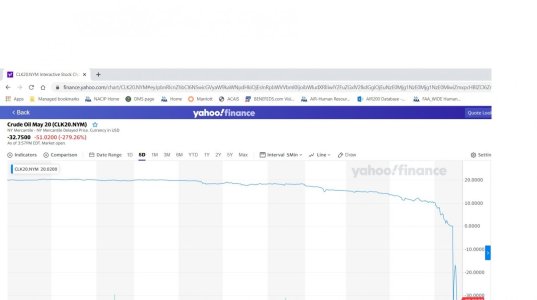

May contract down to $4.80

Oil is getting crushed again with one futures contract down 75% to record low under $5

Oil is getting crushed again with one futures contract down 75% to record low under $5

https://www.cnbc.com/2020/04/20/oil...res-in-focus-as-coronavirus-dents-demand.htmlU.S. crude prices plunged to their lowest level in history as traders continue to fret over a slump in demand due to the coronavirus pandemic.

weatherweenie

TSP Legend

- Reaction score

- 187

WTF is going on?! -75% on the day.

May contract down to $4.80

Oil is getting crushed again with one futures contract down 75% to record low under $5

https://www.cnbc.com/2020/04/20/oil...res-in-focus-as-coronavirus-dents-demand.html

- Reaction score

- 2,579

WTF is going on?! -75% on the day.

Yet the June contract is "only" down 11%.

All I can think of is that it's the the extension of the shutdown in to May? :scratchchin:

James48843

TSP Talk Royalty

- Reaction score

- 946

James48843

TSP Talk Royalty

- Reaction score

- 946

Our Government ought to be smart today- and BUY all available at the negative price, to put into the Strategic Petroleum Reserve.

It's a huge money maker if they do.

It's a huge money maker if they do.

exnavyew

TSP Pro

- Reaction score

- 366

[h=1]Does this mean my local gas station will pay me to take gasoline off their hands? :laugh::lmao:

US oil goes negative for the first time[/h]

https://www.cnn.com/2020/04/20/business/oil-price-crash-bankruptcy/index.html

US oil goes negative for the first time[/h]

https://www.cnn.com/2020/04/20/business/oil-price-crash-bankruptcy/index.html

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

We need to dig more Salt Mines to store the extra!! Well, we don't have to buy anymore from overseas!

Well, we don't have to buy anymore from overseas!

https://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude_quotes_settlements_futures.html

Well, we don't have to buy anymore from overseas!

Well, we don't have to buy anymore from overseas!https://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude_quotes_settlements_futures.html

bmneveu

TSP Pro

- Reaction score

- 92

Our Government ought to be smart today- and BUY all available at the negative price, to put into the Strategic Petroleum Reserve.

It's a huge money maker if they do.

I think one of the reasons for the price dropping was because storages are already full. Seems like a simple solution to that though, get more storage.

exnavyew

TSP Pro

- Reaction score

- 366

Our Government ought to be smart today- and BUY all available at the negative price, to put into the Strategic Petroleum Reserve.

It's a huge money maker if they do.

Nice call.

[h=1]Trump seeks to add 75 million barrels of oil to Strategic Petroleum Reserve amid historic price crash[/h]

https://www.marketwatch.com/story/t...oric-price-crash-2020-04-20?mod=mw_latestnews

James48843

TSP Talk Royalty

- Reaction score

- 946

Nice call.

Trump seeks to add 75 million barrels of oil to Strategic Petroleum Reserve amid historic price crash

https://www.marketwatch.com/story/t...oric-price-crash-2020-04-20?mod=mw_latestnews

You know THE DONALD is actually here with us as a TspTalker, right?

Right Don?

He listens to what TSPTALKERS have to say. We're better than most of his economic advisers.

Now if I can just convince him we need to get two more trades per month.....